Yen bears revel in the market! Sanae Kawasaki's high stock price triggers a major shock in the foreign exchange market. This is the key to the future market.

2025-10-09 10:15:40

The yen's weakness is closely tied to new Prime Minister Sanae Takaichi's campaign promises. However, tough campaign rhetoric and policy implementation after taking office are two different things. Former Bank of Japan board member Tomoyuki Shimoda warned that the Bank of Japan might still choose to raise interest rates even if Sanae Takaichi were elected prime minister.

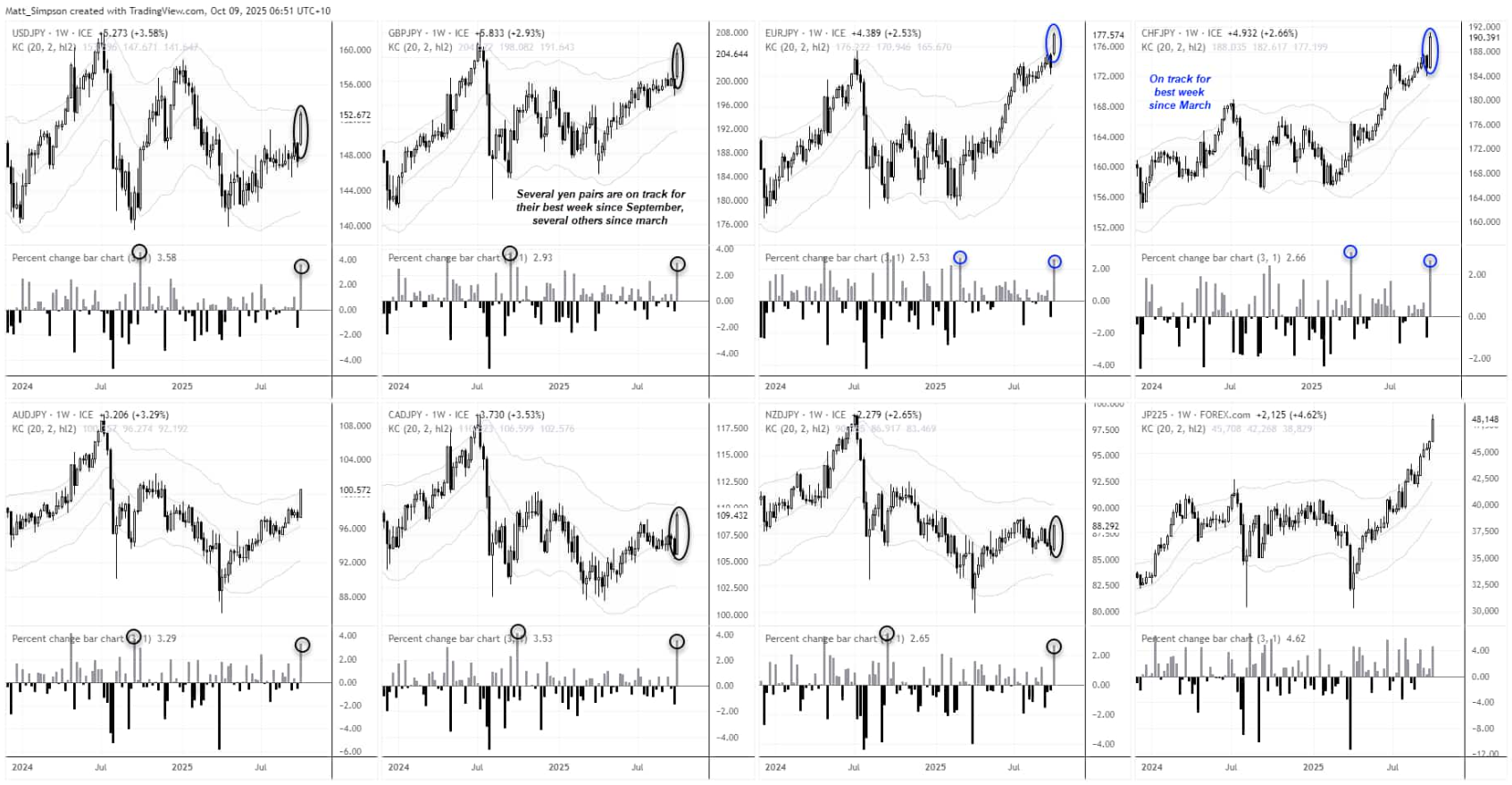

While it's too early to call a peak in yen crosses, declining volatility and overbought signals suggest bullish momentum may be fading before the weekend. Whether this leads to sideways trading or a deeper correction will largely depend on how the market interprets Takami Sanae's monetary policy stance.

USD/JPY technical analysis: daily chart

Analysis of intraday volatility indicators reveals that while USD/JPY had previously risen for five consecutive trading days, reaching an eight-month high of 152.99 at one point, its intraday volatility has been narrowing for nearly three trading days. This may not yet constitute a clear peak signal, but it does indicate that bullish momentum is weakening.

Although the K-line on Wednesday showed a long upper shadow, it has not yet formed a classic reversal pattern such as a shooting star.

USD/JPY has paused below the 153.00 level after its recent surge, and is currently trading between the 152.45-152.55 high volume key resistance area. The short-term structure suggests a potential pullback towards the 152.20-152.25 support area before retesting the 153.00 resistance level.

If the price effectively breaks through the 153.00 mark, the upward trend is expected to continue to the 153.80-154.00 range; but if the support level of 152.20 is not maintained, it may trigger a deeper correction, falling to 151.70 or the March high around 151.30.

The current important resistance level is at 154.80. However, bulls should be wary of possible resistance near the 153 and 154 integer levels, while the monthly R1 pivot point of 154.52 also constitutes a key resistance level.

(USD/JPY daily chart, source: Yihuitong)

At 10:15 Beijing time, the US dollar was trading at 152.52/53 against the Japanese yen.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.