Iraq urgently cancels Russian oil orders; surge in maritime inventories triggers supply tsunami.

2025-11-06 14:53:11

Data from the U.S. Energy Information Administration (EIA) showed that crude oil inventories surged by 5.202 million barrels last week, reversing a previous decline of 6.858 million barrels. This figure far exceeded market expectations of a 1.8 million barrel increase, marking the largest weekly increase since July.

The continued expansion of crude oil production by the Organization of the Petroleum Exporting Countries (OPEC+) and its allies, including Russia, as well as non-member countries, has raised concerns about a global supply glut.

OPEC+ recently approved a modest production increase plan for December, but indicated it will pause further increases in early 2026, sending a cautious signal amid weak demand.

A JPMorgan Chase client report indicated that global crude oil demand grew by an average of 850,000 barrels per day as of November 4, lower than the bank's previous forecast of 900,000 barrels per day. The report added that "high-frequency indicators show continued weakness in U.S. oil consumption."

Iraq cancels Lukoil shipments

Following the U.S. sanctions imposed last month on Russia's second-largest oil producer, Iraq's State Oil Marketing Organization (SOMO) has cancelled three scheduled shipments of crude oil from Lukoil this month.

Lukoil holds a 75% stake in Iraq’s giant West Qurna-2 oil field, which produces more than 400,000 barrels of crude oil per day.

These three batches of crude oil from the West Qurna-2 oil field were originally scheduled to be shipped on November 11, 18 and 26, but Iraq was clearly unwilling to deal with these sanctioned crude oils.

Since the U.S. imposed sanctions on Lukoil and Rosneft in late October, global oil traders and operators have been avoiding any cargo from these two Russian oil giants to avoid attracting the attention of the Trump administration and suffering secondary sanctions.

Last week, Lukoil announced it had agreed to sell its international operations to Swiss commodities trader Mercuria. This move comes a week after the U.S. imposed sanctions on Russia's top oil company, making business with its international subsidiaries exceptionally complex and nearly impossible.

Following the U.S. sanctions imposed on Lukoil and Rosneft on Russia for "not seriously committing to a peace process to end the Russia-Ukraine conflict," Lukoil announced it would sell all of its international assets and initiate formal procedures to receive offers from potential buyers.

Last week, Lukoil announced in a statement that it had received and accepted a takeover offer from trading giant Mercuria for LUKOIL International GmbH, a wholly-owned subsidiary of Lukoil that holds all of Lukoil Group’s international assets.

If necessary, Mercuria and Lukoil will apply to the U.S. Treasury Department’s Office of Foreign Assets Control for an extension of the business liquidation deadline from November 21 to complete the transaction.

Meanwhile, buyers of Russian crude oil are seeking alternative sources of supply, or at least trading Russian crude oil through unsanctioned entities.

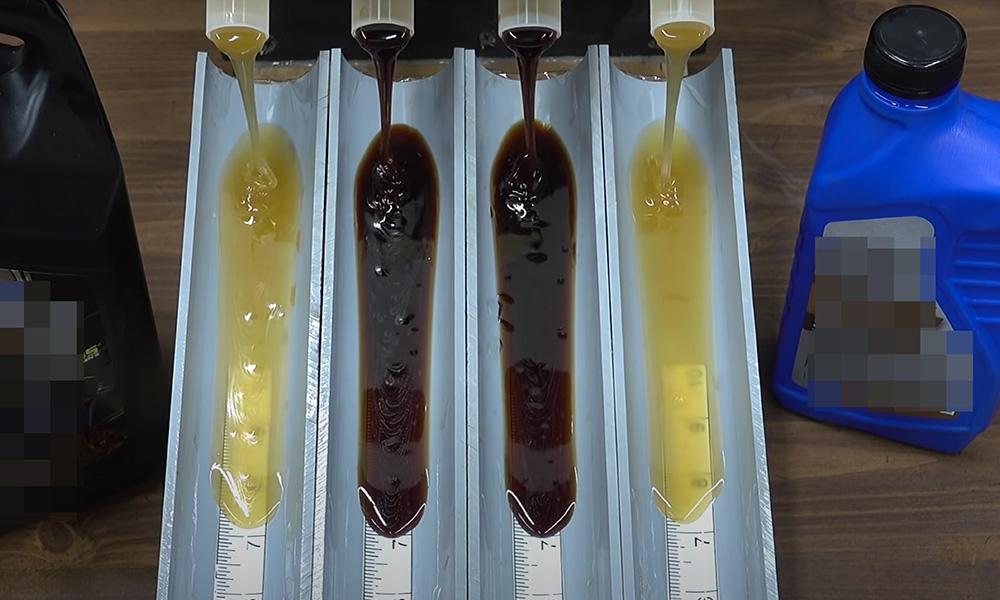

Faced with US sanctions, Russian and Iranian crude oil have been forced to accumulate in large quantities on tankers.

Tobjörn Trnqvist, co-founder of commodities trading giant Mercuria Group, said on Wednesday that U.S. sanctions against Russia and Iran have resulted in an "unprecedented" massive backlog of crude oil in tankers.

This storage is enormous, and if all sanctions were suddenly lifted, the market could face a severe oversupply.

While ample supply is reducing volatility in the crude oil market, sanctions have created a “massive” mismatch of crude oil, some of which is being stored in tankers around the world.

It is worth mentioning that Mercuria Group is about to acquire the international business of Russian oil giant Lukoil after the United States imposed sanctions on major Russian oil companies, making it extremely complicated and almost impossible to conduct business with their international subsidiaries.

The assessment that a large amount of crude oil is stuck at sea has also been echoed by other major commodity trading companies.

Marco Dunant, CEO and co-founder of Mercuria Energy Group, said crude oil supply could exceed demand by as much as 2 million barrels per day next year. However, he added that sanctions and their enforcement will be an uncertain factor in assessing the supply glut.

Dunan analyzed, "This means that the daily surplus of 2 million barrels may gradually shrink to 1 million barrels. Current onshore inventories are indeed low, but offshore floating storage remains high. The supply surplus is slowly forming and is likely to impact the market in the coming months."

While the market widely anticipates a supply glut, analysts' estimates of its size differ—ranging from a record super-glut to a more moderate inventory increase during the traditionally slow demand season of the first quarter. The impact of U.S. sanctions on major Russian oil companies remains one of the biggest unknowns in current forecasts.

(US crude oil daily chart, source: FX678)

At 14:52 Beijing time, US crude oil futures were trading at $59.83 per barrel.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.