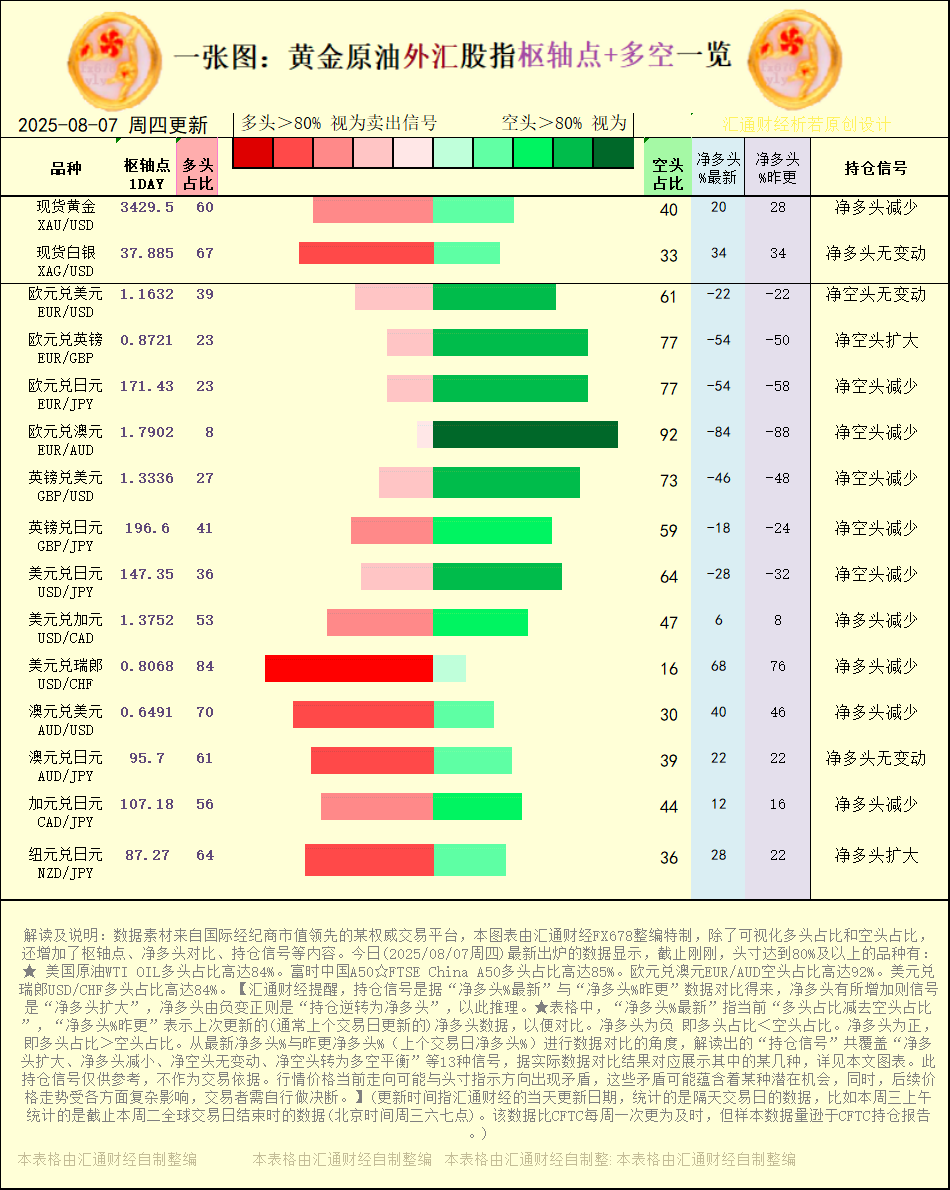

A chart showing the "pivot points + long and short position signals" for gold, crude oil, foreign exchange, and stock indices on August 7, 2025.

2025-08-07 11:19:27

Among the signals of position changes, two saw an increase in net long positions, nine decreased net long positions, two saw an increase in net short positions, and seven decreased net short positions. The following commodities saw positions of 80% or more: WTI OIL (long position) at 84%; FTSE China A50 (long position) at 85%; EUR/AUD (short position) at 92%; and USD/CHF (long position) at 84%.

[Image: Gold, crude oil, foreign exchange, and stock index pivot points and long/short position signals. Source: Huitong Finance custom chart. (Click on the image to enlarge it.)]

The currencies whose net short positions decreased include: Dow Jones Index US30, Germany DAX40 GERMANY 40, Euro/JPY, Euro/AUD, Pound/USD, Pound/JPY, and USD/JPY.

Net long positions increased in the Hong Kong Hang Seng Index (HK50) and the New Zealand dollar/Japanese yen (NZD/JPY). Net long positions decreased in spot gold (XAU/USD), U.S. crude oil (WTI OIL), the FTSE China A50 (☆), the S&P 500 (S&P 500), the USD/CAD, the USD/CHF, the AUD/USD, the CAD/JPY, and the NZD/US.

Huitong Finance reminds you that position signals are derived by comparing the "Latest Net Long %" with the "Yesterday Net Long %" data. An increase in net longs signals an expansion of the net long position, while a change from negative to positive signals a reversal of the net long position. In the table, "Latest Net Long %" refers to the current "long position minus short position," while "Yesterday Net Long %" represents the last updated net long position (usually the previous trading day) for comparison purposes. A negative net long position indicates a lower long position than a lower short position. A positive net long position indicates a higher long position than a lower short position. Comparing the latest net long % with yesterday's net long % (the previous trading day's net long %) reveals 13 types of position signals, including an expansion of the net long position, a decrease in the net long position, no change in the net short position, and a shift to a long-short balance. Some of these signals are presented based on actual data comparison results. See the charts in this article for details. This position signal is for reference only and should not be used as a basis for trading. The current price trend may conflict with the position indicated. These conflicts may contain potential opportunities. At the same time, subsequent price trends are subject to complex influences from various factors, and traders must make their own decisions.

The trading instruments included in this chart are: spot gold, spot silver, US crude oil, FTSE China A50, Hong Kong Hang Seng Index, S&P 500, Nasdaq 100, Dow Jones Industrial Average, German DAX 40, EUR/USD, EUR/GBP, EUR/JPY, EUR/AUD, GBP/USD, GBP/JPY, USD/JPY, USD/CAD, USD/CHF, AUD/USD, AUD/JPY, CAD/JPY, and NZD/USD.

[Title: One Chart: Overview of "Pivot Points + Long/Short Position Signals" for Gold, Crude Oil, Foreign Exchange, and Stock Indices on August 7, 2025] [Summary: The following is a summary of the latest "Pivot Points + Long/Short Position Signals" for gold, crude oil, foreign exchange, and stock indices in a one-chart series, including chart and text interpretations. Comparing the latest net long % with yesterday's net long % (the previous trading day's net long %), 13 different position signals are identified, including: an increase in net long, a decrease in net long, no change in net short, and a shift to a long-short balance. Some of these signals are presented based on actual data comparison results.] The latest data released today (Thursday, August 7, 2025) shows that as of just now, [In this chart, three stocks are currently in "overbought" (over 80% long), and one is currently in "oversold" (less than 20% long). Among them, the FTSE China A50 index has the highest proportion of long positions. Long positions in spot gold (XAU/USD) account for 60%, long positions in WTI (West Texas Intermediate) crude oil (WTI) account for 84%, and long positions in EUR/USD account for 39%. For a more detailed list of "change signals" for these commodities compared to yesterday, please see the Huitong Finance chart.

Among the signals of position changes, two indicated an increase in net long positions, nine indicated a decrease in net long positions, two indicated an increase in net short positions, and seven indicated a decrease in net short positions. [★★★★★★ Check the punctuation on the left] The following commodities have positions of 80% or more: ★ US crude oil (WTI) long positions account for as much as 84%. FTSE China A50 (FTSE China A50) long positions account for as much as 85%. EUR/AUD short positions account for as much as 92%. USD/CHF long positions account for as much as 84%.

[Image: Gold, crude oil, foreign exchange, and stock index pivot points and long/short position signals. Source: Huitong Finance custom chart. (Click on the image to enlarge it.)]

The currencies whose net short positions decreased include: Dow Jones Index US30, Germany DAX40 GERMANY 40, Euro/JPY, Euro/AUD, Pound/USD, Pound/JPY, and USD/JPY.

Net long positions increased in the Hong Kong Hang Seng Index (HK50) and the New Zealand dollar/Japanese yen (NZD/JPY). Net long positions decreased in spot gold (XAU/USD), U.S. crude oil (WTI OIL), the FTSE China A50 (☆), the S&P 500 (S&P 500), the USD/CAD, the USD/CHF, the AUD/USD, the CAD/JPY, and the NZD/USD.

Huitong Finance reminds you that position signals are derived by comparing the "Latest Net Long %" with the "Yesterday Net Long %" data. An increase in net longs signals an expansion of the net long position, while a change from negative to positive indicates a reversal of the net long position. In the table, "Latest Net Long %" refers to the current "long position minus short position," while "Yesterday Net Long %" represents the last updated net long position (usually the previous trading day) for comparison purposes. A negative net long position indicates a lower long position than a short position. A positive net long position indicates a higher long position than a short position. Comparing the latest net long % with yesterday's net long % (the previous trading day's net long %) reveals 13 types of position signals, including an expansion of the net long position, a decrease in the net long position, no change in the net short position, and a shift to a long-short balance. Some of these signals are presented based on actual data comparison results. See the charts in this article for details. This position signal is for reference only and should not be used as a basis for trading. The current price trend may conflict with the position indication direction. These conflicts may contain potential opportunities. At the same time, subsequent price trends are subject to complex influences from various aspects, and traders must make their own decisions. ] [The trading instruments involved in this chart are: spot gold, spot silver, US crude oil, FTSE China A50, Hong Kong Hang Seng Index, S&P 500 Index, Nasdaq 100, Dow Jones Index, German DAX40, EUR/USD, EUR/GBP, EUR/JPY, EUR/AUD, GBP/USD, GBP/JPY, USD/JPY, USD/CAD, USD/CHF, AUD/USD, AUD/JPY, CAD/JPY, NZD/USD, ★]

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.