Gold prices rise on stronger crude oil and lower bond yields

2025-07-30 00:44:37

The Federal Open Market Committee (FOMC) meeting began this morning and will conclude Wednesday afternoon, with Fed Chairman Jerome Powell expected to deliver a statement and hold a press conference. The market generally expects the Fed to maintain its benchmark federal funds rate range unchanged this week. However, after President Trump urged the Fed to lower US interest rates, many market observers believe Powell may signal at this meeting that the Fed may be inclined to ease monetary policy this fall.

Fidelity International predicts that gold prices could reach $4,000 per ounce by the end of 2026, primarily driven by the Federal Reserve's interest rate cuts and increased gold holdings by central banks. Fidelity's Ian Samson stated that the firm remains bullish on gold, citing the increasing clarity of the Fed's path toward a more accommodative policy and the potential for a weaker dollar. Samson argues that widening fiscal deficits will further strengthen gold's appeal as a hard asset, and that the precious metal's gains may not be excessive given the bull market.

Key external market conditions of the day showed: the U.S. dollar index rose, hitting a five-week high; New York Mercantile Exchange crude oil futures strengthened, trading around $67.50 a barrel; the benchmark 10-year U.S. Treasury yield is currently 4.352%.

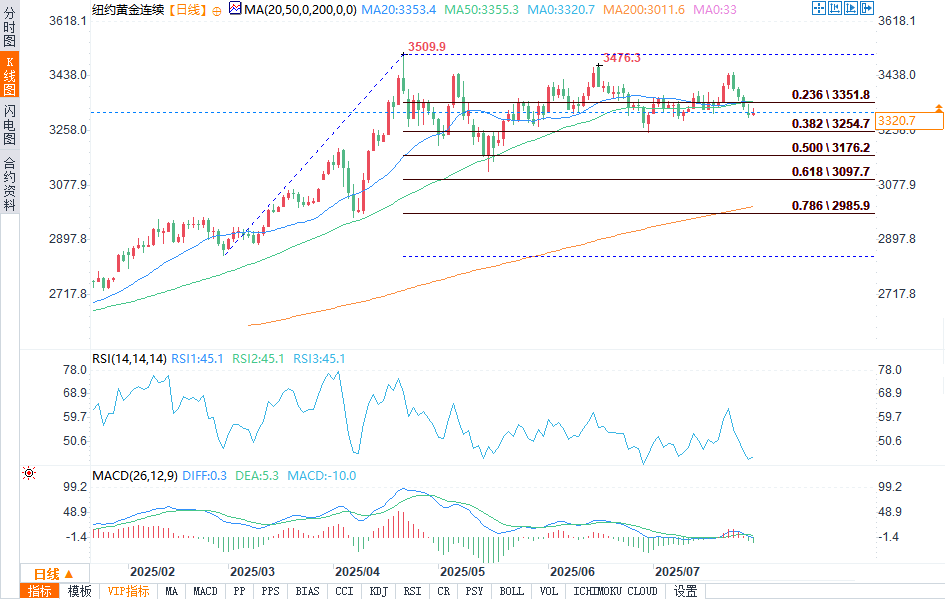

(Comex Gold Daily Chart Source: Yihuitong)

From a technical perspective, August gold futures bulls still have the overall near-term advantage, but their advantage is waning. Bulls' next upside price objective is closing prices above key resistance at the July high of $3,451.70. Bears' next near-term downside price objective is pushing futures prices below key technical support at the June low of $3,250.50. First resistance is seen at this week's high of $3,345.40, followed by last Friday's high of $3,376.60. First support is seen at this week's low of $3,300.00, followed by $3,275.00.

September silver futures bulls have a clear overall near-term technical advantage. The daily chart shows silver prices are in an uptrend. Silver bulls' next upside price objective is a close above key technical resistance at $40.00. Bears' next downside price objective is a close below key support at $36.00. First resistance is seen at $39.00, followed by $39.57. Next support is seen at $38.00, followed by $37.73.

At 00:37 Beijing time, spot gold was trading at $3,322.17 per ounce, up 0.23%. Spot silver was trading at $38.159 per ounce, up 0.06%. COMEX gold was trading at $3,319.9 per ounce, up 0.30%. COMEX silver was trading at $38.33 per ounce, up 0.29%.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.