The collapse of US non-farm payroll data and the tariff storm pushed for a September interest rate cut, and Wall Street was wildly bullish on gold.

2025-08-03 08:59:08

Spot gold prices ended the week above key short-term resistance at $3,350 an ounce, with sentiment among market analysts extremely positive, according to Kitco News' Weekly Gold Survey.

Kitco did not conduct its social media retail poll due to technical issues.

The shift in market sentiment was quite swift, as precious metals underperformed at the start of the week, with gold facing some selling pressure following the release of economic data showing that the U.S. economy grew by 3% in the second quarter. However, some economists questioned the latest GDP data, noting that it remains sensitive to extreme trade fluctuations.

Negative for gold was the Federal Reserve's decision on Wednesday to keep interest rates unchanged, with Fed Chairman Jerome Powell even expressing doubts about a possible rate cut in September.

“We haven’t made any decisions about September,” Powell said at a news conference after the central bank’s decision.

However, heading into the weekend, analysts pointed out that Powell's comments seemed somewhat outdated as the July US non-farm payroll data fell far short of market expectations.

The economy created just 73,000 jobs last month, according to the Bureau of Labor Statistics. Meanwhile, the combined job gains for May and June were revised down by 258,000. According to the revised figures, just 14,000 jobs were created in June, compared to 19,000 in May.

The disappointing jobs data single-handedly put a September rate cut back on the agenda, breathing new life into the gold market.

Adrian Day, president of Adrian Day Asset Management, said: "It is clear that the U.S. job market is far from the 'solid' that Federal Reserve Chairman Jerome Powell said it was, and today's government employment data once again proves this. Given that the 'solid' job market was Powell's main reason for not cutting interest rates this week, this report significantly increases the pressure for a September rate cut. Therefore, after two consecutive weeks of weakness in gold prices, we expect gold prices to rise next week."

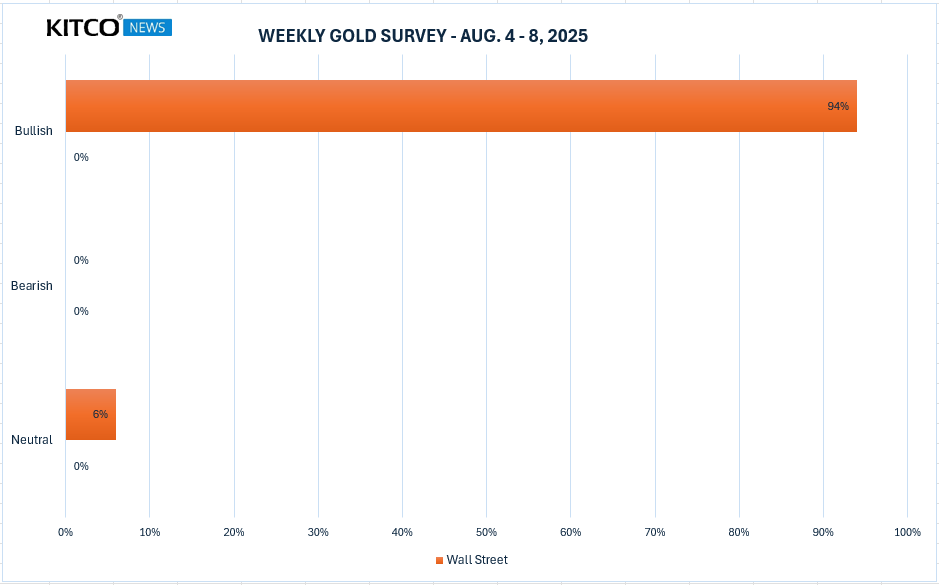

This week, 17 market analysts participated in the gold survey, and none cast a bearish vote.

David Morrison took a neutral stance, saying the jobs data was positive for gold, but he did not believe prices would break out of their current range anytime soon.

He said: "While gold prices rose today, they remain range-bound and may need a period of 'correction' before they can re-break above $3,400, let alone hold that level on a pullback. We must remember that today's rise came against the backdrop of a stunning reversal of fortune for the US dollar. This reversal was itself triggered by unexpectedly weak non-farm payrolls. While this increases the likelihood of a September rate cut, don't forget that this is just one data point, plus a downward revision, in a notoriously volatile data series."

However, Morrison also pointed out that the technical outlook for gold is bullish as the daily momentum indicator has retreated from overbought levels, "which means there is a lot of room for gold prices to rise."

Despite the disappointing economic data, some analysts remain bullish on gold as it continues to be an attractive safe-haven asset and an important global currency asset, especially as U.S. President Donald Trump imposes higher import tariffs around the world.

Last week's trade deals with Japan and Europe—which would have raised import tariffs by 15%—have eased some global trade uncertainty, but countries like Canada that haven't yet reached an agreement face higher tariffs of 35% starting in August. Meanwhile, India faces a 25% increase in import duties, Taiwanese exports face a 20% tariff, South African products face 30%, and Switzerland faces tariffs as high as 39%, to name a few.

“The tariffs mean that countries will use less of the dollar to trade, so I expect gold to continue to do well as the world looks for an alternative currency asset,” said Chris Vecchio, head of futures and FX strategy at Tastylive.

He also said: "Gold has had a tough couple of weeks as the dollar rebounded and short positions were unwound, but this could be the antidote for gold to regain its shine."

Darin Newsom, senior market analyst at Barchart, said he is bullish on gold due to geopolitical uncertainty stemming from President Trump's ongoing trade war.

"From a technical perspective, the more actively traded December contract entered a short-term uptrend early Friday," he said. "Why? The simplest answer is the arrival of a new month, which means fresh tariff threats from the U.S. president. What will become of these threats depends on how other headlines about the president develop. If the news elsewhere deteriorates, his trade threats will become more outrageous in an attempt to divert attention. In short, as a safe-haven market, gold should continue to attract buying interest."

Regarding the upside potential for gold next week, Marc Chandler, managing director of Bannockburn Capital Markets, commented:

“The U.S. jobs data and the subsequent sharp decline in U.S. interest rates and a weaker dollar could help gold find a bottom. If spot gold breaks through $3,375, it will re-target the $3,440 area. The market is more confident about a rate cut in September and another rate cut in the fourth quarter.”

(Spot gold daily chart, source: Yihuitong)

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.