US Dollar Outlook: The US dollar index rebounds amid weak employment data and expectations of a Fed rate cut.

2025-11-07 18:19:10

The ongoing US government shutdown, now the longest in history, continues to exert significant pressure on the dollar. There are no signs of the shutdown ending. However, senators are expected to meet over the weekend, so it's worth watching for any new developments on Monday morning. Betting markets indicate a 46% probability that the shutdown will continue beyond November 16th.

ING analysts believe the dollar index has encountered resistance at the top of its three-month trading range and expects a pullback. However, it remains unclear what will drive its decline today. One final point to note: last week's tightness in the US money market may have contributed to the dollar's strength. Money market conditions appear to have improved this week, with the Federal Reserve's overnight borrowing in its Standing Repo Facility falling to zero, compared to $50 billion at the same time last week. The dollar index may have already reached a high near 100.35 on Wednesday. If so, further gains may be capped in the 99.90-100.00 range.

OCBC analysts believe that given the Federal Reserve's continued interest rate cuts and weak US economic data, the US dollar is expected to remain weak. As long as overall market risk appetite remains unchanged and economic growth outside the US remains stable, the dollar has room to fall further.

Signs of further deterioration in the US labor market

Weak labor data reinforced expectations of an imminent Federal Reserve rate cut, while the record-long government shutdown continues to erode investor confidence and weigh on the dollar's outlook.

Two private employment reports in the United States exacerbated market concerns about the labor market, offsetting the mild optimism brought about by Wednesday's ADP employment data.

Data released by Revelio's Bureau of Public Labour Statistics shows that net employment fell by 9,100 in October, including a decrease of 22,000 public sector jobs.

According to the layoff consulting firm Challenger, Gray & Christmas, the number of layoffs rose to 153,074 in October, the highest level in 22 years, as companies cut costs and adopted artificial intelligence technologies.

With the US government shutdown entering its fifth week, the crucial non-farm payroll report will be delayed for the second consecutive month. Therefore, today's market focus will be on speeches by several Federal Reserve officials and the preliminary reading of the University of Michigan Consumer Sentiment Index—which is expected to decline slightly in November.

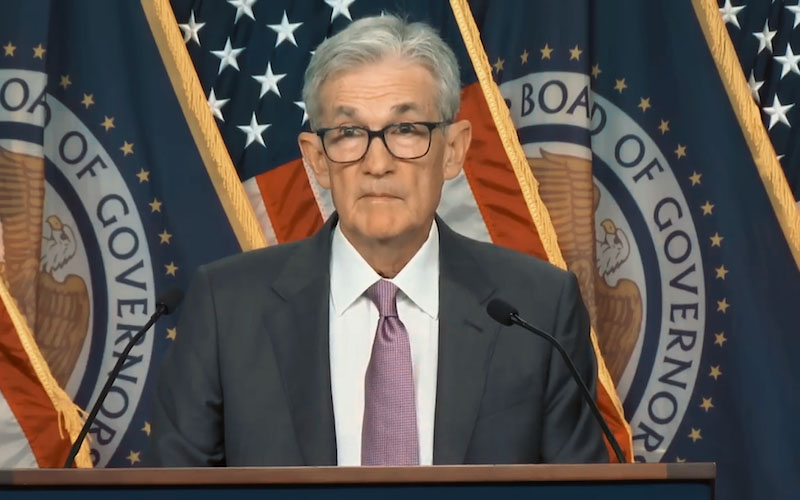

Federal Reserve officials signal divergence in inflation outlook

St. Louis Federal Reserve President Alberto Musalem stated that inflation still faces moderate upward pressure due to tariffs, but he expects this impact to subside next year. Despite some localized economic resilience, a slowing labor market and political gridlock are reinforcing expectations that the Fed will adopt a more cautious stance.

Trade easing cannot offset the supporting role

The U.S. government's plan to suspend some tariffs on China's shipbuilding industry has slightly eased trade tensions. However, due to slowing job growth and persistent fiscal uncertainty, the dollar's short-term rebound remains fragile.

The US is focusing on consumer confidence and speeches by Federal Reserve officials.

The US will release the preliminary November consumer sentiment index from the University of Michigan today, with the market expecting it to remain at a healthy level of 53. The Nasdaq's bubble-like trend will continue to be a market focus; yesterday's sharp decline in the index dragged down yen cross rates. Currently, Nasdaq December futures suggest a slight rise at the open today.

In addition, two dovish Federal Reserve officials—John Williams and Philip Jefferson—will deliver speeches. However, in the short term, hard data rather than Fed officials' speeches appear to be the more significant factor influencing the dollar's trajectory.

Technical Analysis

(US Dollar Index 4-hour chart source: FX678)

The US dollar index is currently trading around 99.87, finding support at the lower trendline of the ascending channel and the 38.2% Fibonacci retracement level of 99.67. After a significant rise in October, the pair has recently retreated from 100.35 and is currently consolidating in the short term.

The 20-day exponential moving average (20-EMA) remains above the 50-day exponential moving average (50-EMA), maintaining a mildly bullish structure. The Relative Strength Index (RSI) is around 47, indicating neutral momentum after a pullback from overbought levels. A sustained close above 99.94 could restart the uptrend, targeting the 100.35-100.64 range; a break below 99.46 could lead to further pullbacks to 99.25 or even 98.99.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.