Technical analysis: USD/JPY runs out of steam near July highs

2025-07-30 18:12:43

While markets are typically relatively stable ahead of Federal Reserve monetary policy meetings, upcoming U.S. GDP growth data, particularly the price component, could trigger volatility ahead of the central bank's interest rate announcement. Investors anticipate a swift 2.4% rebound in the second quarter after a 0.5% contraction in the first quarter, the first decline in more than two years.

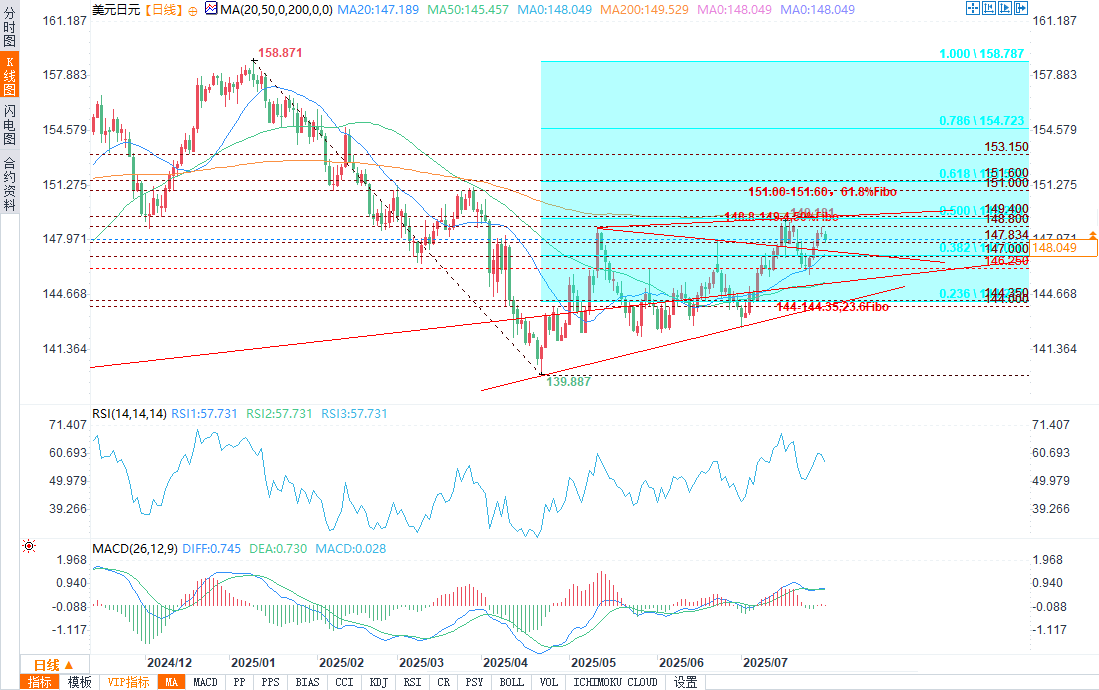

From a technical perspective, the formation of a doji candlestick candlestick on Tuesday has sparked concerns, suggesting that the currency pair may remain trapped in a three-month sideways trading range. Momentum indicators are also lacking bullish signals: the Stochastic Oscillator is about to top out in overbought territory, while the Relative Strength Index (RSI) is declining towards the neutral 50 mark.

Traders may wait for a clear break below the 200-day exponential moving average (EMA) at 147.80, or even below the 20-day EMA at 147.00, before targeting the 50-day EMA at 146.25. Failure to rebound from there could open the door for a deeper decline towards the 144.00–144.35 area, which not only houses a tentative support line from April but also the 23.6% Fibonacci retracement of the January-April decline.

(Source of USD/JPY daily chart: Yihuitong)

On the upside, a move towards the 151.00 round number and the 61.8% Fibonacci level of 151.60 would require a sustained breakout above the 148.80–149.40 resistance range. A further breakout could see the pair continue its upward movement towards 153.15.

In summary, USD/JPY remains in wait-and-see mode, with downside risks increasing after encountering resistance for the second time in the key resistance range of 148.80–149.40. A clear break below the 200-day moving average could signal the start of the next downturn.

At 18:10 Beijing time, the USD/JPY exchange rate was 148.071/79, down 0.25%.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.