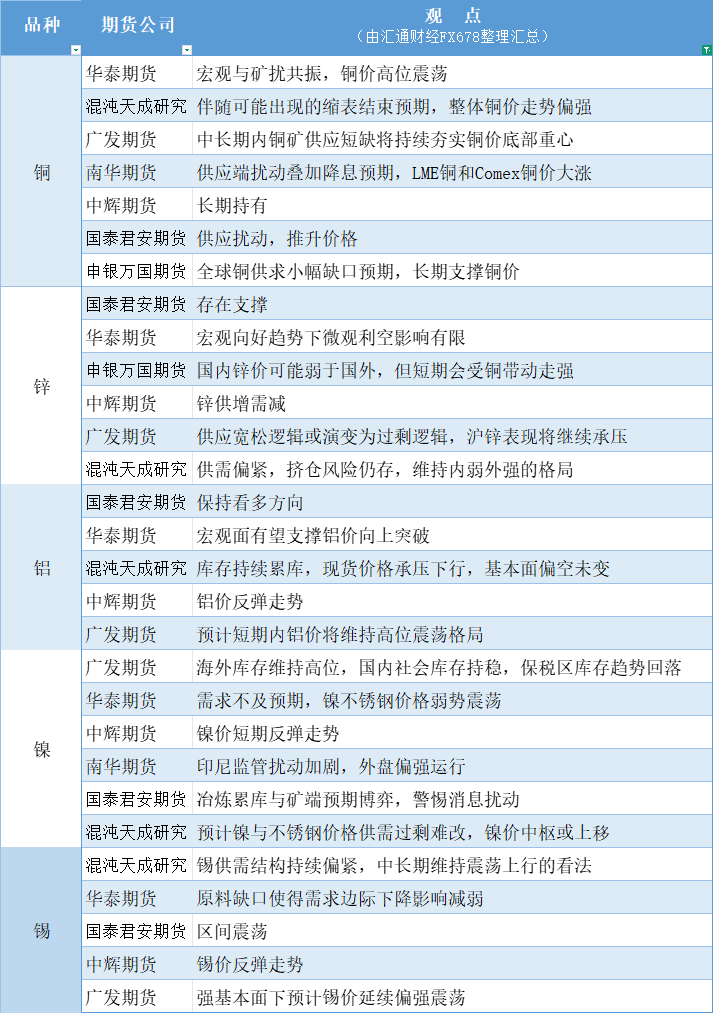

A chart summarizing the views of futures companies: Nonferrous metals (copper, zinc, aluminum, nickel, tin, etc.) on October 9th

2025-10-09 11:42:29

Copper: In the medium and long term, the shortage of copper ore supply will continue to consolidate the bottom center of gravity of copper prices. The macro and mine disturbances will resonate, and copper prices will fluctuate at a high level. Zinc: The logic of loose supply may evolve into a logic of oversupply. The performance of Shanghai zinc will continue to be under pressure. Domestic zinc prices may be weaker than foreign prices, but in the short term it will be driven by copper to strengthen. Aluminum: Inventories continue to accumulate, spot prices are under downward pressure, and the fundamentals remain bearish. Nickel: Overseas inventories remain high, domestic social inventories remain stable, and the bonded area inventory trend declines. Demand is lower than expected, and nickel stainless steel prices fluctuate weakly. Tin: The raw material gap weakens the impact of the marginal decline in demand. Under strong fundamentals, tin prices are expected to continue to fluctuate strongly.

This chart is specially created and compiled by Huitong Finance, all rights reserved.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.