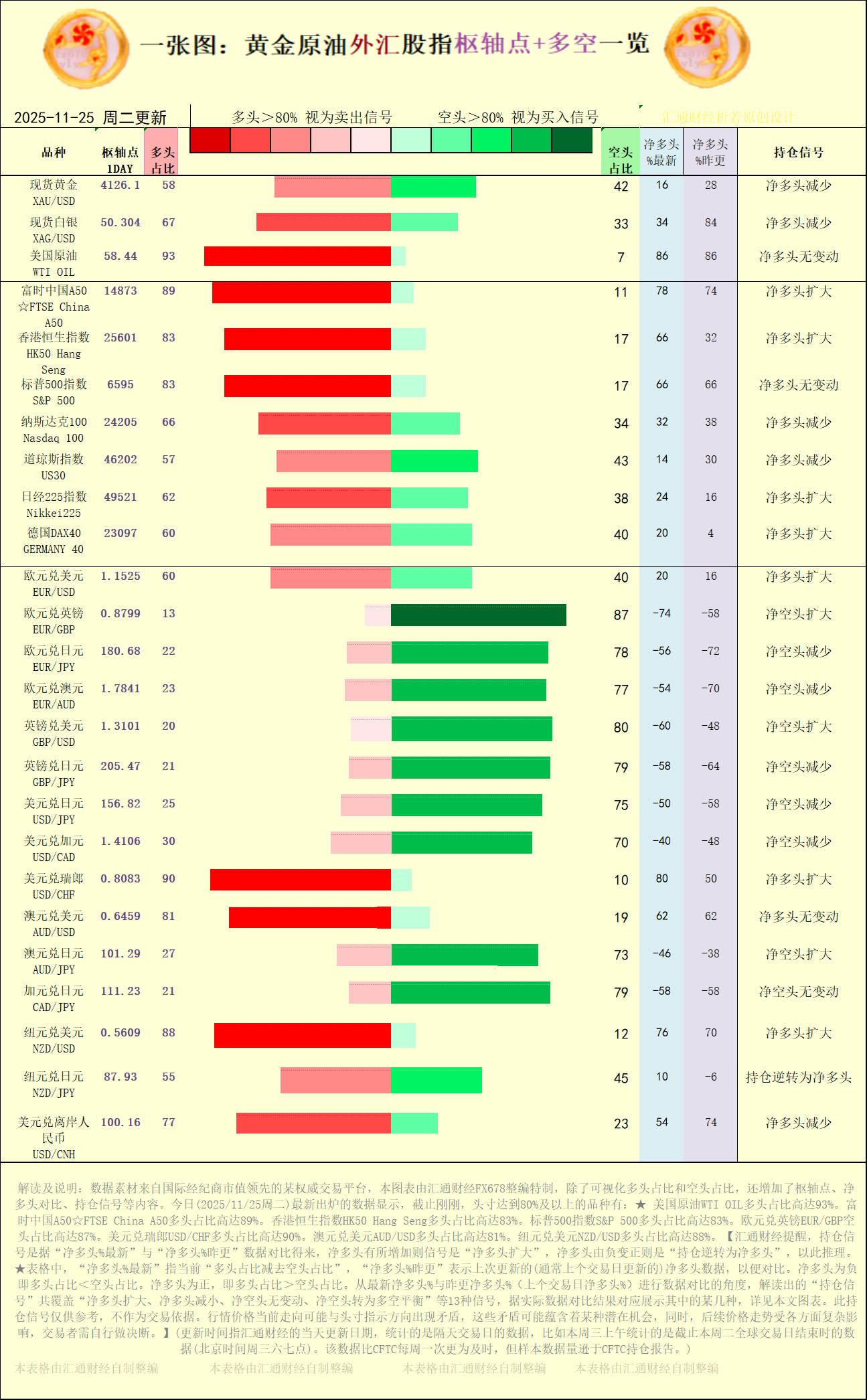

A chart: A summary of "pivot points + long/short position signals" for gold, crude oil, forex, and stock indices on November 25, 2025.

2025-11-25 14:44:39

The latest data released today (Tuesday, November 25, 2025) shows that, as of now, there are 7 commodities in this chart that are currently in an "overbought" state (bullish momentum exceeding 80%), and 1 commodity that is currently in an "oversold" state (bullish momentum less than 20%).

[Among them, the highest proportion of long positions is in: US crude oil WTI OIL. Spot gold XAU/USD long position ratio: 58%, US crude oil WTI OIL long position ratio: 93%, Euro/US dollar long position ratio: 60%. For updated "change signals" and more detailed lists of these instruments compared to yesterday, please see the specially created chart. [Among the change signals in positions, there are 7 instances of net long positions increasing, 5 instances of net long positions decreasing, 3 instances of net short positions increasing, and 5 instances of net short positions decreasing.]

The following instruments have long positions of 80% or more: ★ US WTI Crude Oil (93% long). ★ FTSE China A50 (89% long). ★ Hong Kong Hang Seng Index (83% long). ★ S&P 500 Index (83% long). ★ EUR/GBP (87% short). ★ USD/CHF (90% long). ★ AUD/USD (81% long). ★ NZD/USD (88% long).

[Chart: Pivot Points and Long/Short Position Signals for Gold, Crude Oil, Forex, and Stock Indices. Source: FX678 Special Chart. (Click image to enlarge)]

The following pairs saw a decrease in net short positions: EUR/JPY, EUR/AUD, GBP/JPY, USD/JPY, and USD/CAD.

The following currencies saw an increase in net long positions: FTSE China A50, Hang Seng Index (HK50), Nikkei 225, DAX 40, EUR/USD, USD/CHF, NZD/USD. The following currencies saw a decrease in net long positions: XAU/USD, XAG/USD, Nasdaq 100, US30, and USD/CNH.

[FX678 reminds you that the position signal is derived by comparing the latest "net long position %" and yesterday's "net long position %" data. An increase in net long position indicates "net long position expansion", and a change from negative to positive net long position indicates "position reversal to net long position", and so on.]

★In the table, "Latest Net Long Position %" refers to the current "long position percentage minus short position percentage," and "Yesterday's Net Long Position %" represents the last updated (usually the previous trading day's) net long position data for comparison. A negative net long position means the long position percentage < the short position percentage. A positive net long position means the long position percentage > the short position percentage. By comparing the latest net long position % with yesterday's updated net long position % (previous trading day's net long position %), the interpreted "position signals" cover 13 types, including "net long position expansion, net long position decrease, net short position unchanged, and net short position turning into a balance between long and short positions." Several of these signals are displayed based on the actual data comparison results; see the charts in this article for details. These position signals are for reference only and should not be used as trading advice. The current price movement may contradict the position indication direction; these contradictions may contain potential opportunities. Furthermore, subsequent price movements are influenced by various complex factors, and traders must make their own decisions.

The trading instruments covered in this chart include: spot gold, spot silver, US crude oil, FTSE China A50, Hong Kong Hang Seng Index, S&P 500 Index, Nasdaq 100, Dow Jones Index, German DAX 40, EUR/USD, EUR/GBP, EUR/JPY, EUR/AUD, GBP/USD, GBP/JPY, USD/JPY, USD/CAD, USD/CHF, AUD/USD, AUD/JPY, CAD/JPY, and NZD/USD.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.