A weaker dollar and falling U.S. Treasury yields push gold to a record high

2025-09-16 01:15:51

Spot gold rose 1% to $3,680.55 an ounce, having earlier hit an all-time high of $3,685.47. Gold prices rose about 1.6% last week. U.S. gold futures for December delivery rose 0.9% to $3,719.8.

The dollar index fell 0.3% to a one-week low, making gold more attractive to holders of other currencies; meanwhile, the benchmark 10-year U.S. Treasury yield edged lower.

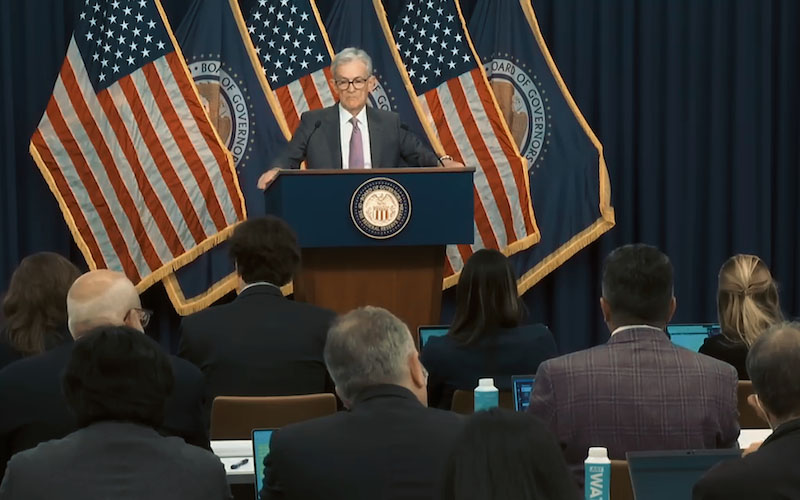

The Chicago Mercantile Exchange's (CME) "Fed Watch Tool" shows that the market is almost certain that the Federal Reserve will announce a 25 basis point interest rate cut on Wednesday, which will be the first rate cut since December last year. Some investors still expect a larger 50 basis point rate cut.

"A 25 basis point rate cut is pretty much a done deal at this point," said Peter Grant, vice president and senior metals strategist at Zaner Metals, adding that one or two more rate cuts are possible before the end of the year. Grant pointed out that the next upside target for gold in the short term is $3,700, followed by $3,730 and $3,743.

The Fed meeting comes amid unique pressures: a leadership dispute and President Trump's attempts to exert greater influence over policy. The U.S. Senate also left the door open for Trump's economic adviser, Stephen Milan, to join the rate-setting committee in time for Wednesday's vote.

Independent metals trader Tai Wong said weekend reports that China may relax gold import and export controls stimulated strong buying, with both official and private demand seen as key drivers of gold's rise.

Data released last week showed the U.S. consumer price index (CPI) rose at its fastest pace in seven months in August, while recent employment data pointed to a weak labor market, keeping the Federal Reserve on track for rate cuts.

In addition to the Fed's decision, the monetary policy trends of the Bank of England (BoE), the Bank of Japan (BoJ) and the Bank of Canada (BoC) have also added more uncertainty to this series of important events, which may exacerbate market volatility in various assets including gold.

"The charges against the Fed members are a clear warning that FOMC members are bowing to government pressure, which makes gold investment more attractive in this environment," analysts at Commerz bank said in a note.

JPMorgan predicts that central bank gold purchases will remain at a high of 900 tons in 2025, driven by the macroeconomic environment and investor diversification, particularly the expansion of ETFs and Chinese investors. The firm expects the average gold price to reach $3,675 per ounce in the fourth quarter, with further upward movement expected depending on the Federal Reserve's path of interest rate cuts.

Goldman Sachs maintains its bullish stance, predicting that gold will rise to $3,700 an ounce by the end of the year, benefiting from continued central bank buying and a low interest rate environment.

(Source of spot gold 1-hour chart: Yihuitong)

"The gold market is entering a period of seasonally strong consumption, and coupled with expectations of a September Fed rate cut, we continue to expect new record highs," said Suki Cooper, precious metals analyst at Standard Chartered Bank.

In its mid-year outlook, the World Gold Council stated that gold prices have risen 26% in the first half of this year. If economic conditions deteriorate (such as worsening stagflation or escalating geopolitical tensions), gold could rise an additional 10%-15% in the second half of the year, bringing the annual gain to nearly 40%. Conversely, if conflicts ease, gold could experience a 12%-17% pullback.

Overall, continued low U.S. Treasury yields, a weakening U.S. dollar, and lingering geopolitical risks have further fueled safe-haven demand. Consequently, gold prices are well-positioned to trade near all-time highs and continue to rise.

At 01:02 Beijing time, spot gold was quoted at US$3,680.38 per ounce, up 1.02%.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.