Gold trading reminder: The US and Europe reached an agreement, the gold price retreated to 3320 after three consecutive declines, and the "super week" storm is coming

2025-07-28 08:04:27

This week, the market will experience multiple major risk events, including the international trade situation, interest rate decisions of the Federal Reserve and other central banks, important economic data such as the US PCE, and geopolitical situation.

Dollar strength: Gold's "natural enemy" is back

As the world's reserve currency, the movement of the U.S. dollar is crucial to the price of gold. Last week, the U.S. dollar index rebounded from a low of more than two weeks, significantly pushing up the cost of gold for overseas buyers. The strength of the U.S. dollar is not only due to the solid performance of U.S. economic data, such as the moderate growth of core capital goods orders in June, but also due to the market's digestion of optimism about U.S.-EU trade negotiations. Peter Grant, vice president of Zaner Metals, pointed out that the rebound of the U.S. dollar directly weakened the appeal of gold, because the higher price of the U.S. dollar discouraged investors holding other currencies. This short-term pressure caused the price of gold to fall rapidly after being blocked at the $3,400 mark, highlighting the "tightening curse" effect of the U.S. dollar on the price of gold.

However, the dollar's strength is not without concerns. Despite short-term support from economic data and trade agreement expectations, the dollar still recorded its biggest weekly drop in a month in the past week. Elias Haddad, a strategist at Brown Brothers Harriman, believes that the Fed's cautious approach to monetary policy and Trump's continued pressure on the Fed may limit the dollar's further upside. This complex background provides some support for gold, as market expectations for future Fed rate cuts have not completely subsided.

US-EU trade agreement: a “fatal blow” to safe-haven demand?

The progress of the US-EU trade negotiations has become another major driver of the recent decline in gold prices. On July 27, local time, Trump announced that the United States and the European Union had reached a framework agreement to impose a unified tariff of 15% on EU goods exported to the United States. At the same time, the EU promised to increase its investment in the United States by $600 billion and purchase energy and military equipment by $750 billion. This news boosted market risk appetite and drove capital flows to risky assets such as stocks. The S&P 500 and Nasdaq both hit new closing highs. According to Grant's analysis at Zaner Metals, trade agreements with Japan and the European Union have reduced global economic uncertainty and weakened demand for gold as a safe-haven asset.

However, the US-EU trade agreement is not a smooth road. Although European Commission President Ursula von der Leyen called the 15% tariff the "best outcome", Bernd Langer, chairman of the European Parliament's International Trade Committee, bluntly stated that the agreement was "seriously unbalanced" and would cause long-term damage to European interests. The German business community even criticized that the agreement would cause Germany's GDP to fall by 0.15%, and the overall EU economy would also be impacted. Reuters analysts further pointed out that although the 15% tariff was lower than the 30% previously threatened by Trump, it was still higher than the previous average of 1.47%, and the agreement was essentially a compromise by the EU. This unbalanced trade framework may sow the seeds of future conflicts and reserve potential "blood recovery" space for gold's safe-haven demand.

Geopolitics and central bank gold purchases: long-term support for gold

Although safe-haven demand is suppressed in the short term, geopolitical uncertainty still provides long-term support for gold. Recently, the border conflict between Thailand and Cambodia has caused more than 30 deaths and more than 130,000 people to be displaced. Although Trump said that both sides agreed to ceasefire negotiations, the details of the agreement are still unclear. In addition, the ceasefire negotiations between Israel and Hamas in Gaza have reached a deadlock, and the tough statements of Trump and Netanyahu have further exacerbated the tension in the Middle East. French President Macron announced his recognition of Palestinian independence, which triggered Trump's public rebuttal, highlighting the differences between Western countries on the Palestinian-Israeli issue. These geopolitical events may rekindle the market's safe-haven demand for gold in the future.

At the same time, the trend of global central banks buying gold provides a solid bottom support for gold. Kevin Grady, president of Phoenix Futures, pointed out that many countries are reducing their dependence on the US dollar by increasing their gold holdings, and this trend will continue to push gold prices up in the future. The rumors that the Chinese central bank has increased its gold holdings are particularly noteworthy. Although the specific data has not yet been made public, the market generally expects that emerging market countries such as China will continue to increase their gold reserves. This long-term demand provides a "safety cushion" for gold prices. Even if it faces a correction pressure in the short term, the strategic value of gold cannot be ignored.

Federal Reserve policy: a “barometer” for gold prices

The Fed's monetary policy is undoubtedly a key variable in the trend of gold prices. The market generally expects that the Fed will keep interest rates unchanged at 4.25%-4.50% at its meeting on July 29-30, despite continued pressure from Trump for a significant rate cut. Trump recently visited the Fed headquarters and met with Chairman Powell, publicly stating that the two sides had a "very good meeting", but the market reacted coldly. Derek Halpenny of MUFG warned that the independence of the Fed may be damaged by political pressure, which will become a downside risk for the US dollar and indirectly provide support for gold.

Analysts have different interpretations of the Fed's future policies. James Stanley of FXStreet believes that as long as the Fed does not completely deny the expectation of rate cuts this year, gold will continue its bullish trend for a year and a half. Adrian Day Asset Management expects gold prices to remain in a narrow range in the short term, waiting for a breakthrough opportunity. It is worth noting that the "super week" in the coming week will intensively release US second quarter GDP, PCE inflation data and non-farm payrolls reports, which will provide more clues to the Fed's policy path. If the data shows rising inflationary pressures or economic slowdown, market expectations for rate cuts may further heat up, pushing up gold prices.

Outlook

Senior negotiators from China and the United States will meet in Stockholm, Sweden on Monday to resolve the long-running economic dispute at the heart of the trade war between the world's two largest economies, aiming to extend a temporary tariff "truce" agreement on August 12 and avoid a significant increase in tariffs.

On Tuesday, the market will focus on the JOLTS job openings for July and the U.S. consumer confidence index.

On Wednesday, traders will receive ADP employment data, preliminary second quarter U.S. GDP and pending home sales data. The day will also see the Bank of Canada, the Federal Reserve rate decision and the Bank of Japan's monetary policy decision.

The latest PCE inflation data for July and weekly initial jobless claims data will be released on Thursday, and the week will end with July non-farm payrolls and the ISM manufacturing PMI on Friday.

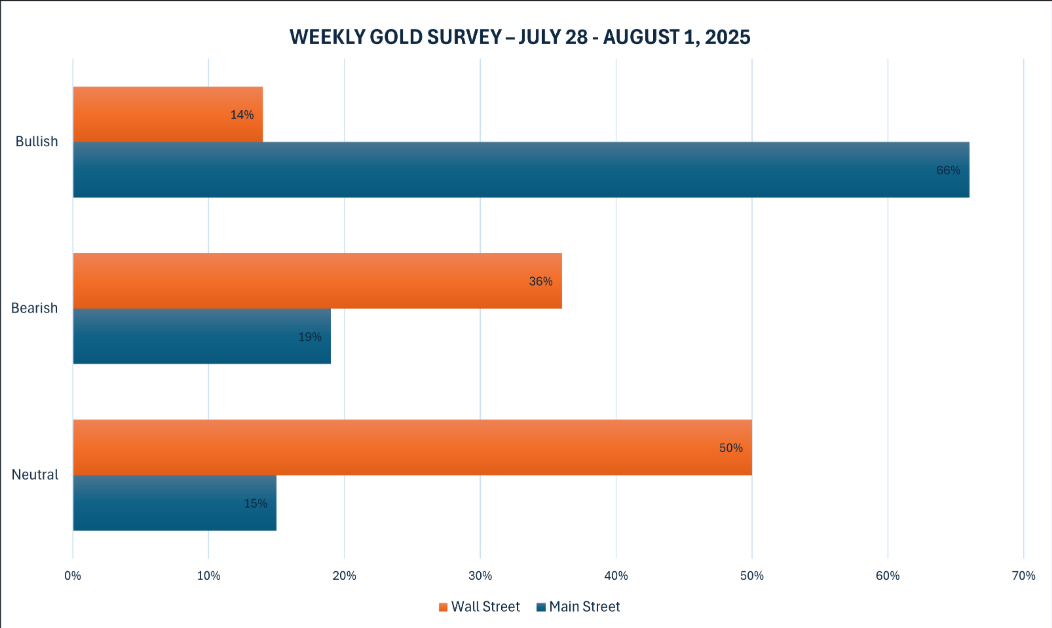

Last week, 14 analysts participated in the Kitco News Gold Survey, and Wall Street bulls were scarce as gold failed to break out. Only two experts (14%) expected gold prices to rise this week, while five (36%) predicted a price drop. The remaining seven analysts (50%) believed that gold prices would move sideways next week.

Meanwhile, Kitco's online poll received 206 votes, with the majority of mass investors maintaining a bullish opinion. 135 retail traders (66%) expect gold prices to rise this week, while 40 (19%) expect gold to fall. The remaining 31 investors (15%) believe that prices will continue to consolidate this week.

Marc Chandler, managing director of Bannockburn Global Forex, warned: "If it falls below $3,321.50, the next target will be $3,309. If it falls below $3,300, it may fall further to $3,250."

Daniel Pavilonis, senior commodities broker at RJO Futures, said: "Gold has been trading sideways for several months since hitting a high of $3,509 in April, forming a pennant-shaped consolidation." He believes that the key issue is the impact of the trade agreement on inflation: "If the Fed cuts interest rates too early, it may push inflation up again in the next few quarters."

Alex Kuptsikevich, senior market analyst at FxPro, warned that gold prices face the risk of a deep correction: "Four unsuccessful attempts to attack $3,450 show that bulls are more willing to close their positions. If it falls below the 50-day moving average, it may quickly fall to $3,150." But he also admitted that gold remains attractive in the long run as the Federal Reserve is about to start an easing cycle.

Jim Wyckoff, senior analyst at Kitco, expects gold prices to "continue to fluctuate and weaken in the coming week as market risk appetite picks up." Market participants are holding their breath for the Fed's policy signals, and this game between monetary policy and safe-haven demand will determine the next direction of gold.

(Spot gold daily chart, source: Yihuitong)

At 08:01 Beijing time, spot gold is trading at $3,335.18 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.