What does the challenge to the Fed's independence and the rare global central bank collaboration signify?

2026-01-14 15:25:22

Why are central banks around the world collectively supporting Powell? If Powell wants to defend the Fed's independence, that is, to base its interest rate policy decisions on data, then the next question is whether this means that if subsequent data all favors Trump or is influenced by the president, the Fed will still have to follow the president's wishes.

Joint Signatory: A Powerful Alliance of Twelve Central Banks and the Bank for International Settlements

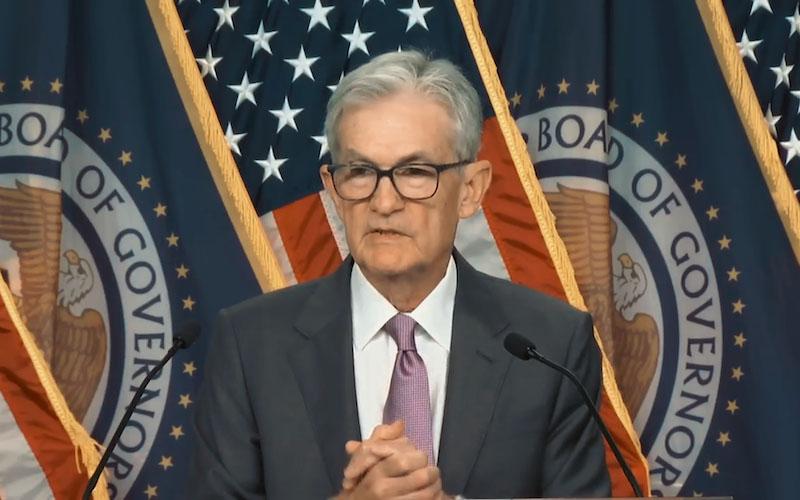

European Central Bank President Christine Lagarde, representing twelve central banks, stated bluntly: "We stand completely on the same side as the Federal Reserve and its Chairman, Jerome H. Powell."

The list of signatories for this statement is nothing short of a "star-studded lineup," including Bank of England Governor Andrew Bailey, Swedish Central Bank Governor Eric Teddyen, Swiss National Bank Chairman Martin Schlegel, Bank of Canada Governor Tiff Macklem, and Reserve Bank of Australia Governor Michel Block.

The governors of the Bank of Korea, Brazil, Norway, Denmark, and the Bank for International Settlements, including Lee Chang-yong, Gabriel Galpo, Eda Wolden Bache, Christian Keitel Thomsen, and senior officials, have also joined the petition.

The statement praised Powell as "a highly respected and prestigious colleague in the industry" and emphasized that the central bank's independence is "the core pillar for maintaining price, financial and economic stability, with the ultimate goal of safeguarding the well-being of the people we serve."

Previously, U.S. Treasury Secretary Bessant stated on a program that it might be necessary to weaken the influence of the Federal Reserve, causing concern throughout the central bank system. He wondered if other countries would follow suit if the independence of the monetary authorities represented by the Federal Reserve was threatened and allowed to be manipulated by governments. In other words, if other countries faced a conflict of interest between their governments and monetary authorities, would the governments also pressure and manipulate their central banks? Who would speak up for the monetary authorities then?

Root of the controversy: Investigation into headquarters renovations exacerbates the conflict between the White House and the Federal Reserve.

The release of this statement of support was triggered by Powell's unusually tough remarks on January 11.

At the time, Powell pointed out that the U.S. Department of Justice's criminal investigation into his congressional testimony was essentially an attempt by a political force to undermine the independence of the Federal Reserve.

It is worth noting that the target of this investigation is the renovation costs of the Federal Reserve's Washington headquarters, which undoubtedly exacerbates the already tense relationship between the White House and the Federal Reserve.

U.S. officials, including White House economic advisor and potential Federal Reserve chairman Kevin Hassett, have repeatedly argued that the survey has nothing to do with interest rate policy.

But it's clear to anyone with a discerning eye that central banks around the world are skeptical of this explanation.

Market Reaction: Reassuring Inflation Data Allows Stocks and Bonds to Calmly Digest Noise

Despite the uproar over the political turmoil, economists believe that the Federal Reserve's policy path has not undergone any substantial shift.

Bernard Yaros, chief U.S. economist at Oxford Economics, bluntly stated: "The criminal investigation into Powell is unlikely to change the pace of the Federal Reserve's monetary policy, and may even have the opposite effect."

Yaros further analyzed that Federal Reserve officials are likely to deliberately slow down the pace of interest rate cuts to avoid the outside world interpreting policy actions as bowing to political pressure.

He reiterated his baseline forecast: as long as inflation steadily declines and economic growth remains resilient, the Federal Reserve will most likely follow the trend of the dot plot and implement one rate cut each in June and September this year.

The market's reaction also confirmed this view: as long as the data is reliable and accurate, it will directly influence the Fed's interest rate decision. Tuesday's December inflation data accurately met expectations, which reassured the market and stabilized market sentiment. The decline in core inflation data supported the Fed's continued rate cuts for several years, propelling Wall Street stocks to continue their strong performance and reach new historical highs. Meanwhile, Treasury yields gave back the gains that surged on Monday due to political pressure on the Fed.

The US dollar index fell at the same time, while gold and silver continued to rise.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.