Gold prices remain under moderate pressure due to profit-taking

2025-09-15 23:24:30

Global stock markets were mixed overnight. U.S. stock indexes are expected to open slightly higher in New York today.

In overnight news, U.S. and Chinese trade officials held high-level talks in Madrid, Spain, on Sunday to discuss trade and global economic issues. China said over the weekend it would launch an investigation into U.S. semiconductors and alleged that Nvidia violated antitrust laws. The talks are expected to continue today.

Fitch Ratings downgraded France's government credit rating from AA- to A+ over the weekend, citing the country's rising public debt and political instability. The downgrade follows the fall of another French government and comes as the country struggles to control its ballooning debt burden. Fitch warned that the approaching 2027 presidential election will further constrain France's room for fiscal consolidation. Fitch expects France's fiscal deficit to remain above 5% of GDP in 2026-2027 and believes the upcoming budget negotiations will result in a more relaxed fiscal consolidation plan than previously proposed.

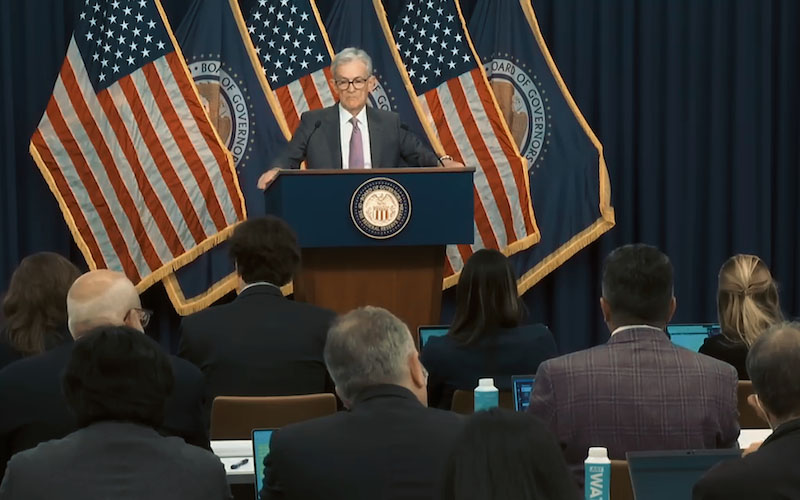

Global markets are awaiting the Federal Open Market Committee (FOMC) meeting, which will begin on Tuesday morning and conclude with a statement and press conference from Fed Chairman Jerome Powell on Wednesday afternoon. The FOMC is expected to announce a 25 basis point interest rate cut, the first since November 2024. This decision comes amid criticism that the Fed has been slow to respond to weak US economic data, including large wage revisions and tariff-induced inflation. The Fed's latest forecasts are likely to show slower economic growth and rising unemployment, and Fed Chairman Jerome Powell will face tough questions at his post-meeting press conference.

The key outside market developments today were that the U.S. dollar index was slightly weaker, while U.S. crude oil prices were slightly higher, trading around $63.37 per barrel. The benchmark 10-year U.S. Treasury yield is currently at 4.036%.

U.S. economic data due for release on Monday includes a New York State manufacturing survey. The pace of U.S. economic data releases will pick up significantly on Tuesday.

(Comex Gold Daily Chart Source: Yihuitong)

From a technical perspective, December gold futures bulls have a strong overall near-term advantage. Bulls' next upside price objective is closing prices above strong resistance at $3,750 an ounce. Bears' next near-term downside price objective is pushing futures prices below strong technical support at $3,550 an ounce. First resistance is seen at $3,700 an ounce and then at this week's contract high of $3,715.2 an ounce. First support is seen at the overnight low of $3,662.8 an ounce and then at $3,650 an ounce.

December silver futures bulls also have a strong overall near-term technical advantage. A bull flag or pennant pattern has formed on the daily chart. Silver bulls' next upside price objective is closing prices above strong technical resistance at $45/oz. Bears' next downside price objective is closing prices below strong support at $40/oz. First resistance is seen at last week's high of $43.04/oz, followed by $43.50/oz. Next support is seen at $42/oz and then at last week's low of $41.08/oz.

At 23:20 Beijing time, spot gold was trading at $3,664.71 per ounce, up 0.59%. Spot silver was trading at $42.405 per ounce, up 0.53%. COMEX gold was trading at $3,703.0 per ounce, up 0.45%. COMEX silver was trading at $42.885 per ounce, up 0.13%.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.