October 31st Financial Breakfast: Markets assess the effectiveness of trade negotiations; gold prices rebound above $4,000; oil prices remain stable awaiting the OPEC+ meeting.

2025-10-31 07:27:47

Key Focus Today

stock market

U.S. stocks closed lower across the board on Thursday, with the Nasdaq and S&P 500 leading the decline. Shares of social media giant Meta plunged 11.3%, its biggest one-day drop in three years, primarily due to market concerns about its surging spending on artificial intelligence. Microsoft shares also fell 2.9% after the company reported near-record $35 billion in first-quarter capital expenditures and projected further increases in spending for the full year.

In contrast, Alphabet, Google's parent company, bucked the trend, rising 2.5%, thanks to solid performance in its advertising and cloud computing businesses. Amazon rose 9% in after-hours trading, as strong performance in its cloud computing business offset the impact of slowing e-commerce growth.

The Federal Reserve cut interest rates by 25 basis points as expected on Wednesday, but Chairman Powell's reservations about another rate cut in December raised doubts about the future policy path. Traders lowered their estimate of the probability of another rate cut in December from over 90% earlier this week to about 70%.

At the close, the Dow Jones Industrial Average fell 0.23% to 47,522.12 points; the S&P 500 fell 0.99% to 6,822.34 points; and the Nasdaq Composite fell 1.57% to 23,581.14 points. This pullback occurred after the three major indexes hit new highs for four consecutive trading days, with concerns about artificial intelligence-related spending being the main drag.

Gold Market

Gold prices rose significantly on Thursday, with spot gold gaining nearly 2.4% to settle at $4,003.62 an ounce, while U.S. December gold futures rose 0.4% to settle at $4,015.9. The rise was driven by two main factors: first, the Federal Reserve's latest interest rate cut enhanced the attractiveness of gold; and second, market doubts remain about the actual effectiveness of the newly reached trade agreement.

Jeffrey Christian, Managing Partner of CPM Group, pointed out that although gold showed signs of weakness during the session, initial optimism about an end to the trade war quickly faded as the market scrutinized the details of the trade negotiations, providing support for gold prices. In a period of low interest rates and economic uncertainty, gold, which does not generate interest, typically offers greater investment value.

Meanwhile, Wells Fargo Investment Institute's latest report significantly raised its year-end 2026 gold price target from the previous $3,900-$4,100 to a range of $4,500-$4,700. The firm's analysts emphasized that ongoing geopolitical and trade policy uncertainties are expected to continue driving gold demand from both the private and official sectors, thus providing sustained support for prices.

Other precious metals also performed strongly: spot silver surged 2.7% to $48.81 per ounce; platinum rose 1.2% to $1,604.38; and palladium was particularly strong, jumping 3.4% in a single day to close at $1,447.08 per ounce.

oil market

Oil prices held steady on Thursday as investors assessed the outcome of trade negotiations. Brent crude futures rose 0.1% to settle at $65.00 a barrel, while U.S. crude rose 0.1% to settle at $60.57 a barrel.

PVM analyst Tamas Varga said investors viewed the announced agreement as more of a easing of tensions than a structural change in the relationship between the two countries.

The Federal Reserve cut interest rates on Wednesday, in line with market expectations and helping to boost the economic outlook. Lower rates reduce borrowing costs for consumers and are likely to stimulate economic growth and oil demand. Meanwhile, in Europe and Asia, the European Central Bank and the Bank of Japan kept interest rates unchanged.

Amid concerns about oversupply, both major crude oil futures prices fell by about 3% in October, marking their third consecutive month of decline.

Investors say they are anticipating the OPEC+ meeting scheduled for November 2, where the alliance may announce a further increase in supply of 137,000 barrels per day in December. OPEC+ includes the Organization of the Petroleum Exporting Countries (OPEC) and allies such as Russia.

Foreign exchange market

The yen fell sharply against the dollar on Thursday, hitting a near nine-month low, mainly as the Bank of Japan maintained its ultra-loose monetary policy stance, dashing market expectations for a near-term interest rate hike. Meanwhile, hawkish comments from Federal Reserve Chairman Jerome Powell, who did not guarantee a December rate cut, further boosted the dollar.

The Bank of Japan decided to keep interest rates unchanged at its meeting. Although Governor Kazuo Ueda signaled a possible rate hike in December based on next year's wage outlook, the level of disagreement within the policymaking body remained the same as in September. Furthermore, Ueda did not provide further details on a specific timetable for rate hikes after the meeting, disappointing the market. Karl Schamotta, chief market strategist at Corpay in Toronto, pointed out that the Bank of Japan's decision to hold rates steady dealt a blow to yen bulls.

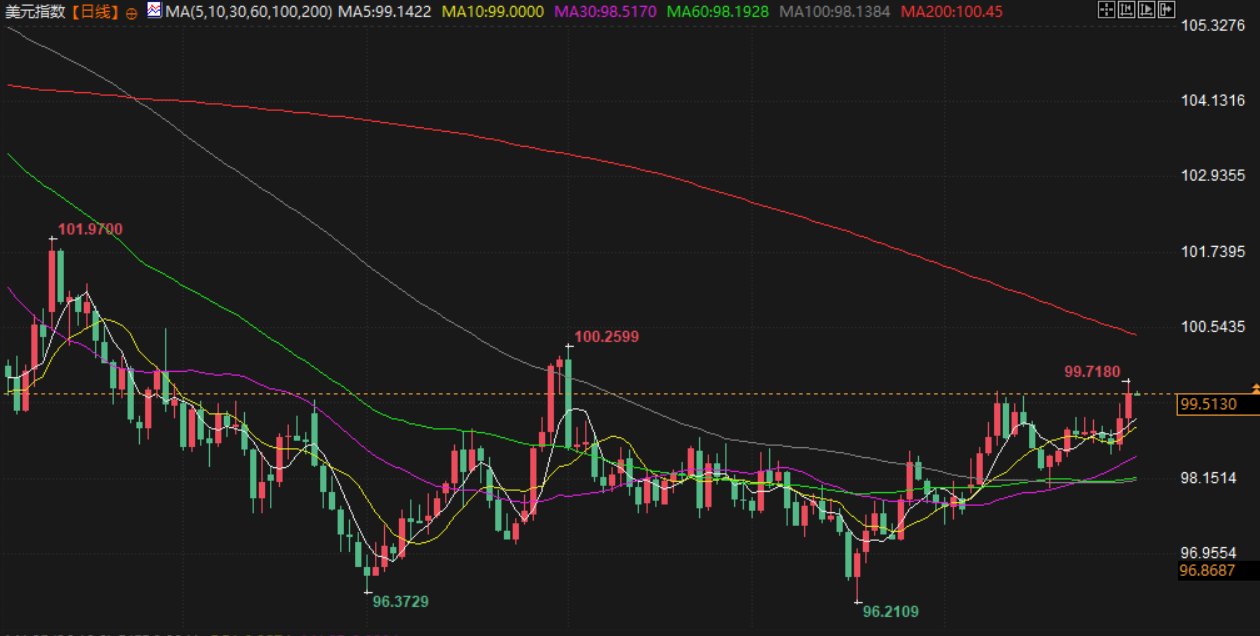

In stark contrast, while the Federal Reserve cut interest rates as expected, Powell explicitly stated that whether there would be another rate cut in December was "still uncertain," acknowledging that officials saw threats to the job market and remaining cautious about further rate cuts in the absence of comprehensive economic data. This relatively hawkish stance pushed the dollar index up 0.38% to 99.51, its highest level since August 1.

The dollar rose 0.9% against the yen to close at 154.08, its highest level since February 13. Among other major currencies, the euro fell 0.27% to $1.1568, and the pound fell 0.31% to $1.3152, both hitting multi-month lows. Market expectations for a December rate cut by the Federal Reserve have now fallen from 85% before Powell's speech to 71%, while the European Central Bank and the Bank of England are expected to maintain their current policies in the near term.

International News

The probability of the Federal Reserve cutting interest rates by 25 basis points in December is 74.7%.

According to CME's "FedWatch": the probability of the Federal Reserve cutting interest rates by 25 basis points in December is 74.7%, and the probability of keeping rates unchanged is 25.3%. The probability of the Fed cumulatively cutting rates by 25 basis points by January next year is 57.7%, the probability of keeping rates unchanged is 16.6%, and the probability of cumulative rate cuts of 50 basis points is 25.6%.

Government shutdown leads to air traffic controller shortages, causing flight delays at multiple US airports.

On October 30th, local time, the US government shutdown entered its 30th day. Due to a shortage of air traffic controllers, flights at Ronald Reagan Washington National Airport and Dallas-Fort Worth International Airport were delayed on October 30th. The Federal Aviation Administration stated that the average delay time for flights at Ronald Reagan Washington National Airport was 91 minutes, and the average delay time for flights at Dallas-Fort Worth International Airport was 21 minutes. Flights at Orlando Airport were also expected to be delayed that day due to staff shortages. (CCTV)

US Vice President Vance said that if the shutdown continues into the Thanksgiving travel season, it could be a disaster.

U.S. Vice President Vance stated that a prolonged government shutdown could cause travel disruptions during the busy holiday season. The White House is attempting to increase pressure on Democrats over the funding impasse. Vance made these remarks after a roundtable meeting with airline industry executives at the White House on Thursday.

Federal Reserve Chair Jerome Bowman plans to restructure the agency's regulatory department and lay off 30% of its staff.

The Federal Reserve's top banking regulator announced plans to restructure its regulatory division and cut about 30% of its staff. According to sources familiar with the matter, Michelle Bowman, the Fed's vice chair for supervision, stated at a meeting with staff on Thursday that the reductions would primarily be achieved through attrition, employee retirement, and voluntary departure incentives. A memo to staff indicated that she anticipates the overall size of the Supervision and Oversight (S&R) division will be reduced to approximately 350 people by the end of 2026—a reduction of about 30% from the previously approved staff of nearly 500.

Goldman Sachs CEO: Slow economic growth could lead to a US debt "liquidation".

Goldman Sachs CEO Jonathan Solomon said that if U.S. economic growth fails to improve, the current rising debt levels could lead to a "liquidation" of the economy. "If we continue on our current trajectory and growth fails to improve, then there will be a liquidation," Solomon said Thursday at an event hosted by the Economic Club of Washington. "The way out is economic growth." He believes the likelihood of a U.S. recession in the short term is "low."

The UK Chancellor of the Exchequer's rental irregularities have resurfaced.

The controversy surrounding Chancellor of the Exchequer Reeves' rental irregularities continues to escalate. A Downing Street spokesperson confirmed that emails concerning Reeves' failure to obtain a rental permit for her southeast London residence have been submitted to the Prime Minister's office and forwarded to the government's independent ethics advisor. These emails are expected to be released later today. The spokesperson also clarified to reporters that despite the controversy, Chancellor Reeves will still deliver the budget as planned next month. Previously, after moving into 11 Downing Street, Reeves rented out her private residence without obtaining the required rental permit from the local council. Reeves apologized to Prime Minister Starmer, calling it an "unintentional mistake," and immediately obtained the permit upon realizing the issue. Prime Minister Starmer had previously consulted with the independent ethics advisor, Sir Laurie Magnus, who decided against launching a formal investigation. The release of these emails may provide further details about the incident.

The EU is seeking assurances from the US that it will not prevent AT1 from being written down in the event of a bank failure.

Europe’s top officials responsible for handling bank failures are seeking assurances from the United States that it will not prevent other regulators from forcing bondholders to accept losses when large banks fail. Dominique Laboureix, head of the European Single Settlement Board (SRB), has convened a panel at the Financial Stability Board (FSB) that is working on the matter “seriously” and has received “some positive signals” from the new leadership of the U.S. Securities and Exchange Commission (SEC).

Russia's second-largest natural gas producer: Exclusion of Russian liquefied natural gas will lead to soaring gas prices.

Leonid Mikhelson, chairman of Novatek, Russia's second-largest natural gas producer, said on the 30th that the West cannot exclude Russian liquefied natural gas (LNG) from the global natural gas supply and demand balance; forcing this would lead to a sharp rise in natural gas prices and harm the interests of European consumers. Speaking at the Verona Eurasia Economic Forum in Istanbul, Turkey, Mikhelson said that Russia accounts for more than 10% of global LNG production, making it unrealistic to remove it from the global natural gas supply and demand balance.

Domestic News

Ministry of Commerce: Encourages qualified industries and enterprises to establish industry carbon footprint factor databases.

The Ministry of Commerce has released implementation opinions on expanding green trade. The opinions propose accelerating the construction of a carbon footprint database for foreign trade products. This includes expediting the construction of a national carbon footprint factor database, publishing and continuously updating electricity carbon footprint factor data, and promoting research on carbon footprint factors for other basic energy sources and raw materials, providing a foundation for foreign trade enterprises to calculate the carbon footprint of their products. The opinions also encourage qualified industries and enterprises to build industry-specific carbon footprint factor databases and promote cooperation between international carbon footprint database providers and Chinese carbon footprint database providers.

National Data Administration: Encourages exploration of cutting-edge technologies such as intelligent data encapsulation and the construction of innovative scenarios based on data infrastructure.

The National Data Administration issued the "Implementation Plan on Strengthening Scenario Application in the Pilot Construction of National Data Infrastructure," which encourages the exploration of cutting-edge technologies and the construction of innovative scenarios based on data infrastructure, such as intelligent data encapsulation, trusted high-speed transmission, and multimodal full-domain storage. It supports leading enterprises and research institutions in jointly conducting cutting-edge technology adaptation and verification based on data infrastructure, providing technical support for the large-scale promotion of scenarios. Simultaneously, it supports and encourages the creation of other replicable application scenarios that facilitate the release of data element value, leveraging data infrastructure and its functions.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.