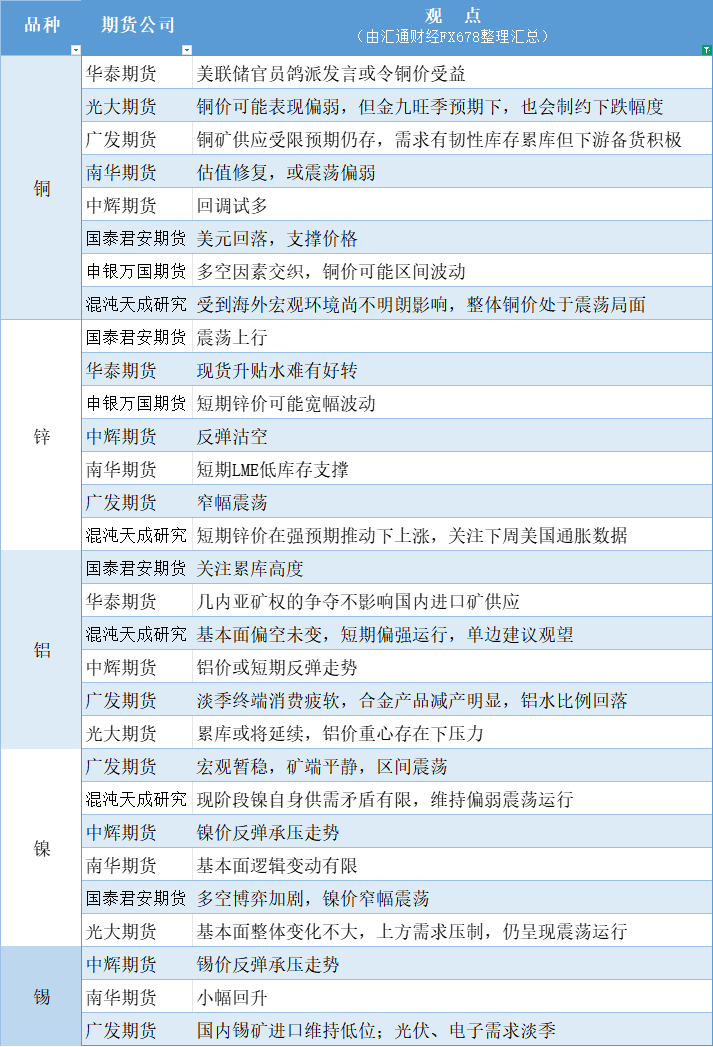

A chart summarizing the views of futures companies: Nonferrous metals (copper, zinc, aluminum, nickel, tin, etc.) on August 7

2025-08-07 13:36:29

Copper: Expectations of limited copper ore supply remain, demand is resilient, inventories are accumulating, but downstream stocking is active, with intertwined bullish and bearish factors, and copper prices may fluctuate within a range; Zinc: In the short term, zinc prices will rise driven by strong expectations, and attention will be paid to US inflation data next week; Aluminum: Terminal consumption is weak in the off-season, alloy product production has decreased significantly, the proportion of molten aluminum has fallen, the fundamentals are bearish and unchanged, and the short-term trend is strong. It is recommended to wait and see; Nickel: The overall fundamentals have not changed much, and the upward demand is suppressed, and the trend is still volatile; Tin: Domestic tin ore imports remain low.

This chart is specially created and compiled by Huitong Finance, all rights reserved.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.