Trump's ambition to buy islands could trigger a full-blown trade war between the US and Europe, prompting a risk aversion warning for crude oil.

2026-01-16 19:04:47

This controversy comes after escalating discussions surrounding US President Donald Trump's potential annexation of Greenland, the world's largest island. Talks involving the US, Denmark, and Greenland on Wednesday failed to reach a diplomatic solution.

On Friday during the European session, US crude oil prices fluctuated upwards, rising by about 1.3% on the day, and are currently trading around $59.85 per barrel.

France warns of economic consequences

French Finance Minister Roland Lecourt stressed that economic ties between Washington and Brussels would be at risk if the Trump administration continued its targeting of Danish autonomous territories.

Lesgül stated, "Greenland is an integral part of the sovereignty of a sovereign state that is a member of the European Union. This is beyond question."

When asked whether the EU would impose economic sanctions for the US invasion of Greenland, Lesgül did not give a direct confirmation but hinted at a major strategic shift. He said, "If that happens, we will undoubtedly enter a completely new world, and we must adjust accordingly."

United States' strategic interests in the Arctic

President Trump has framed U.S. interest in Greenland as a national security issue. According to analysts interviewed, this move also stems from the U.S. desire to secure emerging trade routes and acquire mineral resources crucial to key industries such as defense.

Amid escalating tensions, a Democratic-led U.S. delegation is preparing to meet with Danish lawmakers in Copenhagen.

Sanctions could trigger a trade war

Experts believe that the aggressive economic measures taken by the United States will trigger a strong reaction from Europe.

"Significant economic pressure from the U.S., such as tariffs or sanctions against Denmark, could trigger a strong retaliation from the EU," said Dan Alamariu, chief geopolitical strategist at Alpine Macro. He warned that the EU could "retaliate in kind, leading to a trade war with the U.S. and ongoing market risks."

Alamariu added that such conflicts would “disrupt markets” and pose a challenge to NATO’s integrity, although he noted that internal political and market pressures could limit the Trump administration’s actions.

European coordinated response

As a clear demonstration of solidarity, European troops arrived in Greenland on Thursday to participate in joint military exercises. Maria Martisius, a policy analyst at the European Policy Centre, said in an interview that this shows Arctic defense is a "joint effort by allies" and not entirely reliant on the United States.

"If we want to strengthen veterans' and defense capabilities in Greenland or the wider Arctic, this cannot be done by the United States alone. It can be achieved through the joint efforts of our allies," Martisius explained, adding that the exercise sent a "strong signal."

The EU is also strengthening its fiscal commitments. As the group's executive body, the European Commission has proposed doubling spending on Greenland in its latest draft budget.

European Commission President Ursula von der Leyen confirmed the support on Thursday, stating, "It is clear that Greenland can rely on us – politically, economically, financially and securityly."

The impact of this event on crude oil has significantly increased.

In the short term: The event itself provides a clear geopolitical and trade risk premium. Any escalation of confrontational rhetoric between the US and Europe could trigger short-term safe-haven buying of crude oil.

In the medium term: The core risk lies in whether it evolves into a substantial transatlantic economic confrontation. If it does, this would become a powerful external force driving oil prices upward, with an impact far exceeding that of regional military conflicts, as it directly impacts the core engine of global economic growth.

For investors, this event has evolved from "worthy of attention" to "a key variable requiring close monitoring." Investment decisions should allocate weight to this risk and closely monitor the aforementioned policy and market confirmation signals. Current oil prices may already partially reflect this risk premium, but if a trade war truly begins, the upside potential for oil prices will be further unlocked.

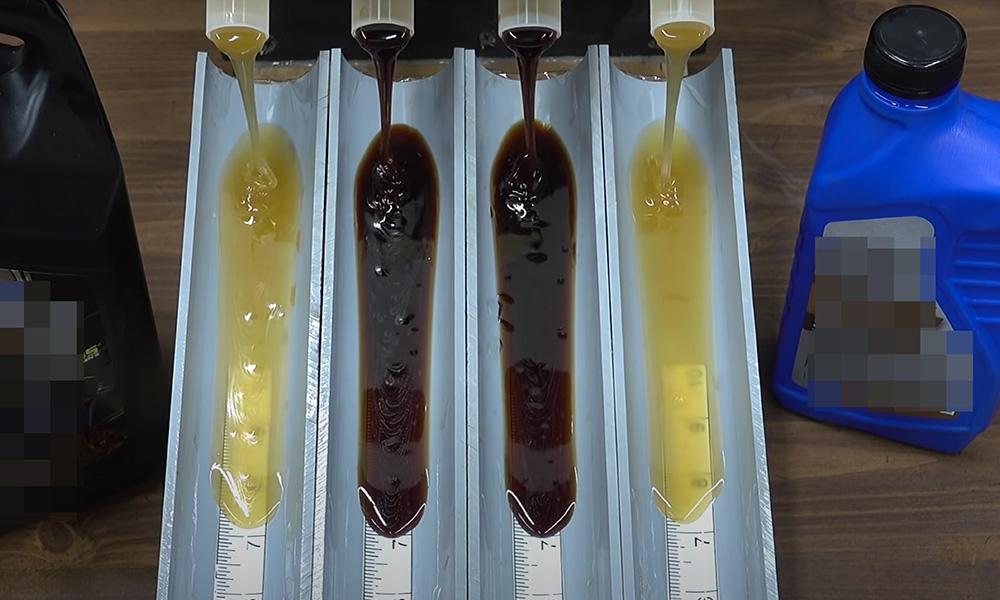

(US crude oil daily chart, source: FX678)

At 19:00 Beijing time, US crude oil futures were trading at $59.84 per barrel.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.