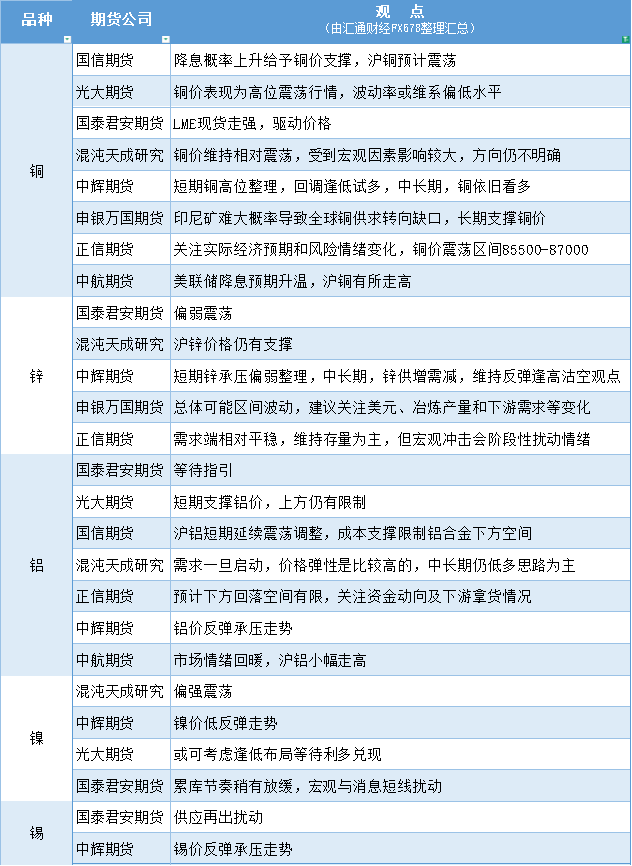

A summary chart of futures company viewpoints: Non-ferrous metals (copper, zinc, aluminum, nickel, tin, etc.) on November 26th

2025-11-26 11:21:59

Copper: Copper prices remained relatively volatile, heavily influenced by macroeconomic factors, with the direction still unclear. The Indonesian mining disaster is likely to cause a global copper supply-demand imbalance, providing long-term support for copper prices. Zinc: Zinc prices are under pressure and consolidating in the short term. In the medium to long term, zinc supply is increasing while demand is decreasing, maintaining a buy-on-dips strategy on rallies. Aluminum: Once demand picks up, price elasticity is relatively high, and the medium to long term strategy remains to buy on dips. Nickel: The pace of inventory accumulation has slowed slightly, with short-term disturbances from macroeconomic factors and news. Tin: Supply disruptions have put pressure on tin prices during rebounds.

This chart was specially created and compiled by FX678 and is copyrighted.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.