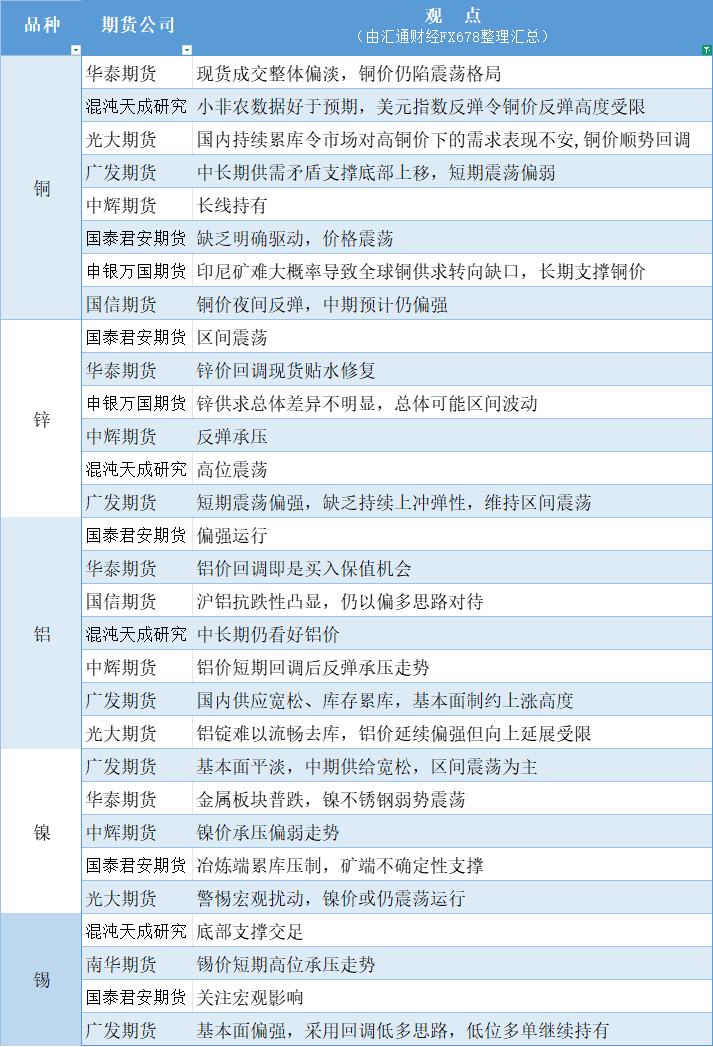

A summary chart of futures company viewpoints: Non-ferrous metals (copper, zinc, aluminum, nickel, tin, etc.) on November 6th

2025-11-06 11:26:05

Copper: Domestic inventory accumulation has caused market unease regarding demand under high copper prices, leading to a price correction. The medium- to long-term supply-demand imbalance supports a shift in the bottom, while short-term fluctuations are expected to be weak. Zinc: Overall zinc supply and demand are not significantly different, and prices are likely to fluctuate within a range. Aluminum: Aluminum ingot inventory reduction is difficult, and while aluminum prices remain relatively strong, upward momentum is limited. A short-term correction followed by a rebound is expected to face downward pressure. Nickel: Fundamentals are lackluster, with ample supply in the medium term, and range-bound trading is expected. Tin: Fundamentals are relatively strong; a buy-on-dips strategy is recommended, and existing long positions should be held.

This chart was specially created and compiled by FX678 and is copyrighted.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.