Gold prices surged towards the $3,600 mark, with Wall Street tycoons collectively bullish. Will they reach new highs next week?

2025-09-07 15:03:40

Gold price trend this week

At the beginning of this week, spot gold opened at $3446.61 per ounce. It initially experienced a brief downward process, with the price falling below $3440. Then it began to rebound rapidly and started to rise, soaring to $3483. After entering the European trading session on Monday, the price climbed further to $3488 per ounce. Although the Labor Day holiday resulted in thin trading volume and the rise could not be fully maintained, gold prices continued to rise on Tuesday, breaking through the historical high of 3500 in one fell swoop, and continued to rise, closing at around $3533. Gold prices remained strong on Wednesday, further refreshing the historical high to $3578.29. Gold prices fell slightly on Thursday, but received support from bargain hunting in the late trading. It fluctuated in the 3545-3560 range in the Asia-Europe session on Friday.

The release of the non-farm payroll report, which fell far short of market expectations, ignited another surge in gold prices, pushing the price close to $3,600 per ounce. Despite reaching these unprecedented highs, gold prices have barely retreated, closing the week around $3,590 per ounce, demonstrating the gold market's resilience and upward momentum.

(Spot gold daily chart, source: Yihuitong)

Expert opinion analysis: Multiple interpretations under Wall Street's bullish consensus

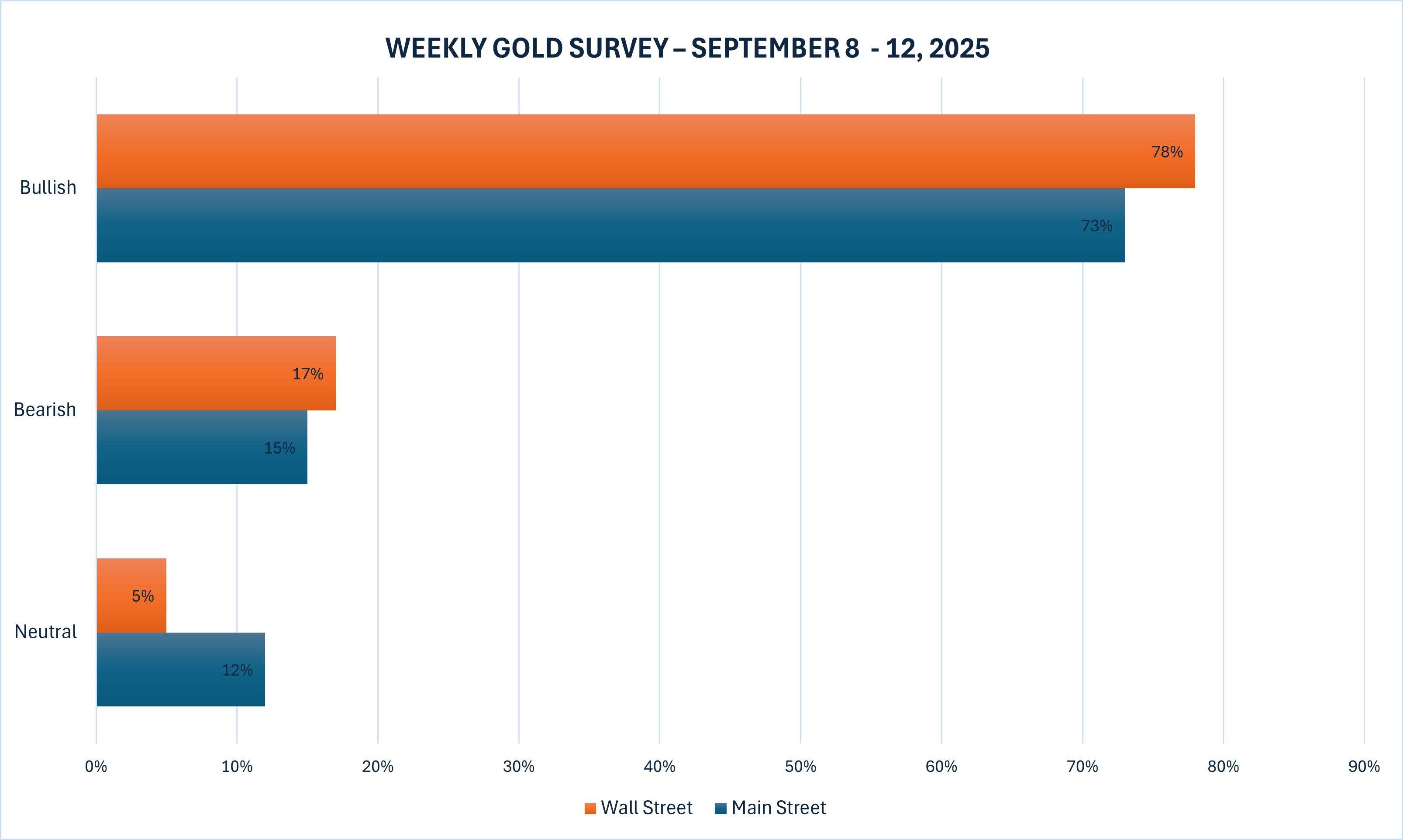

The latest Kitco News Weekly Gold Survey shows that after gold prices hit a series of record highs, Wall Street analysts generally remain bullish, and the bullish sentiment of ordinary investors has also risen accordingly.

In this week's Kitco survey, 18 analysts participated, with 14 (78%) predicting gold prices will rise next week. Only three (17%) predicted a decline, and one (5%) predicted sideways movement. Meanwhile, a Kitco online poll received 219 votes, with 160 retail traders (73%) predicting an increase, 33 (15%) predicting a decline, and 26 (12%) predicting consolidation. These views reflect a strong market consensus on gold. While a few voiced concerns about short-term risks, overall bullish sentiment prevails.

Colin Cieszynski, chief market strategist at SIA Wealth Management, made it clear that he is bullish on gold next week as disappointing U.S. jobs data this week increases pressure on the Federal Reserve to cut interest rates at its upcoming meeting, possibly even by 50 basis points, which would push down Treasury yields and the dollar, paving the way for gold to continue its rise.

Rich Checkan, president and chief operating officer of Asset Strategies International, believes that gold prices may fall, but not sharply, and he expects prices to fall slightly due to profit-taking and cautious sentiment ahead of the September 17 FOMC interest rate decision.

Darin Newsom, senior market analyst at Barchart, bluntly stated that gold prices will rise because all aspects of the market continue to set new record highs and it is foolish to think otherwise.

Adrian Day, president of Adrian Day Asset Management, noted that gold is clearly benefiting from continued central bank purchases and new buying based on loose monetary policy in the United States and globally. The Federal Reserve's expected rate cut this month has been priced in by the market. Nevertheless, if Fed Chairman Jerome Powell's comments on the rate cut appear hawkish, or if consumer price data is very strong, gold prices could fall back to recent ranges such as $3,400, but will still rise after the dust settles. He is uncertain about next week but is optimistic about an increase in a month or two.

FXTM Market Analysis Manager Lukman Otunuga maintains a neutral stance on gold in the short term, but warns that the market is severely overbought. Forex Senior Market Strategist James Stanley emphasizes that questioning the trend at this stage is pointless. He has been bullish on gold for the past few years and maintains this view even after this week's record high. He believes that with the FOMC meeting approaching, market expectations of a hawkish and dovish Fed policy will continue to drive gold prices higher, and any corrections will be shallow. Pepperstone Senior Research Strategist Michael Brown is slightly bearish for next week, noting that gold has risen significantly in a short period of time, posing a risk of a correction, but that corrections should be viewed as buying opportunities.

Paul Wong, market strategist at Sprott Asset Management, analyzed the impact of Friday's sharp rise in gold prices. He believes that macro funds buying gold while selling long-term bonds was the direct driver of gold prices breaking through $3,500. Since April, gold has been in a four-month bullish consolidation pattern with no real signs of selling. This long period of stability is technically very bullish and usually leads to a gap-up rise, with a target of approximately $3,900 on the chart.

He also emphasized that the fundamentals of the United States support the rise in gold prices, including above-target inflation, a weak labor market, soaring debt, and political pressure on the Federal Reserve, which make the devaluation of the US dollar the only viable path. In addition, another major factor supporting this rally is the lack of trust in the entire financial system, central banks, institutions, and governments, making gold a safe haven asset and even a safe asset.

Next week's economic data preview: key events as inflation returns to the spotlight

Next week's economic data releases will be relatively light, but several key events will be significant, with inflation, in particular, once again in the spotlight. On Wednesday, markets will see the release of the US Producer Price Index (PPI) for August, with both headline and core figures expected to show a significant decline compared to July. On Thursday, traders will focus on the European Central Bank's monetary policy meeting, where interest rates are expected to remain unchanged at 2.15%. This will be followed by the release of the US Consumer Price Index (CPI) for August and weekly unemployment claims data, which will reveal further signs of weakness in the US labor market. On Friday, the week's releases will conclude with the University of Michigan's preliminary survey of consumer sentiment, which has been particularly focused on inflation dynamics this year.

Marc Chandler, managing director of global foreign exchange at Bannockburn, noted that gold hit a record high following a weak U.S. jobs report, a falling dollar, and lower U.S. interest rates, but he remained cautious about gold prices approaching $3,600, as market sentiment toward a Fed rate cut has reached its limit and next week's CPI could rise slightly. He also warned that declining U.S. reverse repo usage could inject volatility into the bond market, with spot gold prices trading above the upper Bollinger Band at approximately $3,474.

Sameer Samana, head of global equities and real assets at Wells Fargo Investment Institute, believes that gold and silver will outperform the stock market in a low-interest rate environment. He emphasizes that the Federal Reserve's shift in focus from inflation to the labor market has put pressure on bonds, making gold a simple diversification alternative, especially as central banks shift away from the dollar. Silver will also benefit, but may weaken in the short term and may slightly outperform gold over the next 12 months.

Eugenia Mykuliak, founder and executive director of B2PRIME Group, said that a weaker dollar, expectations of a US interest rate cut this month, and doubts about the Federal Reserve's independence have pushed gold prices to new highs. Central banks like China, Turkey, and India continue to increase their reserves, and steady inflows into exchange-traded funds (ETFs) are creating strong demand. She expects prices to move towards the $3,600-$3,800 range, with $4,000 as a realistic peak.

FxPro senior market analyst Alex Kuptsikevich expects further gains next week, with a global bond market sell-off increasing safe-haven demand, ETFs and central banks supporting demand for precious metals, and expectations of a Fed rate cut creating a tailwind for gold.

Michael Moor, founder of Moor Analytics, analyzed from a technical perspective that gold has been unwound on higher time frames and is poised for future strength, with various breakouts driving strong gains. Kitco Senior Analyst Jim Wyckoff expects gold to continue to rise based on its recent breakout, with both fundamentals and technicals firmly bullish.

Summarize

In summary, gold's astonishing rally this week not only set a new record but also reinforced market expectations for inflation and loose monetary policy. While there may be a short-term correction risk, the bullish consensus among Wall Street and Main Street investors, along with supportive fundamentals such as central bank buying and a lack of trust, suggests that gold will continue to shine. With a cumulative gain of 4.04% this week, gold prices will bear close attention next week as key data is released. If it can withstand a correction, the next all-time high may be just around the corner.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.