August 14th Financial Breakfast: The Fed's easing policy bets boosted gold prices, while the oil market showed pessimistic guidance, and oil prices fell to a new low in more than two months.

2025-08-14 07:21:10

Focus on the day

stock market

The S&P 500 and Nasdaq closed at record highs for a second day on Wednesday, as investors anticipate the Federal Reserve will soon begin a monetary easing cycle. However, some technology stocks showed signs of weakness after strong gains the day before.

Signs that U.S. tariffs on imports have yet to fully filter through to overall consumer prices provided some relief to investors this week seeking to understand the economic impact of trade uncertainty.

Nvidia, Alphabet, and Microsoft, three of the "Big Seven" tech giants, closed lower as investors sought new growth drivers. Katherine Bordlemay, co-head of Goldman Sachs Asset Management, said, "Valuations are stretched. But I do think it ultimately comes down to earnings, and that's what we're focused on." She noted that the divergence in returns across U.S. equities is at one of the highest levels of the past 30 years.

Apple shares rose 1.6% after Bloomberg News reported the company is planning to expand into artificial intelligence robots, home security and smart displays.

The Dow Jones Industrial Average rose 1.04% to 44,922.27, the S&P 500 gained 0.32% to 6,466.58 and the Nasdaq Composite added 0.14% to 21,713.14.

The Russell 2000 index of small-cap stocks rose nearly 2%, hitting a six-month high. According to the Chicago Mercantile Exchange's (CME) FedWatch tool, traders are now fully pricing in a 25 basis point interest rate cut from the Federal Reserve. The Fed last lowered borrowing costs in December.

Finance Minister Benson Besant said on Wednesday he believed a sharp half-percentage point rate cut was possible given recent soft jobs data.

Investors are also starting to look at other sectors after a recent rally in U.S. stocks, led by technology stocks, pushed the S&P 500's valuation above its long-term average.

The health-care sector, which has been sluggish for much of the year, rose 1.6%, leading the gains among the 11 S&P 500 sectors.

Chicago Federal Reserve Bank President Goolsbee said on Wednesday the Fed is trying to understand whether tariffs will temporarily boost inflation or have a more persistent impact, which will inform its decision on when to cut interest rates.

Gold Market

Gold prices rose on Wednesday, boosted by a weaker dollar and falling Treasury yields. Tame U.S. inflation data reinforced expectations of a September interest rate cut by the Federal Reserve and boosted bets on further easing later this year. Spot gold rose 0.3% to $3,355.58 an ounce. U.S. gold futures for December delivery settled up 0.3% at $3,408.3.

The dollar index hit a new low in more than two weeks, making gold cheaper for overseas buyers, while the benchmark 10-year Treasury yield fell. "Gold is strong as expectations of a September rate cut by the Federal Reserve rise following the mild CPI data and weak July non-farm payrolls," said Nikos Tzabouras, senior market analyst.

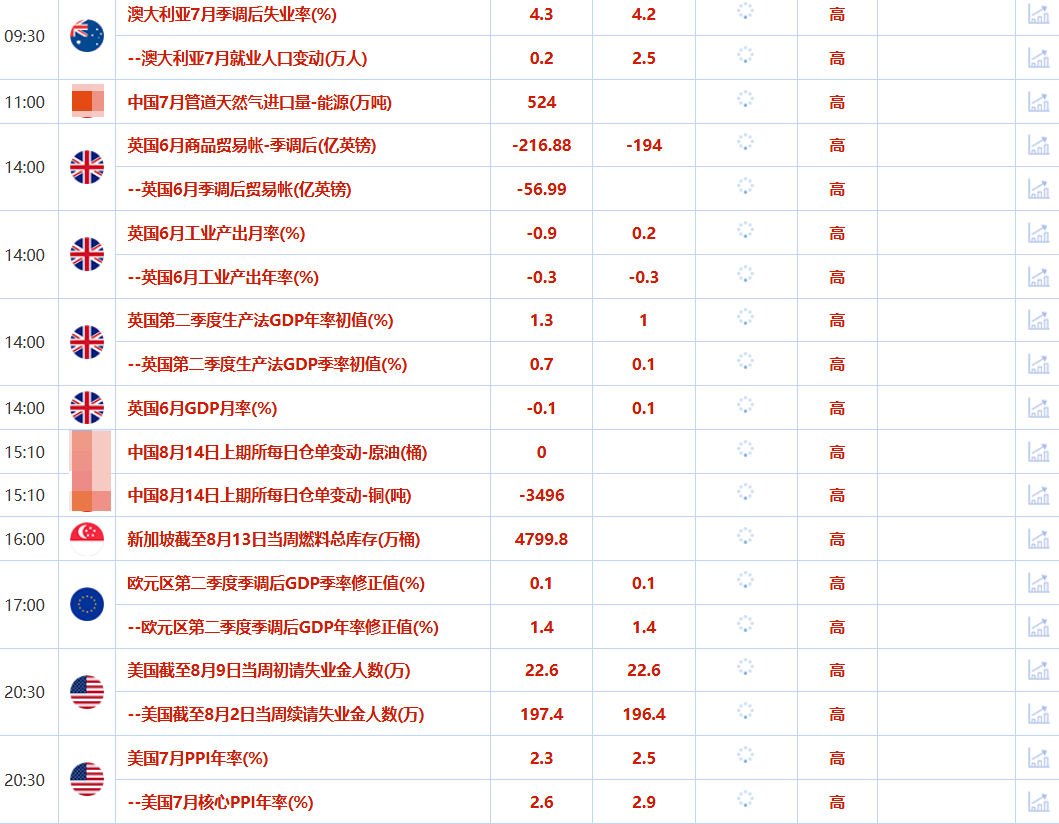

Investors now await further U.S. indicators this week, including producer prices, weekly jobless claims and retail sales. On the geopolitical front, European and Ukrainian leaders will meet with Trump before he meets with Russian President Vladimir Putin, while China and the U.S. extended their tariff truce by 90 days.

Spot silver rose 1.6% to $38.50 an ounce, platinum rose 0.3% to $1,339.75, and palladium rose 0.5% to $1,135.23.

Oil Market

Oil prices fell to a more than two-month low on Wednesday after downbeat supply guidance from the U.S. government and the International Energy Agency, while investors focused on U.S. President Donald Trump's threat that Russian President Vladimir Putin would face "severe consequences" if he stood in the way of peace in Ukraine.

Brent crude futures settled down 0.7% at $65.63 a barrel. They fell to $65.01, their lowest level since June 6. U.S. West Texas Intermediate (WTI) crude futures fell 0.8% to $62.65 a barrel. They fell to $61.94, their lowest level since June 2.

The U.S. Energy Information Administration (EIA) reported on Wednesday that U.S. crude oil inventories rose by 3 million barrels to 426.7 million barrels. Analysts polled by Reuters had expected a 275,000-barrel draw. The EIA said net U.S. crude oil imports rose by 699,000 barrels per day (bpd) last week.

“Crude exports remain below what we’re accustomed to because of tariff headwinds,” said John Kilduff, partner at Again Capital in New York, adding that a continued decline in exports could weigh on prices. The IEA on Wednesday raised its forecast for oil supply growth this year but lowered its demand forecast.

Trump is expected to meet with Putin in Alaska on Friday to discuss ending Russia's war in Ukraine, which has been impacting the oil market since February 2022. Asked whether Russia would face any consequences if Putin did not agree to stop the war after Friday's meeting, Trump replied on Wednesday: "Yes, they would." Asked whether those consequences would be sanctions or tariffs, Trump told reporters they would be very severe.

Meanwhile, OPEC+ raised its forecast for global oil demand next year in its monthly report released on Tuesday and cut its expectations for supply growth in the United States and other non-OPEC producers, suggesting a tighter market.

foreign exchange market

The dollar fell for a second consecutive trading day on Wednesday, a day after U.S. inflation data reinforced market expectations that the Federal Reserve will cut interest rates next month, while U.S. President Trump renewed pressure for a rate cut, further exacerbating the dollar sell-off.

The dollar index fell 0.2% to 97.856, its lowest since July 28, after falling 0.5% on Tuesday.

Data on Tuesday showed U.S. consumer prices rose slightly in July, broadly in line with expectations, as the pass-through of Trump's massive tariffs on goods prices has so far been limited.

Data from the London Stock Exchange Group (LSEG) shows that investors are almost certain that the Federal Reserve will cut interest rates next month.

U.S. Treasury Secretary Jeffrey Besant called for a "series of rate cuts" on Wednesday and said the Federal Reserve could begin its easing efforts with a 50 basis point cut, a day after Trump, who has repeatedly criticized Fed Chairman Jerome Powell for not cutting rates sooner, ratcheted up pressure.

White House spokesman Levitt said the president is considering filing a lawsuit against Powell for mismanaging the renovation of the Federal Reserve's Washington headquarters.

“I think there’s a fair amount of pressure coming out of the political arena in Washington on the Fed to move interest rates,” said Shaun Osborne, chief currency strategist at Scotiabank.

Trump also slammed Goldman Sachs CEO David Solomon, saying the bank was wrong to predict U.S. tariffs would hurt the economy. Trump questioned whether Solomon should continue to lead Goldman Sachs.

Atlanta Federal Reserve Bank President Raphael Bostic said on Wednesday that the United States is close to full employment, which gives the Fed the "luxury" of not rushing to make any policy adjustments.

Chicago Federal Reserve Bank President Goolsbee said on Wednesday the Fed is trying to understand whether tariffs will temporarily boost inflation or have a more lasting impact.

The weak dollar supported the euro and sterling. The euro rose 0.2% to $1.1698, briefly hitting its highest level since July 28. The pound rose 0.5% to $1.3567, briefly hitting its highest level since July 24.

Data on Tuesday showed Britain's jobs market weakening again but wage growth remained strong, highlighting why the Bank of England has been so cautious about cutting interest rates.

The Australian dollar rose 0.2% to $0.6541, while the New Zealand dollar rose 0.3% to $0.5973.

The Reserve Bank of Australia cut interest rates on Tuesday as expected and signaled further easing may be needed to achieve its inflation and employment targets as the economy loses some momentum.

International News

U.S. interest rate swaps show traders see a 100% chance of a Fed rate cut at its September meeting

Overnight Index Swap (OIS) contracts, which are tied to the Federal Reserve's meeting dates, fully priced in a 25 basis point rate cut at the September Federal Open Market Committee (FOMC) meeting late Wednesday, leading to heavy trading in federal funds futures contracts. Before 3:00 PM New York time, August and October federal funds futures contracts were trading actively, while the September 2025 secured overnight financing rate (SOFR) futures contract saw heavy trading. As a result, the OIS rate, tied to the Fed's September policy meeting, fell to a day low near 4.08%, indicating a 100% probability of a 25 basis point rate cut. Further out on the swap curve, the market now prices a combined 62 basis points of rate cuts over the remaining three FOMC meetings this year, compared to 59 basis points at Tuesday's close.

Trump may propose to Putin to jointly develop Alaska's rare earth resources

The Daily Telegraph, citing sources, reported that US President Trump will propose to Putin during the US-Russia summit the joint development of rare earth mineral resources in Alaska and the lifting of the export ban on Russian aircraft parts. British government sources told the newspaper that such incentives would be "acceptable to Europe." The newspaper noted that Alaska contains vast oil and natural gas reserves, including approximately 13% of the world's oil reserves.

Trump: If the Trump-Putin meeting goes well, a trilateral meeting between the US, Russia and Ukraine will be held

On August 13th, local time, US President Trump stated that if his meeting with Russian President Vladimir Putin on August 15th goes well, a second meeting will be held soon. Trump stated that the second meeting would include Ukrainian President Volodymyr Zelensky. Trump also stated that Russia would face consequences if the conflict did not cease. That same day, Trump held a video conference with European leaders and Zelensky. Sources familiar with the matter stated that Trump and the attendees discussed possible locations for meetings with Zelensky and Putin following the Trump-Putin summit. (CCTV News)

German Chancellor: Ukraine is ready for territorial negotiations

German Chancellor Angela Merz, after organizing an online conference on Ukraine, stated that Ukraine is ready for territorial negotiations, and that the so-called "contact line" should be the starting point. "Ukraine is ready for territorial negotiations, and the so-called 'contact line' should be the starting point," Merz said at a joint press conference with Zelensky, which was broadcast on the German Chancellor's official website. Merz said that legal recognition of territories under Russian control "is not on the table."

Bessant: There is a high probability that the Fed will cut interest rates by 50 basis points

In an interview, U.S. Treasury Secretary Benson said the Federal Reserve's interest rate should be 150-175 basis points lower than it is now, and that if the data were accurate, the Fed could have cut rates earlier. Bessant believes a 50 basis point rate cut is possible, with a series of cuts likely starting in September. Regarding the selection of the Fed chair, he mentioned that they will cast a wide net, encompassing 10-11 people. He also stated that he had proposed establishing a "shadow Fed chair" but now believes it is unnecessary. Furthermore, Bessant believes the Fed does not need to resume large-scale asset purchases (QE). Regarding the jobs report, he expressed opposition to halting its release, but emphasized the need for reliable data. Some analysts say the probability of a 50 basis point rate cut by the Fed in September is now almost zero. For this to happen, another weak September non-farm payroll report would likely be needed.

Russia to share production cuts until 2025 to compensate for OPEC+ cuts

Russia plans to spread the remaining production cuts it needs to make to compensate for exceeding OPEC+ production targets by an additional three months. According to the latest compensation schedule, Moscow now plans to cut production by 85,000 barrels per month from July to November, with a reduction of 9,000 barrels in December. The previous plan only lasted until September.

Domestic News

Fortune releases list of "China's 40 Business Elites Under 40"

Liang Wenfeng, Wang Xingxing, and Wang Ning ranked in the top three. According to the list of "China's 40 Business Elites Under 40" released by Fortune (Chinese edition), the top five are Liang Wenfeng (39), founder of DeepSeek; Wang Xingxing (35), founder of Yushu Technology; Wang Ning (38), founder of Pop Mart; Liu Jingkang (33), founder of Insta360; and Zhang Zhengping (36), rotating president of Seres Group.

This year, 188 billion yuan of ultra-long-term special government bonds have been allocated to support equipment renewal investment subsidies.

Since 2025, the National Development and Reform Commission (NDRC) has conscientiously implemented the decisions and arrangements of the CPC Central Committee and the State Council on the implementation of the "two new" policies. Working with relevant departments and local governments, NDRC has optimized the scope of support for equipment upgrades, improved project application and review standards, and rigorously screened and approved projects to promote equipment upgrades in key areas. Recently, 188 billion yuan in investment subsidies for equipment upgrades supported by the 2025 ultra-long-term special government bonds have been allocated. These subsidies support approximately 8,400 projects in the fields of industry, energy-consuming equipment, energy and electricity, transportation, logistics, environmental infrastructure, education, culture and tourism, healthcare, outdated residential elevators, electronics and information technology, facility agriculture, grain and oil processing, safe production, and recycling, generating a total investment exceeding 1 trillion yuan. Moving forward, the NDRC will, in accordance with the decisions and arrangements of the CPC Central Committee and the State Council, work with all relevant parties to continuously strengthen overall coordination, steadily advance project construction, and push for more physical work to be completed as soon as possible. It will also strictly implement closed-loop management of projects and funds to ensure that central funds are effectively used and that the "two new" policies are more effective. (National Development and Reform Commission)

The first batch of typical application cases of artificial intelligence in biomanufacturing were announced, with 16 on the list

According to the Ministry of Industry and Information Technology, in order to implement the decisions and arrangements of the Party Central Committee and the State Council on the development of biomanufacturing, and in accordance with the "Notice of the General Office of the Ministry of Industry and Information Technology on the Collection of Typical Application Cases of Intelligent Technology in the Field of Biomanufacturing" (Ministry of Industry and Information Technology Consumer Letter [2024] No. 394), after recommendation by provincial-level industrial and information technology authorities, expert evaluation, and online announcement, the "Typical Application Cases of Artificial Intelligence in Biomanufacturing (First Batch)" are now issued. Please further promote the deep integration of artificial intelligence and biomanufacturing, and promote the quality upgrade of the entire biomanufacturing industry chain.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.