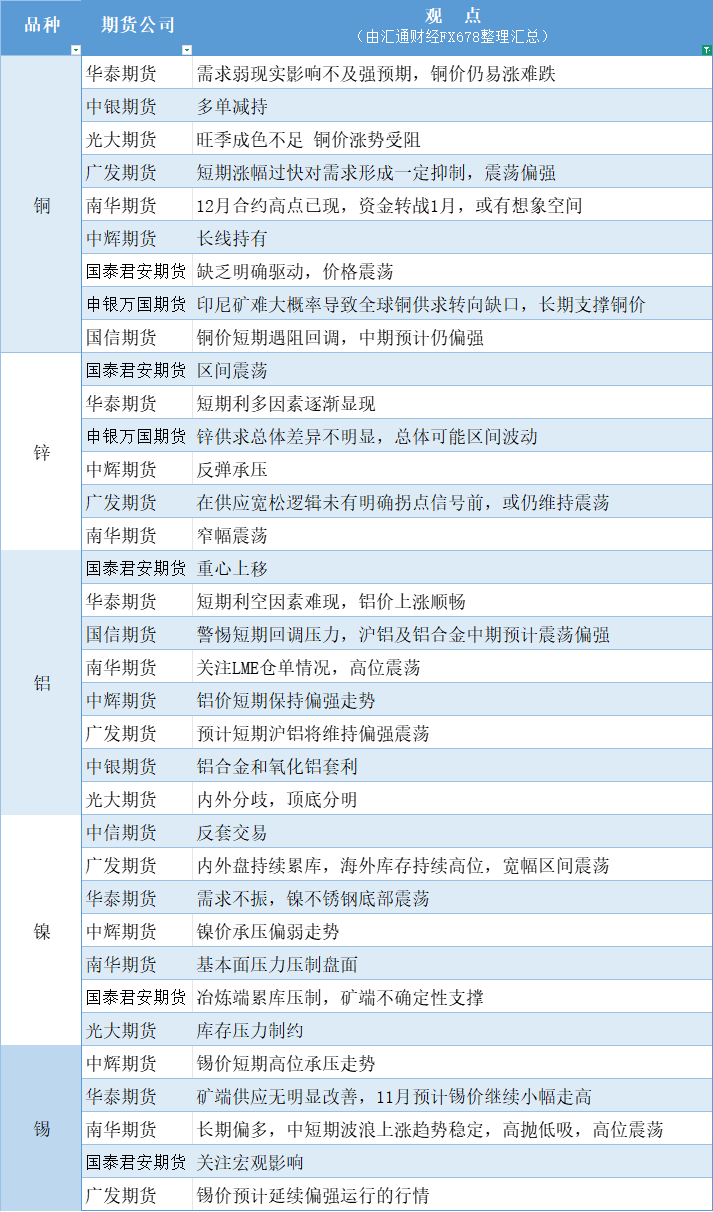

A summary chart of futures company viewpoints: Non-ferrous metals (copper, zinc, aluminum, nickel, tin, etc.) on November 3rd.

2025-11-03 13:13:26

Copper: The Indonesian mining disaster is likely to cause a global copper supply-demand imbalance, providing long-term support for copper prices. However, the rapid short-term price increase has somewhat suppressed demand, resulting in a volatile but slightly bullish trend. Zinc: Until there is a clear turning point in the supply easing logic, prices may continue to fluctuate, with short-term bullish factors gradually emerging. Aluminum: Be wary of short-term pullback pressure; Shanghai aluminum and aluminum alloys are expected to fluctuate but slightly bullish in the medium term. Nickel: Domestic and international inventories continue to accumulate, with overseas inventories remaining high, leading to wide-range fluctuations. Tin: Long-term bullish, with a stable upward trend in the medium and short term; buy low and sell high, with high-level fluctuations expected.

This chart was specially created and compiled by FX678 and is copyrighted.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.