Those who ignore the linkage between US and Japanese bonds are missing out on the next wave of US and Japanese bonds

2025-09-19 20:57:27

This article starts with the high correlation between U.S. and Japanese bonds, combines fundamentals and technical analysis, analyzes the trend of the U.S. dollar against the yen and the linkage logic of the U.S. and Japanese bond markets, and looks forward to future trends.

US Treasuries and Japanese Bonds: Linkage Mechanisms Under High Correlation

As a global pricing benchmark, U.S. Treasury yield fluctuations have a particularly significant impact on Japanese Government Bonds (JGBs). Historical data shows that the correlation coefficient between the 10-year JGB yield and the 10-year U.S. Treasury yield has consistently remained above 0.9, driven by Japan's position as the world's largest holder of U.S. Treasury bonds (holding approximately $1.13 trillion) and its low domestic interest rate environment. On September 19, 2025, the 10-year U.S. Treasury yield was reported at 4.10%-4.14% (GC opened at 4.19%, down 2 basis points from the previous day), reflecting the market's pricing in the Federal Reserve's interest rate cut expectations.

The Bank of Japan's policy meeting sent shockwaves through the market. While the interest rate remained unchanged at 0.5%, two members (Hajime Takada and Naoki Tamura) dissented and advocated for a rate hike to 0.75%, pushing the probability of an October rate hike to 55% (a significant increase from 32.5% yesterday). As a result, the 10-year JGB yield soared to 1.64%, while the 2-year yield broke through 0.90%, reaching a new high since June 2008.

The logic behind the rapid rise in Japanese bond yields and the linkage with US Treasuries is clear: fluctuations in US bond yields are transmitted to Japan through global capital flows and interest rate expectations. Japanese institutional investors (such as life insurers and pension funds) hold significant amounts of US Treasuries. Rising US bond yields often trigger adjustments in Japanese bond allocations, pushing up Japanese bond yields. Furthermore, fluctuations in the yen exchange rate further amplify this effect. The USD/JPY exchange rate is trading at 148.069, approaching its recent high of 149.134, reflecting the combined impact of a strong dollar and a weak yen. While the Bank of Japan's announced plan to reduce its ETF holdings by 330 billion yen annually is limited in scale, market expectations of accelerated sales are exacerbating selling pressure on Japanese bonds, potentially further pushing up yields. Some institutions have pointed out that the Bank of Japan's policy shift could trigger a repricing in global bond markets, and the rapid rise in Japanese bond yields will continue to be driven by US Treasuries.

USD/JPY: Policy Divergence and Market Drivers

Fundamentals: Monetary Policy Divergence Dominates <br/>The divergence in monetary policy between the Federal Reserve and the Bank of Japan is the core driver of USD/JPY performance. Following the Fed's 50 basis point rate cut in September, market expectations for another 25 basis point cut in October reached 92% (federal funds futures data). SOFR futures (SRAZ25-SRAZ28) indicate expectations for a decline from the 10-day average of 4.41%. The 0x3 term OIS is at 3.901%, 51 basis points below the SOFR average, indicating a fully priced-in rate cut. Meanwhile, in Japan, core CPI has exceeded the 2% target for three consecutive years (reporting 2.7% in August), deepening disagreement within the Bank of Japan regarding rate hikes, with the probability of a December hike rising to 77.5%. While Governor Kazuo Ueda has not explicitly stated a rate hike, his cautious tone regarding downside risks has failed to allay market expectations for a policy shift.

Domestic politics in Japan also add to the uncertainty. With the Liberal Democratic Party leadership election approaching, the policy proposals of Sanae Takaichi and Shinjiro Koizumi focus on economic stimulus and investment growth, but their impact on monetary policy is limited. Takaichi's "responsible fiscal expansion" may indirectly support the yen, but it is unlikely to change the Bank of Japan's cautious tone in the short term. Stable US Treasury yields and the rapid rise in Japanese bond yields, coupled with a weak yen, are supporting a bullish USD/JPY trend.

The Interaction Between the US and Japanese Bond Markets and Exchange Rates <br/>The high correlation between US and Japanese Treasury bonds not only affects their respective yields but also transmits to the USD/JPY exchange rate through the exchange rate. If Japanese institutions repatriate domestic bonds due to rising JGB yields (1.64%), this could reduce demand for US Treasury bonds, pushing up US Treasury yields (4.14%+), and thus supporting the strength of the US dollar. Conversely, deepening expectations of a Fed rate cut could limit the upward trend in US Treasury yields, easing upward pressure on the USD/JPY. User analysis suggests that rising expectations of a Bank of Japan rate hike may limit USD/JPY's upside potential in the short term, but the US-Japan interest rate differential (4.10% vs. 1.64%) still supports a bullish trend.

The Bank of Japan's planned reduction of ETF holdings and potential adjustments to its yield curve control (YCC) policy are key variables. If the reduction accelerates or YCC is relaxed, Japanese government bond yields could rise further, attracting capital inflows and easing pressure on the yen's depreciation. However, caution should be exercised regarding spillover effects on the US Treasury market. In the US Treasury market, weakening demand for 20-year bonds (the premium fell 43 basis points to 35 basis points) suggests a heightened market sensitivity to long-term yields, potentially exacerbating USD/JPY volatility.

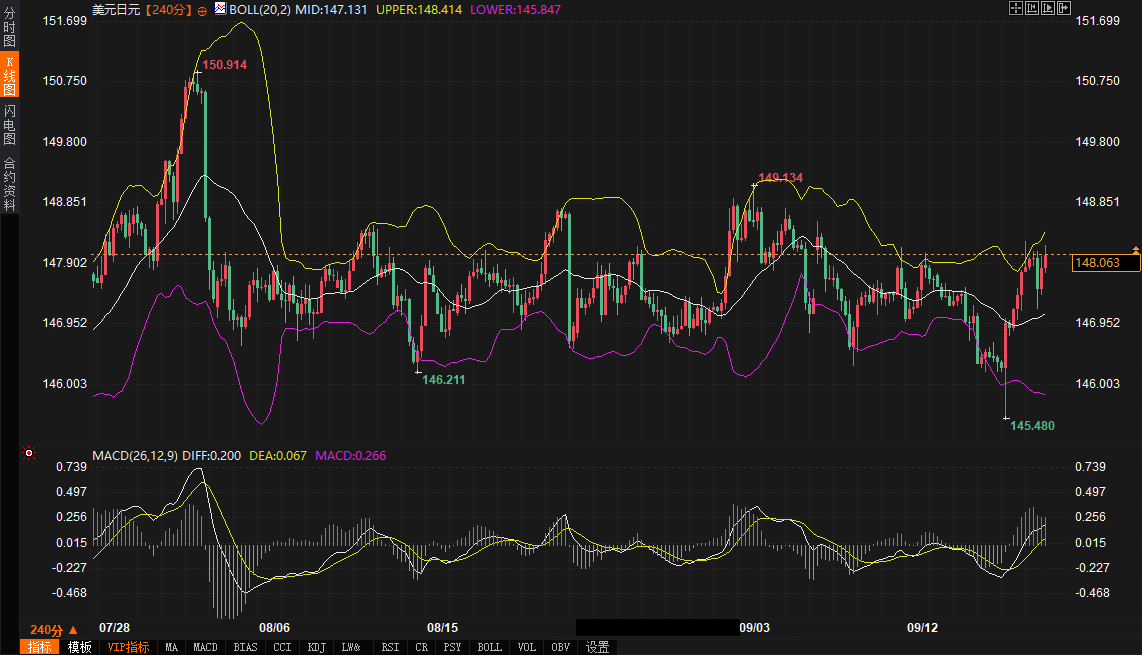

Technical Analysis: Breakthrough Criticality in a Fluctuating Market <br/>The 240-minute USD/JPY chart shows a strong oscillating pattern. It is currently trading above the middle Bollinger Band line at 147.131 and approaching the upper Bollinger Band line at 148.415. The MACD indicator's DIFF line (0.201) is above the DEA line (0.067), and the golden cross pattern continues above the zero axis, indicating dominant bullish momentum. Key support lies between 147.131 and 147.500 (where the middle Bollinger Band line overlaps with the 21-day moving average), while resistance lies between 148.415 and 149.134 (where the upper Bollinger Band line meets the previous high).

The exchange rate is approaching the upper Bollinger Band, and the MACD lines are trending at elevated levels, indicating short-term overbought risks. If the price breaks through 148.415 and stabilizes above 149.134, it could test the psychological level of 150.00. If it encounters resistance and falls back, the 147.131-147.500 range will provide support. End-of-quarter capital flows may exacerbate fluctuations in the 148.00-149.00 range, so keep an eye on the breakout direction.

Future Trend Outlook

In the coming week, the USD/JPY exchange rate and the US and Japanese bond markets will evolve amidst a balancing act between policy expectations and market sentiment. The 10-year US Treasury yield is expected to fluctuate between 4.10% and 4.20%. The clarity on the Fed's rate cut path will limit upside potential, but tariff rhetoric could fuel risk aversion, supporting a stabilization of yields. Driven by rate hike expectations, the 10-year Japanese government bond yield could rise to 1.70%, but gains may slow due to low liquidity and the YCC intervention. Technically, USD/JPY is expected to test resistance at 149.134, potentially challenging 150.00. If it falls back against resistance, the 147.131-147.500 range will provide support.

The market needs to pay attention to the meeting between the Japanese Ministry of Finance and primary dealers on September 24, Kazuo Ueda's speech on October 2-3, and the results of the Liberal Democratic Party leadership election on October 4. These events may further influence JGB and yen trends. The USD/JPY bullish trend is favored in the short term, supported by policy divergence and technical momentum, but caution is warranted regarding volatility risks arising from the Bank of Japan's policy shift and quarter-end capital flows.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.