EUR/USD hits one-month low as investors realize the terms of the US-EU trade deal favor the US

2025-07-29 19:29:13

The euro fell as much as 0.5% to its lowest level since June 23, extending Monday's sharp decline.

France's prime minister on Monday called the framework trade deal a "dark day" for Europe, saying the EU caved to U.S. President Donald Trump and reached a lopsided agreement that leaves the United States with 15% tariffs on EU goods. German Chancellor Angela Merz said the German economy would suffer "significant" damage as a result of the tariff agreement.

"The market has quickly concluded that this relatively good news is still bad news in absolute terms in terms of the near-term impact on eurozone growth," said Ray Attrill, head of FX research at National Australia Bank. "The agreement has been roundly condemned by France, while others, including German Chancellor Merz, have highlighted its negative impact on exporters and economic growth."

Thierry Wizman, global foreign exchange and rates strategist at Macquarie Group, said: "While the dollar's strength ... may reflect the view that the new U.S.-EU deal is overwhelmingly one-sided in favor of the United States, the dollar's strength may also reflect the feeling that the United States is re-engaging with the European Union and its key allies."

Trump said on Monday he expected the United States to impose tariffs of 15% to 20% on countries that fail to reach trade deals with Washington, significantly higher than the 10% general tariff he set in April.

At this time yesterday, we were all focused on how a US-EU trade deal would remove uncertainty and allow EU businesses to move forward. However, by the end of the trading day, investors and some European leaders concluded that widespread tariffs would, on balance, have a negative impact.

As the dust settles, the inclusion of the pharmaceutical and semiconductor industries in the 15% tariff range (even after the trade investigation results are released) may be seen as a good thing. Europe needs to take full advantage of this situation and focus more on domestic demand to cope with the changes.

On Wednesday, the eurozone released its preliminary second-quarter GDP data, with overall economic growth in the eurozone expected to fall from 0.6% quarter-on-quarter in the first quarter to flat, reflecting trade uncertainty and weak external demand.

ING analysts believe that "the euro/dollar trend continues to weaken and is currently trading around $1.1565. If it fails to break through the 1.1600/1.1625 resistance levels today, the exchange rate may fall below the 1.1555 and 1.1500 support levels."

"Tomorrow's Federal Reserve meeting may show that the US government's political pressure is gradually taking effect, and there may be several interest rate cuts starting in September, at which time the US dollar may weaken," said a foreign exchange analyst at Commerzbank.

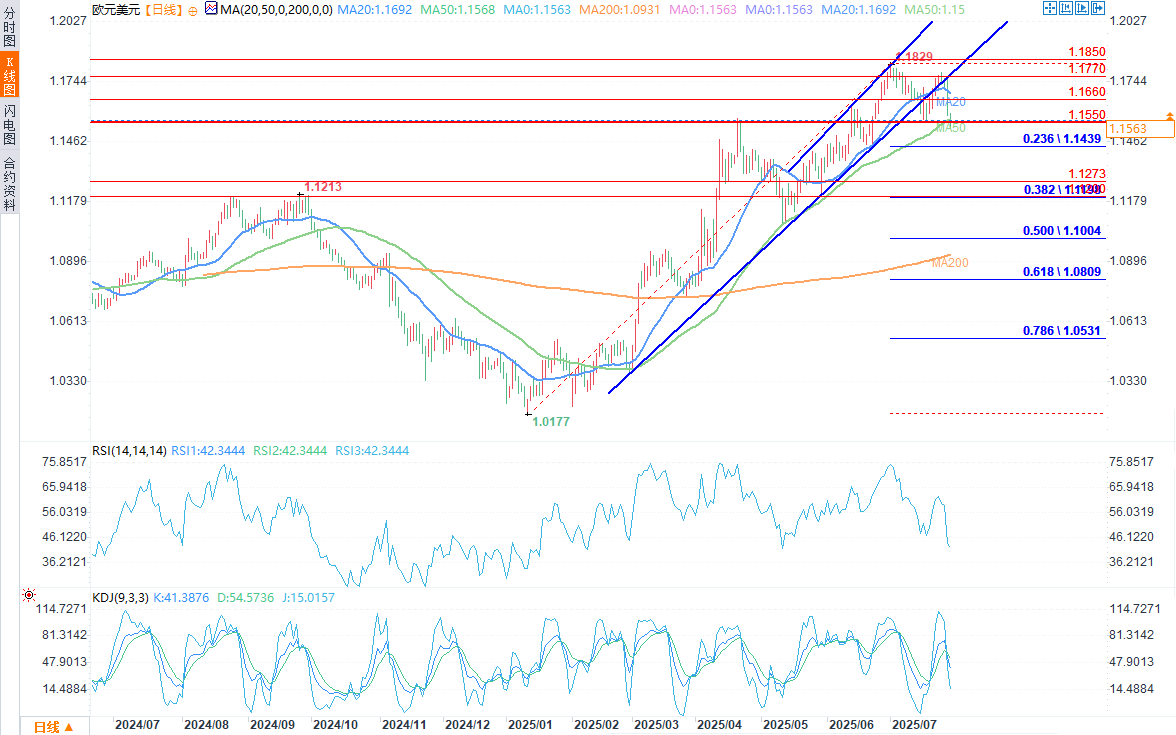

Technical Analysis

(Source of EUR/USD daily chart: Yihuitong)

EUR/USD edged lower on Monday. This sharp decline confirmed the formation of a lower high near 1.1770, potentially setting the stage for a lower low. Continued negative pressure appears to be targeting a close below the prior low of 1.1550 and the 50-day simple moving average (SMA). Notably, the 4-hour chart shows the price has completed a bearish head and shoulders pattern.

Regarding momentum indicators, both the Relative Strength Index (RSI) and the Stochastic Oscillator have just entered bearish territory and remain well above oversold levels, suggesting that the decline may have just begun. If this is the case, the price could test the 23.6% Fibonacci retracement level of the six-month uptrend at 1.1435. A break below this support level could prompt bears to push the pair towards the 1.1200–1.1273 range.

If the price avoids breaking below the 50-day simple moving average as it did in May, bulls may attempt to rebound above 1.1670 and possibly retest the 1.1770 resistance level. Further gains may target the 1.1865–1.1940 resistance range.

All in all, EUR/USD currently faces a bearish outlook, with traders watching to see if the price can decisively break below the 1.1550 area, opening up room for further downside.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.