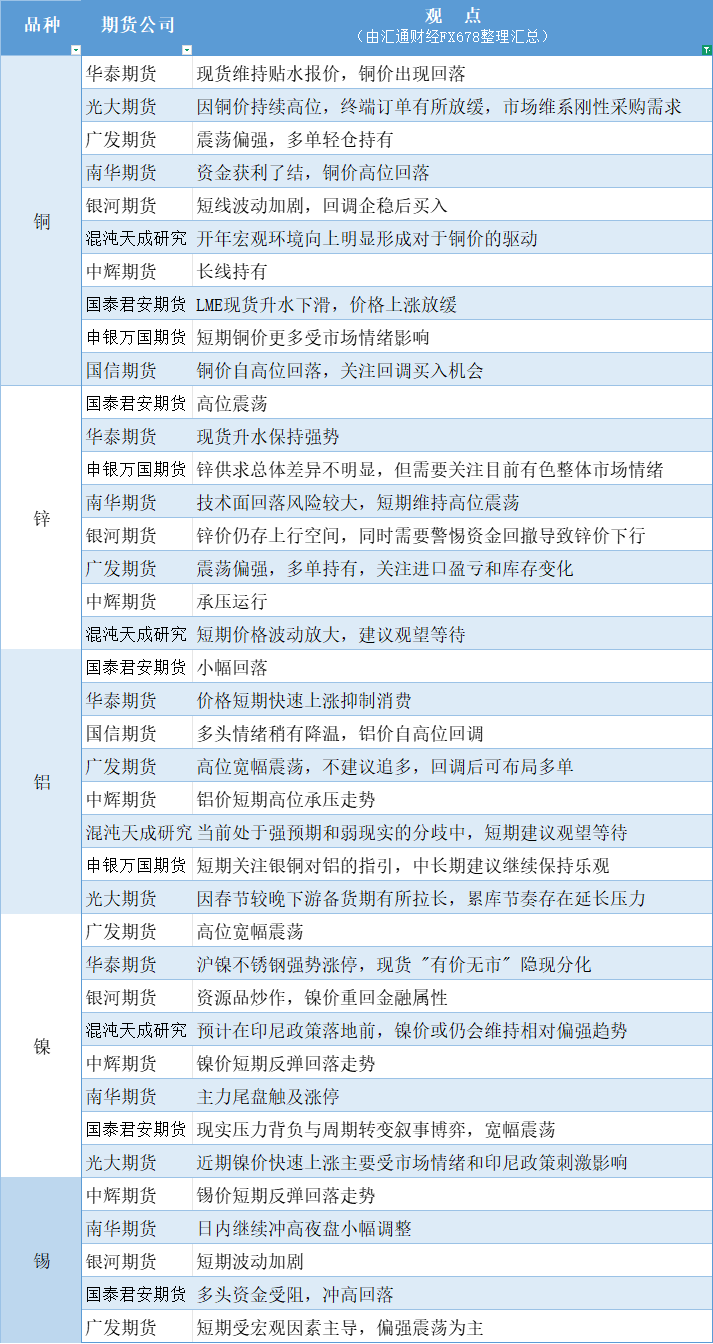

A summary chart of futures company viewpoints: Non-ferrous metals (copper, zinc, aluminum, nickel, tin, etc.) on January 8th

2026-01-08 12:54:17

Copper: Due to persistently high copper prices, end-user orders have slowed down, and the market maintains rigid purchasing demand. Spot prices remain at a discount, leading to a decline in copper prices. Zinc: Overall, the supply and demand of zinc are not significantly different, but attention needs to be paid to the current overall market sentiment in non-ferrous metals. Short-term price fluctuations have increased, and it is recommended to wait and see. Aluminum: Due to the later Spring Festival, the downstream stocking period has been extended, and there is pressure to prolong the accumulation of inventory. It is expected to fluctuate widely at high levels. It is not recommended to chase the price higher. Long positions can be established after a pullback. Nickel: It is expected that nickel prices will maintain a relatively strong trend before the Indonesian policy is implemented. Tin: In the short term, it is mainly driven by macroeconomic factors and will fluctuate with a slightly upward bias.

This chart was specially created and compiled by FX678 and is copyrighted.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.