A dramatic shift in crude oil prices! OPEC+ suddenly raises its demand forecast, creating a fierce battle between bulls and bears.

2025-08-13 16:36:43

OPEC+ ignites demand expectations

The latest OPEC+ monthly report shows that global crude oil demand is expected to rise to 104 million barrels per day in 2025 (an increase of 200,000 barrels from the previous month); the non-OPEC+ supply growth rate is lowered by 0.3 percentage points to 1.4 million barrels per day; and the growth rate of US shale oil production is expected to be halved to 600,000 barrels per day.

Crude oil prices rose as the Organization of the Petroleum Exporting Countries and its allies (OPEC+) raised their forecast for global oil demand next year. They also cut their forecast for supply growth from the United States and other non-OPEC+ producers, signaling a tighter market ahead.

Supply Game Before the US-Russia Summit

Crude oil prices struggled ahead of Friday's meeting between US and Russian leaders. US President Donald Trump and Russian President Vladimir Putin are set to meet in Alaska on August 15 to seek a solution to the conflict between Russia and Ukraine. Any US-Russia agreement is likely to result in the lifting of US sanctions on Russia, which could ease supply concerns.

Crude oil prices are hovering around the key resistance level of $63.50, with the market focusing on the Alaska summit on August 15:

Potential supply shock: If energy sanctions on Russia are lifted, Rosneft may increase its supply by 500,000-800,000 barrels per day.

Uncertainties: Ukrainian President Zelensky’s tough stance has created uncertainty about the possibility of reaching an agreement.

Tip: Pay attention to the changes in the discount of Russian Urals crude oil.

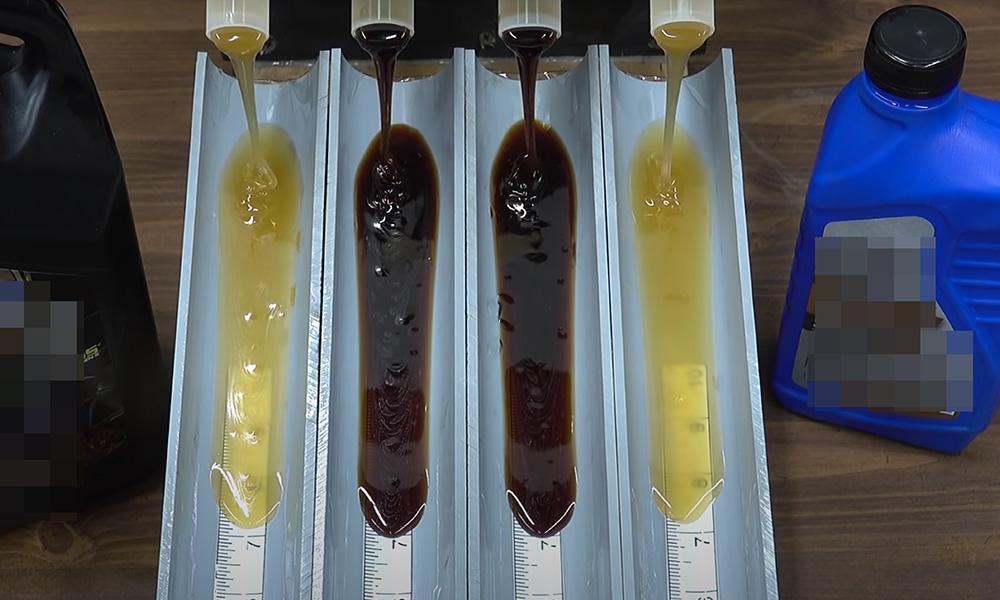

Inventory data holds hidden secrets

Data from the American Petroleum Institute (API) showed that U.S. crude oil inventories increased by 1.5 million barrels last week, compared with expectations for a decrease of 800,000 barrels and a previous decrease of 4.2 million barrels. The unexpected increase in U.S. crude oil inventories suggests that the summer peak demand is coming to an end.

The U.S. Energy Information Administration (EIA) projected in its Short-Term Energy Outlook (STEO) update on Tuesday that global Brent crude oil prices will fall back to $50.00 per barrel in the first quarter of 2026, driven by the combined effects of OPEC+ countries gradually easing production restrictions and continued growth in U.S. oil production. The EIA forecasts that global crude oil inventories will increase by an average of 2 million barrels per day between the fourth quarter of 2025 and the first quarter of 2026, which will suppress crude oil prices in the short term.

OPEC maintained its demand outlook for 2025, but raised its demand growth forecast for 2026 by 100,000 barrels per day to 1.38 million barrels per day, anticipating that as U.S. production declines, production elsewhere will increase. Separately, the U.S. Department of Energy raised its estimate of a global oil surplus this year to 1.7 million barrels per day.

The EIA also expects U.S. crude oil production to reach a record high of about 13.6 million barrels per day by the end of December 2025. As new well drilling and expanded production continue to drive U.S. production growth, the EIA believes that the accumulating supply surplus will become the only factor restraining the growth rate of U.S. drilling activity in early 2026.

Price Prediction

In the short term, WTI crude oil is stuck in a daily consolidation pattern, trading roughly between $64.00 and $62.00 per barrel. While WTI remains significantly below its 200-day exponential moving average (EMA) at $67.50, bearish momentum remains limited as bears have been unable to push the price below the key technical level of $60.00.

(U.S. crude oil continuous daily line)

At 16:21 Beijing time, U.S. crude oil continued to trade at $62.83 per barrel.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.