France's crisis takes unexpected turn! Macron's allies openly turn against each other, casting a shadow over the euro's outlook.

2025-10-10 10:45:57

President Emmanuel Macron has since been facing a wider backlash, a situation that intensified this week when his former prime ministers publicly denounced his handling of the political deadlock in the National Assembly.

The most notable criticism came from Gabriel Attal, a political protégé of Macron who became the youngest prime minister in history in early 2024. However, he resigned in disgrace a few months later when Macron suddenly announced early parliamentary elections. This decision was not even communicated to Attal and other key aides in advance, and since then, the political protégé has gradually distanced himself from his mentor.

As the leader of Macron's centrist coalition in parliament, Attal admitted in front of television cameras on Monday evening (October 6): "Like many French people, I can no longer understand the president's decision-making," and pointed out that the head of state's "insistence on control has left people with the impression of being relentless."

On Tuesday morning, Edouard Philippe, the first prime minister during Macron's first term, made a shocking call for early presidential elections. He described the current situation as a "pathetic political game" and noted that "this political crisis is causing deep anxiety and disappointment among French citizens."

He further emphasized: "We must not allow the chaos of the past six months to continue for another 18 months. That would be too long to bear." In his view, "this crisis is by no means a simple political show or ambition game, but a profound crisis of national governance."

On Tuesday evening, it was Elisabeth Borne's turn to speak out. The prime minister from May 2022 to January 2024 proposed a solution that could both resolve the current crisis and upend Macron's legacy: a temporary halt to the controversial pension reform.

During his tenure, Borne was responsible for pushing forward the reform plan to raise the minimum retirement age from 62 to 64. This highly controversial policy at the time triggered a series of waves of negotiations and a storm of protests.

Although the reform bill was passed two years ago, it remains a focal point of controversy in French politics, with both the left and the far right continuing to call for its revision or even complete repeal.

Freezing the reform could open a path for negotiations with the Socialists and avoid the dissolution of parliament, but halting this signature reform would be a huge symbolic blow to Macron's legacy.

Perhaps this is a necessary sacrifice to prevent the French political system from falling into a deeper crisis and a vicious cycle. After all, compared to the setbacks in reform, the complete paralysis of national governance will undoubtedly leave Macron with a more painful political legacy.

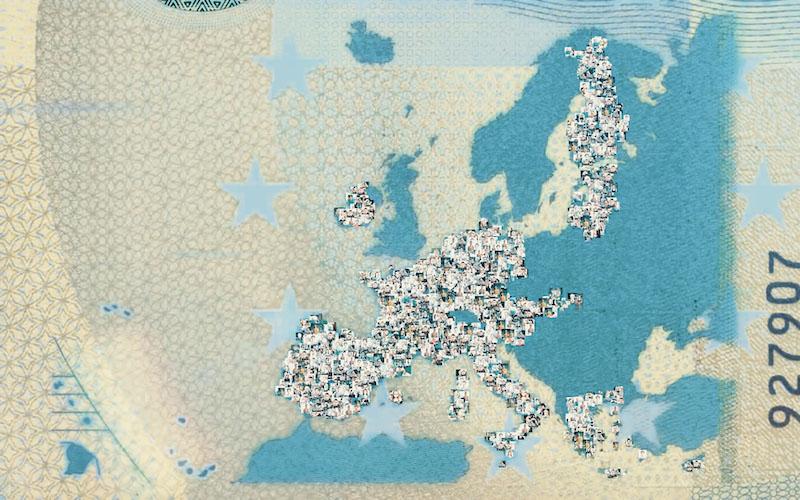

Increasing political uncertainty puts direct pressure on the euro

Public condemnation by key figures, including former Prime Minister Attal, Philippe, and Borne, has exposed deep rifts within the leadership. This high-level infighting sends a strong signal to the market that the government is no longer able to function effectively, and is bound to undermine international investor confidence in French assets and the euro.

The collapse of the ruling coalition means the government's ability to implement any future fiscal reforms or address economic challenges will be significantly compromised. The sharp increase in "policy uncertainty," which the market hates most, will directly lead to capital outflows and put downward pressure on the euro.

The market has reacted significantly to the recent political turmoil in France. The euro has fallen against the US dollar for four consecutive trading days. During the Asian session on Friday, the euro was still fluctuating narrowly around the low of 1.1570 against the US dollar.

The Euroization of "French Risk": France's political crisis is no longer solely a domestic matter. It has heightened concerns about political stability within the Eurozone, reminiscent of the European debt crisis. If markets lose confidence in France's fiscal discipline, the spread between French and German government bonds could widen significantly, reigniting discussions of "Eurozone fragmentation," one of the most fundamental risks facing the euro.

At 10:45 Beijing time, the euro was trading at 1.1569/70 against the US dollar.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.