November 7th Financial Breakfast: The US government added silver to its list of critical minerals, boosting safe-haven demand and supporting gold prices; oil prices were caught in a pincer movement between supply and demand.

2025-11-07 07:29:54

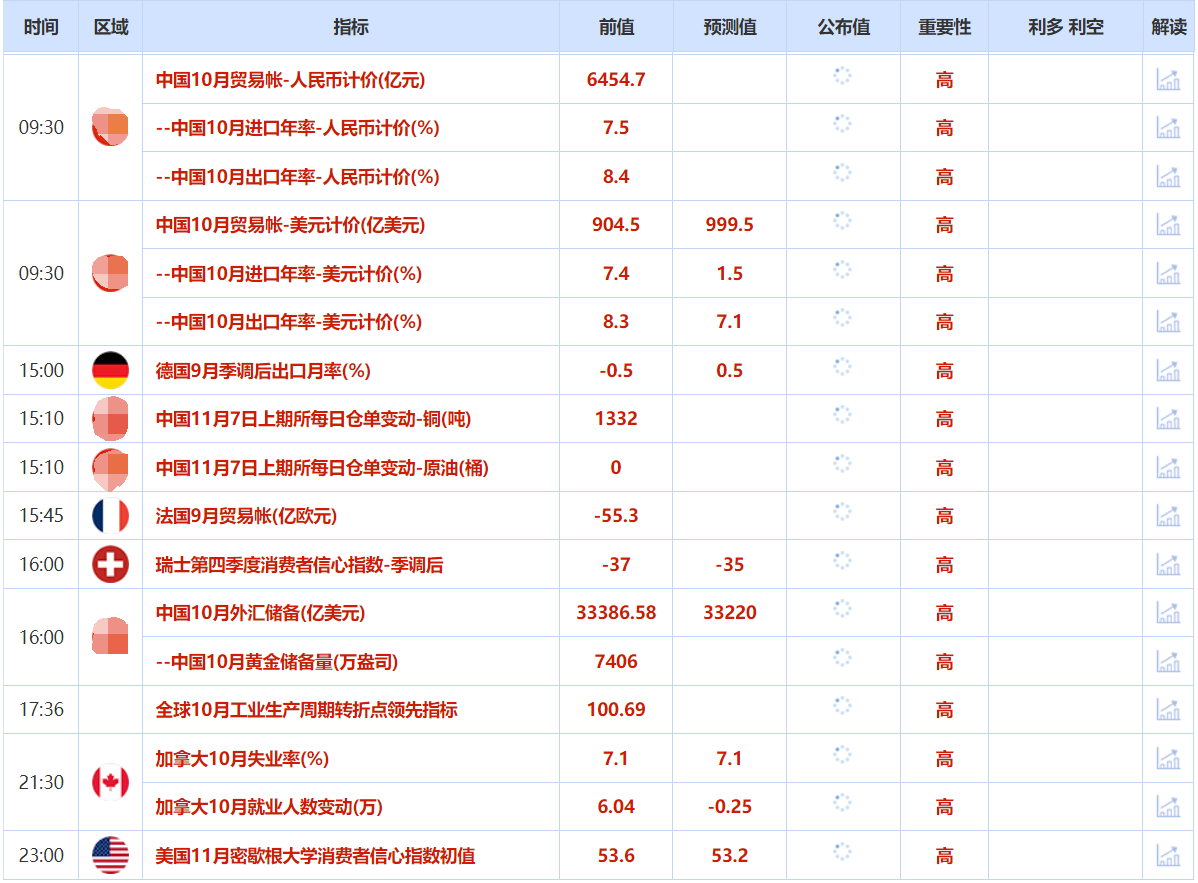

Key Focus Today

stock market

U.S. stocks closed lower across the board on Thursday, with technology stocks experiencing another sharp sell-off. The Dow Jones Industrial Average fell 0.84%, the S&P 500 dropped 1.12%, and the Nasdaq Composite declined by 1.90%. The Philadelphia Semiconductor Index plunged 2.4%, indicating continued pressure on artificial intelligence-related stocks.

Market analysis indicates that overvaluation and economic uncertainty have jointly dampened risk appetite. Murphy & Sylvest market strategists stated that despite worrying valuations, a "buy the dip" mentality remains prevalent in the market. With the government shutdown continuing, investors are forced to rely on private sector data to assess the economic situation.

The latest employment data shows signs of a deteriorating labor market. A report from job placement firm Challenger shows that announced layoffs surged 183.1% in October, the worst October figure in over two decades, with cost-cutting and artificial intelligence cited as major reasons. The chief strategist at Simplify Asset Management believes this data suggests the labor market weakness may be greater than the Federal Reserve anticipated.

Despite a strong earnings season, with 83% of S&P 500 companies reporting better-than-expected results and third-quarter earnings projected to grow 16.8% year-over-year, it failed to offset market concerns about the economic outlook. In individual stocks, DoorDash plunged 17.5% due to lower-than-expected profits, while Snap surged 9.7% on better-than-expected revenue and a partnership with Perplexity AI.

Gold Market

Gold prices extended their gains on Thursday, driven by a weaker dollar and a resurgence in safe-haven demand. Spot gold rebounded above $4,000, approaching $4,020 per ounce, while U.S. gold futures for December delivery were essentially unchanged at $3,991.

Market analysts point out that the continued US government shutdown and the US Supreme Court's questioning of the legality of Trump's tariffs have jointly fueled investors' risk aversion.

"As these uncertainties persist, we are seeing a recovery in safe-haven buying," said Peter Grant, vice president of Zaner Metals. He expects gold prices to reach the $4,300 to $4,400 per ounce range by the end of the year.

The U.S. has added uranium, copper, and silver to its list of critical minerals, indicating that the Trump administration is expanding the range of commodities it deems essential to the U.S. economy and national security. According to the government website, the updated U.S. Geological Survey list also includes metallurgical coal, potash, rhenium, silicon, and lead. This list will replace the 2022 version. The list determines which commodities will be included in the Section 232 investigations into processed critical minerals and their derivatives, announced by the Trump administration in mid-April, which could lead to tariffs and trade restrictions. Trump has prioritized strengthening domestic supplies of critical minerals, arguing that over-reliance on foreign supplies jeopardizes national security, infrastructure development, and technological innovation.

The dollar index retreated 0.5% after hitting a four-month high, enhancing gold's appeal to overseas buyers. The market currently estimates a 72% probability of another Federal Reserve rate cut in December, while traders are closely watching the impact of Trump's trade policies and the risk of a government shutdown.

Other precious metals showed mixed performance, with spot silver rising slightly by 0.3%, while platinum and palladium fell by 1.8% and 2.7%, respectively.

oil market

International oil prices continued their decline on Thursday, with Brent crude and U.S. crude closing at $63.38 and $59.43 per barrel respectively, marking the third consecutive monthly drop. The market continues to be pressured by both oversupply and weak demand.

Analysts point out that increased production from OPEC+ and continued growth in output from non-OPEC oil-producing countries have exacerbated market concerns about oversupply. John Kilduff, a partner at Again Capital, stated, "The market is suffering from the most clearly anticipated oversupply in history." Meanwhile, demand is also weak.

A JPMorgan report shows that global oil demand growth as of November 4 was lower than expected, with U.S. oil consumption remaining sluggish due to weak travel activity and reduced container shipping volumes.

Despite concerns about supply disruptions stemming from new US sanctions against Rosneft, Saudi Arabia's significant reduction in its December official crude oil prices for Asia further confirms the ample supply in the market. Coupled with a larger-than-expected increase of 5.2 million barrels in US crude oil inventories to 421.2 million barrels and low refinery utilization rates, these factors combined to exert downward pressure on oil prices.

Foreign exchange market

The dollar extended its losses against the euro and Swiss franc on Thursday, as weak labor market data reinforced market expectations for another Federal Reserve rate cut this year. A report from global employment agency Challenger showed that the number of U.S. companies planning to lay off workers surged to 153,074 in October, a 183% year-on-year increase and the highest level for the same period in 22 years.

The dollar index fell 0.42% to 99.70, while the euro rose to $1.1547 against the dollar. Convera currency strategist Antonio Ruggero stated that the lack of data following the government shutdown created excessive market optimism, and the release of layoff data immediately triggered panic selling. Interest rate futures markets show that traders now expect a 69% probability of a December rate cut.

The pound bucked the trend, rising 0.3% to $1.3088 after the Bank of England kept interest rates unchanged. Market attention has now shifted to the budget to be announced by Chancellor Reeves on November 26, with potential tax increases being closely watched. Despite the central bank's decision to hold rates steady, Goldman Sachs analysts believe the pound still faces downward pressure in the medium to long term.

The Norwegian central bank announced on the same day that it would maintain its benchmark interest rate at 4.0%, in line with market expectations. The bank indicated that it might further ease policy in the coming year, causing the Norwegian krone to strengthen, rising 0.36% against the US dollar.

International News

Hezbollah in Lebanon has called on the government to be wary of the risks of negotiating with Israel.

Hezbollah issued an open letter on the 6th, urging Lebanese President Joseph Aoun, Speaker of Parliament Nabih Berri, and Prime Minister Nawaf Salam not to "fall into the trap of negotiating with Israel," stating that such dialogue "will only serve the interests of the enemy" and pose an "existential threat" to Lebanon's sovereignty.

The Trump administration added copper, coal, and silver to its list of critical minerals.

The U.S. has added uranium, copper, and silver to its list of critical minerals, indicating that the Trump administration is expanding the range of commodities it deems essential to the U.S. economy and national security. According to the government website, the updated U.S. Geological Survey list also includes metallurgical coal, potash, rhenium, silicon, and lead. This list will replace the 2022 version. The list determines which commodities will be included in the Section 232 investigations into processed critical minerals and their derivatives, announced by the Trump administration in mid-April, which could lead to tariffs and trade restrictions. Trump has prioritized strengthening domestic supplies of critical minerals, arguing that over-reliance on foreign supplies jeopardizes national security, infrastructure development, and technological innovation.

European Central Bank Vice President Guindos said the eurozone's growth outlook has improved slightly.

European Central Bank Vice President Luis de Guindos said the central bank is slightly more optimistic about the eurozone economy and sees positive signs of easing in some worrying areas of inflation. The Spanish official said the risks to economic growth have become more balanced, with positive news on the inflation front and service price increases “performing” much better. “Growth is better than many expected a few quarters ago,” he said at a webinar hosted by Natixis CIB on Thursday. “The eurozone economy has shown a certain resilience.”

US senators propose: Members of Congress should be furloughed if the government doesn't "open."

On November 6th, Eastern Time, the US government shutdown entered its 37th day. On November 5th, local time, Republican Senator John F. Kennedy stated that the shutdown may continue for some time, with many federal employees currently owed wages, military personnel receiving only partial pay, and air traffic controllers working without pay. Kennedy indicated he would submit a bill to suspend the salaries of members of Congress during the continued shutdown. (CCTV)

Nancy Pelosi announces her retirement: she will not seek re-election as a member of the U.S. Congress.

Former U.S. House Speaker Nancy Pelosi announced her retirement at the end of her current congressional term, marking the end of one of the most influential legislative careers in American history and the beginning of a long farewell journey for the California Democrat. In a video address, Pelosi said, “I want you, my fellow San Francisco residents, to be among the first to know this news. I will not seek re-election to Congress. With a grateful heart, I look forward to one last year serving you as your proud representative.” Pelosi’s term in Congress will end on January 3, 2027.

The Ukrainian ambassador stated that Ukraine is in "positive" talks with the United States regarding the purchase of Tomahawk missiles.

Ukrainian Ambassador to the United States Olha Stefanishyna said her country is still in “active” negotiations to purchase Tomahawk missiles and other long-range weapons, despite US President Donald Trump’s stated reluctance to provide them. “Discussions are still ongoing, but we have many delegations working to expand available financial resources to procure more military capabilities from the United States,” Stefanishyna said in an interview. “It’s not just Tomahawk missiles, but various other types of long-range and short-range missiles; I can only say it’s quite positive.”

The Federal Aviation Administration (FAA) has ordered 40 airports across the United States to reduce flight operations.

Reporters learned on November 6th local time that the U.S. Federal Aviation Administration (FAA) issued a draft order requiring major airlines to reduce flight operations at 40 busy airports nationwide by 4% by 6:00 AM Eastern Time on November 7th. United Airlines stated on the 6th that it would pre-cancel approximately 200 flights starting on the 7th, representing about 4% of its flight schedule for that day, primarily regional flights. The company also anticipates that the cancellation rate for the 8th and 9th will remain at approximately 4%. On the same day, Delta Air Lines announced that it would cancel approximately 170 flights on the 7th, in accordance with the FAA's directive. (CCTV News)

Domestic News

The Ministry of Industry and Information Technology: The GDP of 178 national high-tech zones accounts for 14.3% of the national total.

According to the Ministry of Industry and Information Technology, national high-tech zones have achieved positive results in high-quality development this year, with continuously enhanced innovation capabilities and a growing number of high-quality enterprises. During the 14th Five-Year Plan period, national high-tech zones made significant progress in high-quality development, with a more rational development layout. The total number of zones increased from 169 in 2020 to 178, covering 31 provincial-level administrative regions. Wu Jiaxi, Deputy Director of the Planning Department of the Ministry of Industry and Information Technology, stated: "The overall strength has steadily improved. The GDP of the 178 national high-tech zones accounts for 14.3% of the national GDP, and the number of enterprises with revenue exceeding 100 million yuan has reached 43,000." (CCTV News)

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.