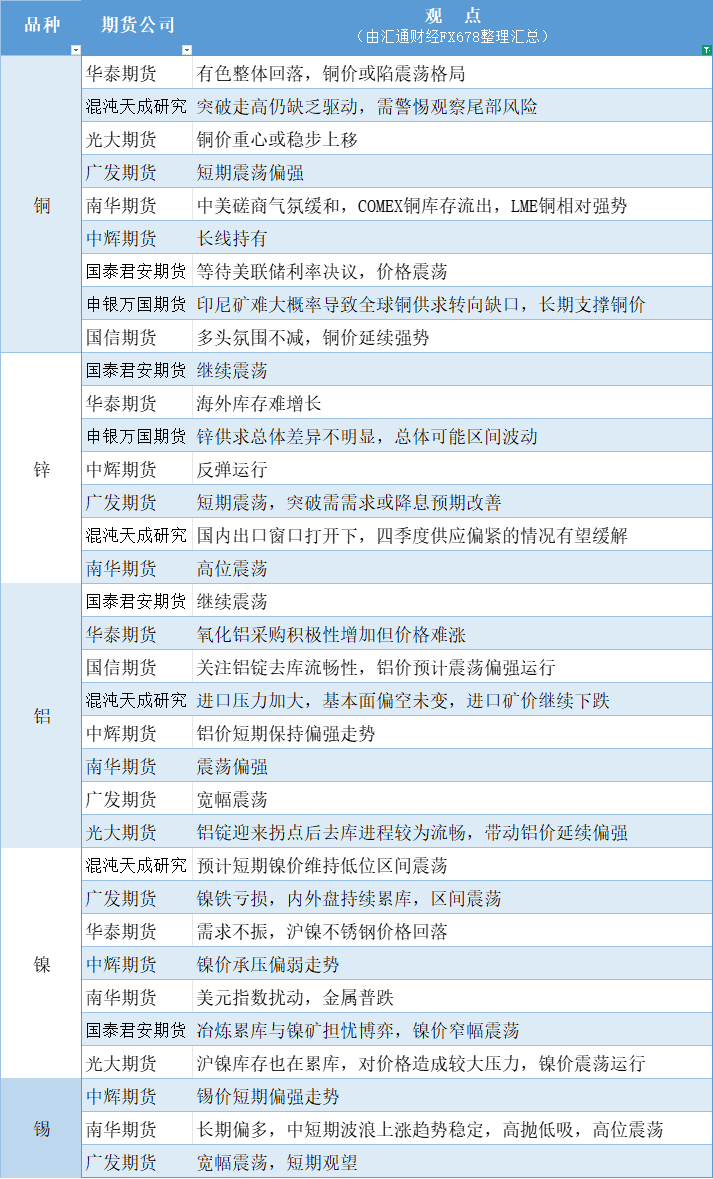

A summary chart of futures company viewpoints: Non-ferrous metals (copper, zinc, aluminum, nickel, tin, etc.) on October 29th

2025-10-29 12:22:58

Copper: With easing tensions in US-China trade talks and a net outflow of COMEX copper inventories, LME copper is relatively strong, leading to an overall decline in non-ferrous metals. Copper prices may be trapped in a volatile pattern. Zinc: With the opening of domestic export windows, the tight supply situation in the fourth quarter is expected to ease. The overall supply and demand of zinc is not significantly different, and prices are likely to fluctuate within a range. Aluminum: Import pressure is increasing, and the fundamentals remain bearish. Imported ore prices continue to fall. Nickel: Shanghai nickel inventories are also accumulating, putting significant pressure on prices. Nickel prices are expected to fluctuate. Tin: The long-term outlook is bullish, and the short-to-medium-term upward trend is stable. Buy low and sell high, with prices expected to fluctuate at high levels.

This chart is specially created and compiled by Huitong Finance, all rights reserved.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.