Crude oil is at a crossroads! Decoding the triple game behind crude oil price fluctuations.

2025-10-29 15:14:44

Oil prices had fallen for three consecutive trading days, mainly due to the potential production increase plan proposed by the Organization of the Petroleum Exporting Countries (OPEC+). The market is closely watching the crude oil inventory change report to be released later that day by the U.S. Energy Information Administration (EIA).

Four sources familiar with the matter revealed that OPEC+ is considering a slight production increase in December. The organization is likely to agree at its November 1st meeting to raise its December production target by another 137,000 barrels per day. While the basic proposal calls for restoring production to approximately 1.66 million barrels per day, member countries remain divided on the pace of further increases. The decision to increase production could put downward pressure on oil prices in the short term.

Andrew Lipo, president of Lipo Petroleum Consulting, pointed out: "Increased OPEC+ production will help offset potential reductions in Russian crude oil supply caused by US sanctions."

Oil traders are also focused on the Federal Reserve's interest rate decision, due on Wednesday (early Thursday morning Beijing time). The market widely expects the Fed to announce a 25 basis point rate cut after its October meeting, bringing the target range for the federal funds rate down to 3.75%-4.00%. Rate cuts typically lead to a weaker dollar, making dollar-denominated crude oil more attractive to overseas buyers, thereby boosting global demand and pushing up oil prices.

Despite claims of oversupply, US crude oil inventories continue to decline.

The American Petroleum Institute (API) estimated that U.S. crude oil inventories fell sharply by 4 million barrels in the week ending October 24, while the market had previously expected a decrease of only 2.9 million barrels.

According to Oilprice's calculations based on API data, U.S. crude oil inventories have decreased by a net 6.4 million barrels so far this year.

Earlier this week, the U.S. Department of Energy reported that crude oil inventories in the Strategic Petroleum Reserve increased by 500,000 barrels to 409.1 million barrels in the week ending October 24. This move was to replenish the national oil reserves, which had been shrinking during the Biden administration.

According to data from the U.S. Energy Information Administration (EIA), U.S. crude oil production fell slightly to 13.629 million barrels per day in the week ending October 17, but was still 94,000 barrels per day higher than at the beginning of the year.

Gasoline inventories plunged by 6.3 million barrels in the week ending October 24, compared with a decrease of 236,000 barrels in the previous week. The latest EIA data shows that gasoline inventories were slightly below the five-year average for the same period last week.

Distillate fuel inventories fell by 4.4 million barrels during the same period, compared with a previous decrease of 974,000 barrels. The latest EIA data shows that as of the week ending October 17, distillate fuel inventories were 7% below the five-year average. Cushing inventories, the delivery hub for US crude oil futures contracts, increased by 1.7 million barrels this week.

Indian refiners suspend orders for Russian oil as US sanctions take effect.

Anonymous sources revealed that Indian refiners have suspended orders for new Russian crude oil as the industry awaits clear guidance from the government on how to respond to new US sanctions.

Indian Oil Corporation (INC) has a long-standing partnership with Rosneft and has now shifted to purchasing crude oil in the spot market, issuing tenders for crude oil shipments.

A source said, "We haven't placed any new orders yet, and we've cancelled some orders placed through traders affiliated with sanctioned entities." Another source said, "It's essential to ensure that the sourcing channels are not linked to sanctioned entities, otherwise banks will refuse to process payments."

This move stems from the Trump administration's latest round of sanctions against Russian energy giants, targeting Rosneft and Lukoil—two giants that account for half of Russia's total crude oil exports (approximately 4 million barrels per day).

Russian crude oil accounts for one-third of India's total oil imports. Following multiple rounds of Western sanctions against Russia, Russian oil, through significant discounts, has risen from a secondary source to become the largest crude oil supplier in the South Asian subcontinent, significantly reducing India's import costs. The country relies on imports for 85% of its oil needs, making it particularly sensitive to price fluctuations.

Logistics restructuring, rising costs, and potential supply disruptions remain a Damocles' sword hanging over the market, providing a floor for oil prices.

Despite repeated emphasis from senior Indian officials, including Prime Minister Modi, that commodity procurement has always prioritized energy security over geopolitics, Indian buyers have begun seeking alternative sources of supply under the pressure of the latest sanctions.

Even before the latest sanctions took effect, Indian refiners had begun diversifying their crude oil sources in anticipation of potential escalation measures by the Trump administration. However, completely replacing Russian crude oil financially remains a significant challenge.

Tariffs will drive up costs, leading to delays in oil and gas projects until 2026.

A report indicates that US President Trump's comprehensive tariff measures will drive up operating costs in the oil and gas industry, disrupt supply chains, and dampen investment momentum in 2026.

The energy industry is highly dependent on the global supply chain, and internationally sourced materials such as drilling rigs, valves, compressors and special steels are core elements of its operations.

The U.S. tariff report points out that rising costs of these components, as well as other key raw materials such as steel, aluminum, and copper, could increase material and service costs across the entire value chain by 4% to 40%, potentially squeezing industry profit margins.

The United States has imposed tariffs on a variety of imported goods, including tariffs of 10% to 25% on crude raw materials not covered by the USMCA, and 50% on steel, aluminum, and copper.

These tariffs could reshape the cost structure of the oil and gas industry and increase uncertainty in raw material procurement.

Inflation and financial uncertainty caused by tariffs could delay final investment decisions (FIDs) and offshore greenfield projects worth more than $50 billion until 2026 or later.

The report points out that operators may therefore find it difficult to pass on rising costs, which could ultimately dampen investment activity in the sector.

As input costs rise and are passed down through the value chain via price adjustments, oil and fuel companies are expected to renegotiate contracts, incorporating price floating and force majeure clauses to share risk and limit exposure to volatility.

The report suggests that the ongoing disruptions may prompt companies to prioritize supply chain resilience over sourcing at the lowest cost, shift to domestic or duty-free suppliers, and utilize foreign trade zones or tariff reclassification to manage tariffs.

This shift is significant given the United States' reliance on imports—nearly 40% of the demand for oil pipes will be met through overseas channels by 2024.

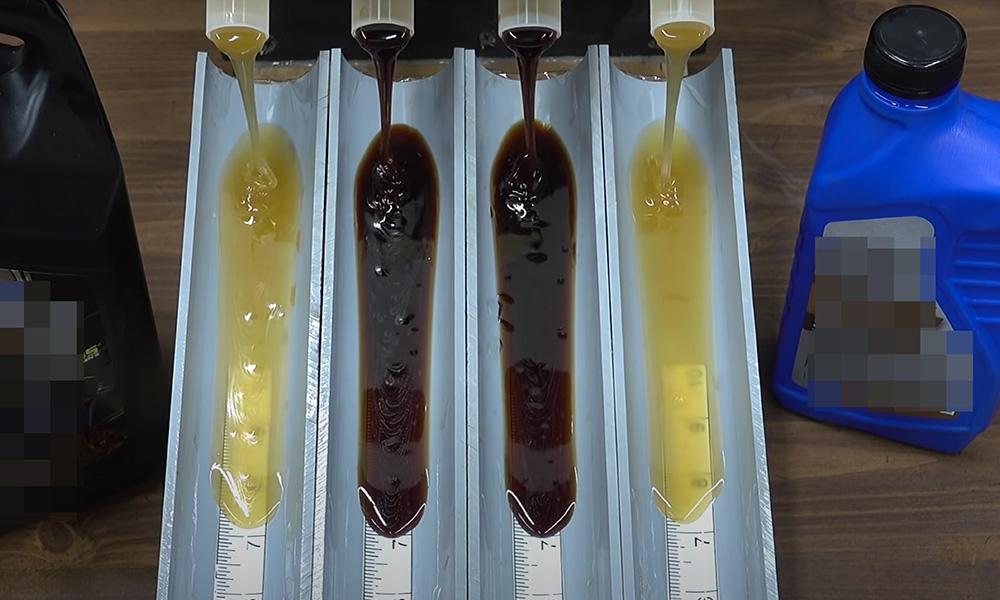

(US crude oil daily chart, source: FX678)

The crude oil market is being influenced by both short-term trading logic (inventory, OPEC+ production) and long-term structural changes (geopolitics, supply chain costs). Until a decisive factor breaks the deadlock, oil prices are likely to continue to fluctuate widely.

The market needs to pay close attention to the OPEC+ final decision on November 1, the actual implementation of sanctions against Russia, and the subsequent trend of US inventories.

At 15:14 Beijing time, US crude oil futures were trading at $60.43 per barrel.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.