Analysts and retail investors are optimistic that gold prices will break through the 3,400 mark next week. Will the US CPI become the biggest driving force?

2025-08-10 14:18:48

Review of gold market volatility this week

This week, the precious metals market saw a significant tug-of-war between bulls and bears, particularly in the final two trading days. Reports of US tariffs on gold bars sparked market panic, leading to sharp price fluctuations. Although the White House ultimately denied the rumors, gold prices did not fall sharply, instead stubbornly holding near $3,400 per ounce, demonstrating strong market demand and resilience for gold.

For the first three trading days of this week, spot gold prices fluctuated between $3345 and $3390. Following Wednesday's dovish comments from Federal Reserve officials, gold prices began a push towards $3400 on Thursday, but failed to break through the $3400 resistance level during the Asia-Europe trading session. It wasn't until Thursday in New York trading, following reports of US tariffs on Swiss gold imports, that gold prices finally broke through the $3400 resistance level. In early Asian trading on Friday, gold prices briefly reached a weekly high of $3408.71. Surprisingly, after the White House announced it would not implement tariffs on gold bars, gold prices briefly tested support at $3380 before quickly rebounding back to the $3400 level and maintaining this level heading into the weekend, closing at $3397.13 per ounce. This volatile market not only reflects the market's sensitivity to trade policy uncertainty but also highlights gold's strong support amid safe-haven demand.

Industry experts' analysis: Bullish sentiment dominates, tariff turmoil becomes catalyst

The latest Kitco News Weekly Gold Survey shows that industry experts are firmly back in the bullish camp, while retail traders also maintain their optimistic bias on the metal’s short-term outlook.

Darin Newsom, senior market analyst at Barchart, bluntly stated that gold prices will rise. He believes that the more things change, the more the essence remains the same, especially the US government's announcement on gold bar tariffs on Thursday, which is a typical manifestation of trade policy uncertainty.

Rich Chekan, president and chief operating officer of Asset Strategies International, holds a neutral view and believes that gold prices will remain unchanged. He expects that the news of Swiss gold bar tariffs will take time to digest in the market, and that people should wait and see this week for clarity, or wait for President Trump's policy shift.

James Stanley, senior market strategist at Forex, is a long-term gold bull. He emphasized the critical importance of the $3,435 level. This level held three times in May, June, and July, with each pullback narrowing, indicating that bullish forces remain dominant and could drive a breakthrough. He also pointed to $3,500 as a more significant barrier, hoping for a slow trend test rather than a rapid breakthrough to prevent bullish stagnation. Support is focused on last week's $3,350.

Ole Hansen, head of commodity strategy at Saxo Bank, emphasized that the spot market is the true signal for a gold price breakthrough. December futures have hit a new high of $3,534, but the premium has widened, and spot prices remain stuck in the range since April. A break above $3,450 is needed to change the situation. He warned against overinterpreting technical breakthroughs in the futures market, as prices are affected by EFP fluctuations.

Sean Lusk, co-director of commercial hedging at Walsh Trading, believes the tariff story is merely adding fuel to the fire. A September rate cut is already priced in. If the market truly believes in a 39% tariff, gold prices will likely rise. Market uncertainty is high, with peaks likely occurring overnight on low volume, and potential for two-way fluctuations. He predicts a drop below $3,400 could lead to a fall back to $3,280; otherwise, the next target is $3,690 to $3,697. He believes rising inflation in next week's data will not shake expectations for a 50 basis point rate cut, as housing, food, and energy inflation are limited, reflecting a more stagnant economy.

Mark Chandler, managing director of Bannockburn Global Forex, expects gold prices to test $3,410 and then fall back, as interest rates and the dollar may rise before Tuesday's CPI and the White House clarifies tariffs. He sees $3,355 as a low-risk buying point and mentions that the U.S. Treasury may revalue its gold holdings.

Adrian Day, president of Adrian Day Asset Management, views tariffs as a misunderstanding and is more focused on consumer data rather than inflation. He believes that a September rate cut is already priced in and the slight increase in CPI has limited impact, so gold prices may fall in the near term.

Eugenia Mikuliak, founder of B2PRIME Group, noted that tariffs increase uncertainty, coupled with rising inflation and slowing employment, and the high risk of recession, which supports gold prices. The reclassification of Swiss gold bars threatens trade, sending futures soaring to $3,534. Spot prices remain high.

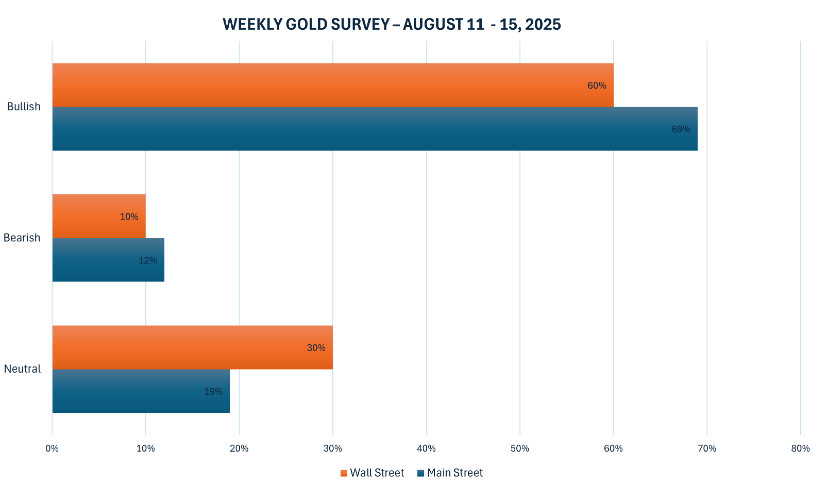

Investor survey results: Wall Street and retail investors are generally bullish

This week's Kitco News Gold Survey, which drew 10 participants, reveals a resurgence of Wall Street bulls following gold's dramatic events and solid gains. Six experts predict further price increases next week, while only one predicts a decline and the remaining three anticipate sideways movement. Meanwhile, the online poll, which received 188 votes, shows a majority of retail investors remaining bullish, with 129 predicting an increase, only 23 anticipating a decline, and the remaining 36 predicting a period of volatile consolidation. This consensus reflects market confidence in gold's safe-haven properties, particularly amid global uncertainty.

Next week's economic data outlook: inflation and consumer indicators become key variables

Economic news will be active again next week. Tuesday morning, the Reserve Bank of Australia is expected to announce a 25 basis point rate cut to 3.60%, followed by the US July CPI report, which is expected to show core inflation rising to 0.3%. Wednesday will be dominated by speeches by Federal Reserve Board members, while Thursday's PPI core inflation is expected to rise by 0.2%, along with weekly initial jobless claims. Friday's July retail sales are expected to fall to 0.5%, with core sales to 0.3%. The University of Michigan's August consumer confidence index will also reveal expectations. These data could reinforce expectations for a rate cut and boost gold prices, but any unexpected inflation could trigger short-term volatility.

In summary, this week's volatile rise in the gold market and the bullish consensus among analysts pave the way for a breakout above $3,400 next week. Despite the subsidence of tariff tensions, inflation and consumer data will be the decisive factors. Investors should closely monitor these indicators. Gold remains a reliable safe-haven option in uncertain times, with significant potential upside.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.