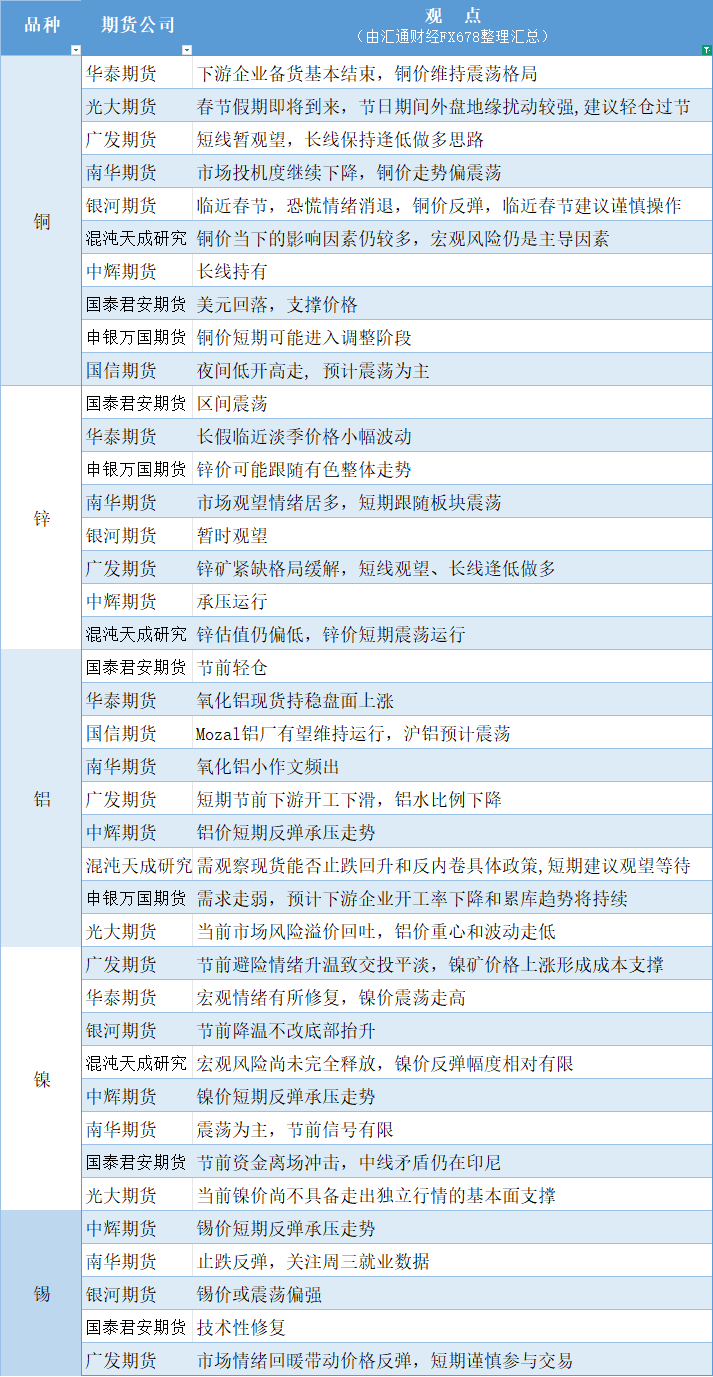

A summary chart of futures company viewpoints: February 10th non-ferrous metals (copper, zinc, aluminum, nickel, tin, etc.)

2026-02-10 12:44:03

Copper: With the Spring Festival holiday approaching, geopolitical disturbances in overseas markets are expected to be strong during the holiday. It is recommended to maintain a light position during the holiday. Downstream companies have largely completed their stockpiling, and copper prices are expected to remain volatile. Zinc: Market sentiment is largely cautious, with prices likely to fluctuate in line with the sector in the short term. The zinc ore shortage has eased, suggesting a wait-and-see approach in the short term and a buy-on-dips strategy in the long term. Aluminum: It is necessary to observe whether spot prices can stop falling and rebound, and to review specific policies to combat price consolidation. A wait-and-see approach is recommended in the short term. Downstream operating rates are expected to decline before the holiday, leading to a decrease in the aluminum-to-water ratio. Nickel: Increased risk aversion before the holiday has resulted in sluggish trading, while rising nickel ore prices have provided cost support. Tin: Improved market sentiment has driven a price rebound, but caution is advised when participating in trading in the short term.

This chart was specially created and compiled by FX678 and is copyrighted.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.