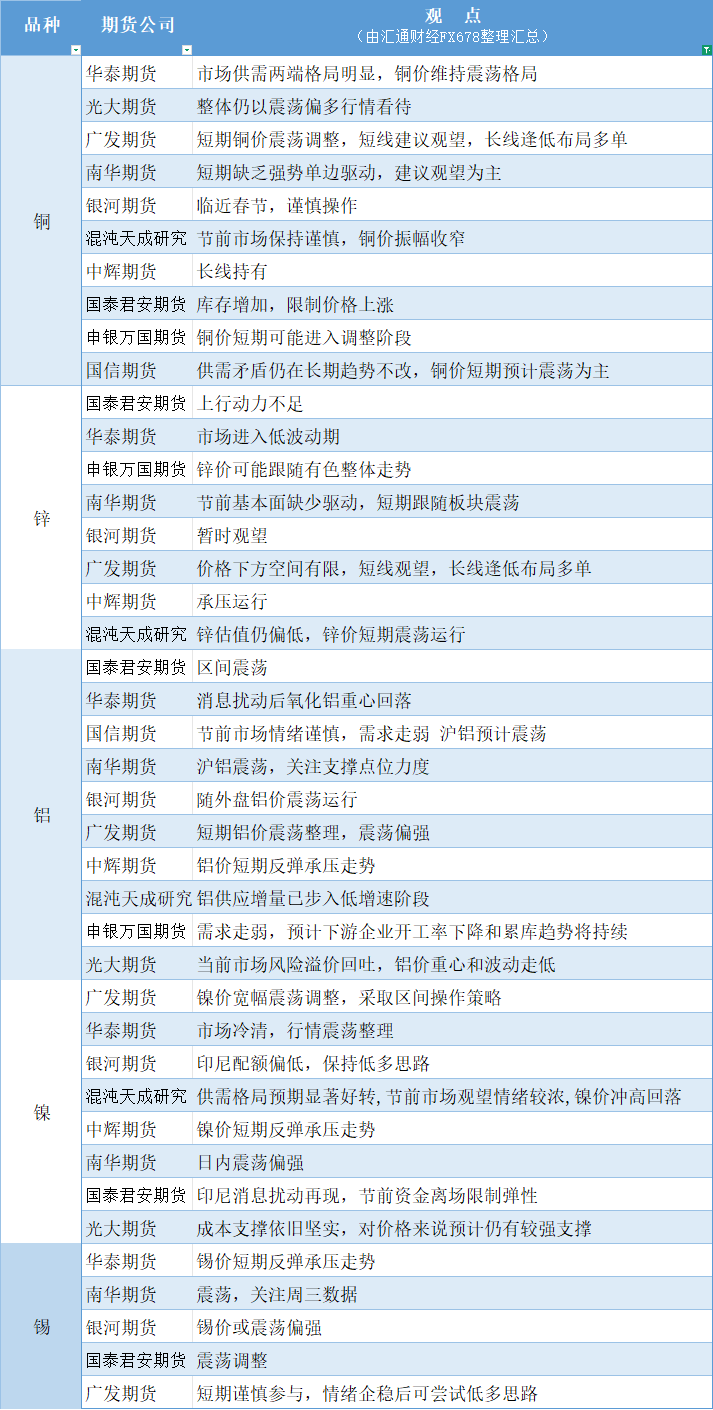

A summary chart of futures company viewpoints: February 11th non-ferrous metals (copper, zinc, aluminum, nickel, tin, etc.)

2026-02-11 13:08:03

Copper: Copper prices are expected to fluctuate in the short term. A wait-and-see approach is recommended for short-term traders, while long-term traders should consider buying on dips. The market's supply and demand dynamics are clear, and copper prices are expected to remain volatile. Zinc: Downside potential is limited. A wait-and-see approach is recommended for short-term traders, while long-term traders should consider buying on dips. Fundamentals lack drivers before the holiday, and prices are expected to fluctuate in line with the sector's performance in the short term. Aluminum: Alumina prices have fallen after news-driven volatility. Market sentiment is cautious before the holiday, and demand is weakening. Shanghai aluminum is expected to fluctuate. Nickel: Supply and demand expectations are expected to improve significantly. Market sentiment is cautious before the holiday, and nickel prices have risen and then fallen back. Tin: Caution is advised in the short term. A buy-on-dips strategy can be considered after market sentiment stabilizes.

This chart was specially created and compiled by FX678 and is copyrighted.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.