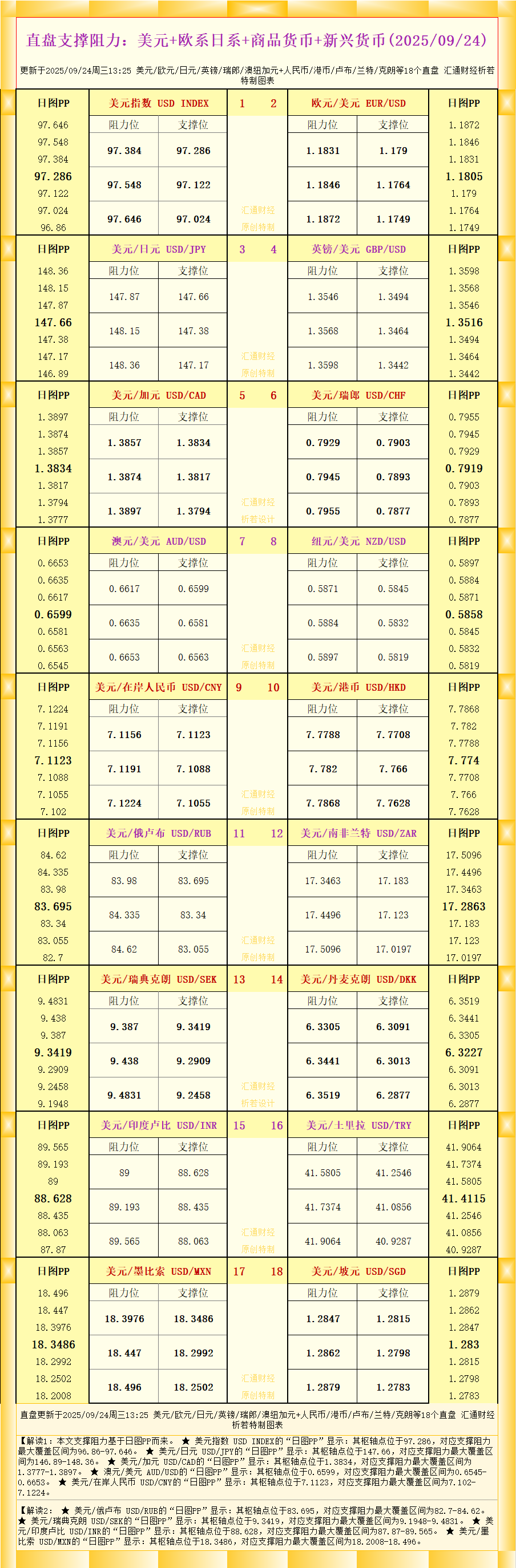

18 Forex Support and Resistance Charts in One Chart: US Dollar + European and Japanese Currencies + Commodity Currencies + Emerging Currencies (September 24, 2025)

2025-09-24 13:22:40

As shown in the data, Interpretation 1: The support and resistance in this article are based on the daily chart PP.

★ The "Daily PP" of the US Dollar Index USD INDEX shows that its pivot point is at 97.286, and the corresponding maximum support and resistance range is 96.86-97.646.

★ The "Daily PP" of USD/JPY shows that its pivot point is at 147.66, and the corresponding maximum support and resistance range is 146.89-148.36.

★ The "Daily PP" of USD/CAD shows that its pivot point is at 1.3834, and the corresponding maximum support and resistance range is 1.3777-1.3897.

★ The "Daily PP" of Australian Dollar/US Dollar AUD/USD shows that its pivot point is at 0.6599, and the corresponding maximum support and resistance range is 0.6545-0.6653.

★ The "daily PP" of the US dollar/onshore RMB USD/CNY shows that its pivot point is at 7.1123, and the corresponding maximum support and resistance range is 7.102-7.1224.

Interpretation 2:

★ The "Daily PP" of USD/RUB shows that its pivot point is at 83.695, and the corresponding maximum support and resistance range is 82.7-84.62.

★ The "Daily PP" of USD/SEK shows that its pivot point is at 9.3419, and the corresponding maximum support and resistance range is 9.1948-9.4831.

★ The "Daily PP" of USD/INR shows that its pivot point is at 88.628, and the corresponding maximum support and resistance range is 87.87-89.565.

★ The "Daily PP" of the US dollar/Mexican peso USD/MXN shows that its pivot point is at 18.3486, and the corresponding maximum support and resistance range is 18.2008-18.496.

For more information on the various varieties, please refer to the chart. Huitong Finance original special, all rights reserved, for reference only

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.