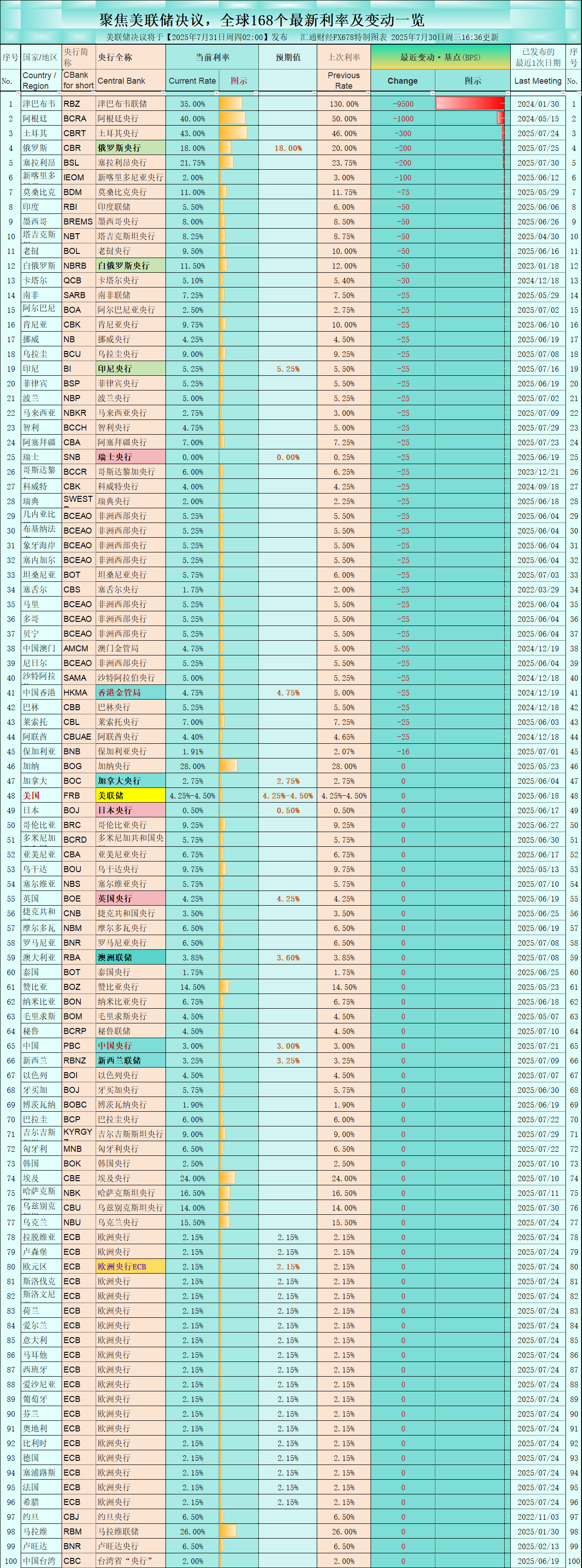

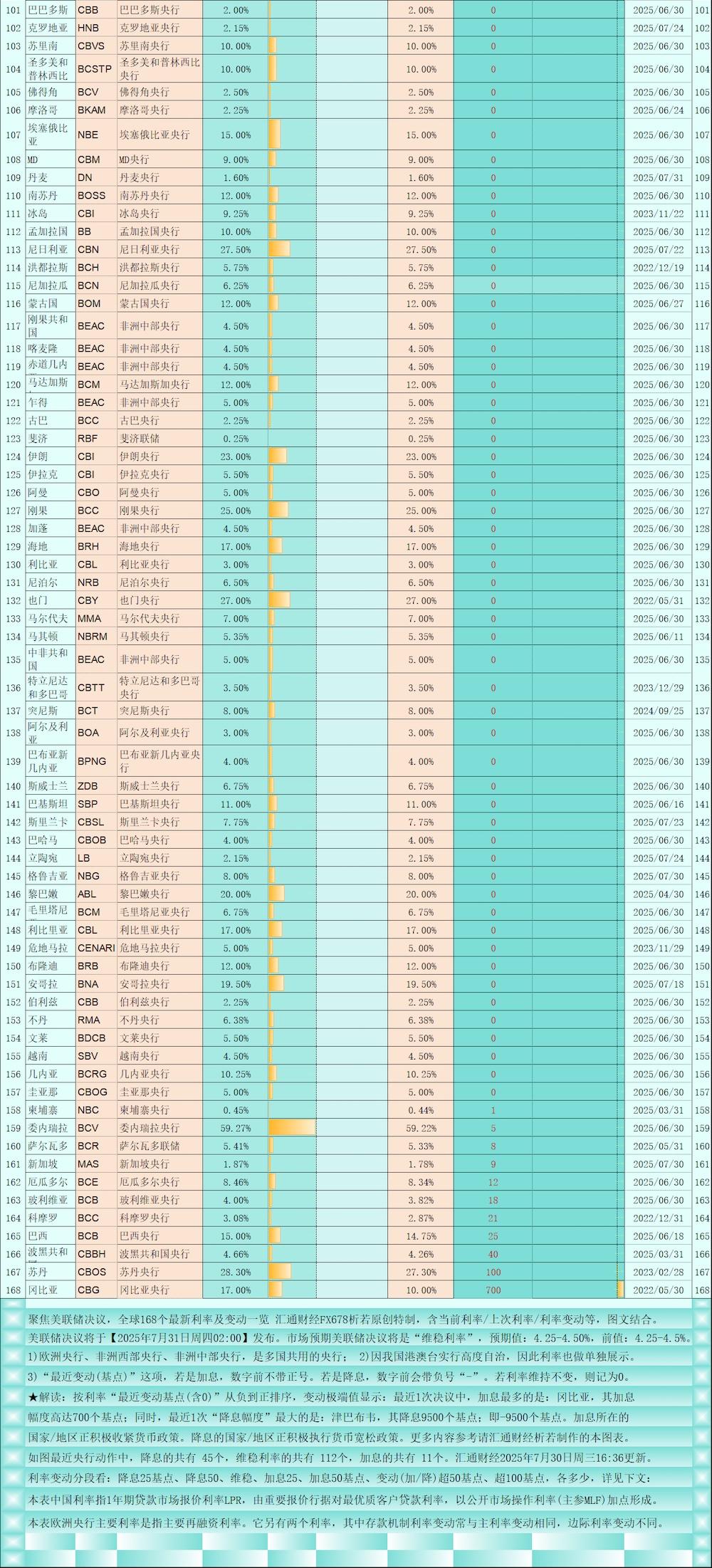

The Fed's decision is coming, and here's a look at the latest interest rates and changes for 168 countries around the world.

2025-07-30 18:46:45

Interpretation: Sort by "Recent Change in Basis Points (Including 0)" from negative to positive. Extreme changes show: Gambia saw the largest interest rate hike in its most recent resolution, with a 700 basis point increase. Meanwhile, Zimbabwe saw the largest recent rate cut, with a 9,500 basis point (-9,500 basis points) reduction. Countries/regions raising interest rates are actively tightening monetary policy. Countries/regions cutting interest rates are actively easing monetary policy. For more information, please refer to this chart created by Xiruo. As shown in the figure, among recent central bank actions, 45 have cut interest rates, 112 have maintained interest rates, and 11 have raised them. Huitong Finance updated at 4:36 PM on Wednesday, July 30, 2025.

Interest rate changes are categorized into: 25 basis point rate cut, 50 basis point rate cut, maintaining stability, 25 basis point rate hike, 50 basis point rate hike, rate hike or cut by more than 50 basis points, rate hike or cut by more than 100 basis points. See below for details on the number of countries/regions involved, as well as financial calendar-related indicators and trend chart screenshots:

Figure 1: Focusing on the Federal Reserve's decision, a look at 168 of the world's latest interest rates and changes. Source: Huitong Finance Special Chart.

★★ The 25 basis point interest rate cuts are in 31 countries and regions: South Africa, Albania, Kenya, Norway, Uruguay, Indonesia, the Philippines, Poland, Malaysia, Chile, Azerbaijan, Switzerland, Costa Rica, Kuwait, Sweden, Guinea-Bissau, Burkina Faso, Ivory Coast, Senegal, Tanzania, Seychelles, Mali, Togo, Benin, Macau, Niger, Saudi Arabia, Hong Kong, Bahrain, Lesotho, and the United Arab Emirates.

★5 countries/regions that have cut interest rates by 50 basis points: India, Mexico, Tajikistan, Laos, Belarus,

★ Interest rate cuts of more than 50 basis points (change <-50) in 7 countries/regions: Zimbabwe, Argentina, Turkey, Russia, Sierra Leone, New Caledonia, Mozambique,

★ Interest rate cuts of 100 basis points or more (change <-100) in 6 countries/regions: Zimbabwe, Argentina, Türkiye, Russia, Sierra Leone, New Caledonia,

[The following countries/regions raised interest rates by 25 basis points: Brazil,

[0 countries/regions raised interest rates by 50 basis points.

[The following two countries/regions have raised interest rates by more than 50 basis points: Sudan and Gambia.

[The following two countries/regions have raised interest rates by ≥100 basis points: Sudan and Gambia.

[Maintaining stable interest rates are: 112 countries/regions: Ghana, Canada, the United States, Japan, Colombia, the Dominican Republic, Armenia, Uganda, Serbia, the United Kingdom, the Czech Republic, Moldova, Romania, Australia, Thailand, Zambia, Namibia, Mauritius, Peru, China, New Zealand, Israel, Jamaica, Botswana, Paraguay, Kyrgyzstan, Hungary, South Korea, Egypt, Kazakhstan, Uzbekistan, Ukraine, Latvia, Luxembourg, Eurozone, Slovakia, Slovenia, the Netherlands, Ireland, Italy, Malta, Spain, Estonia, Portugal, Finland, Austria, Belgium, Germany, Cyprus, France, Greece, Jordan, Malawi, Rwanda, Taiwan, China, Barbados, Croatia, Suriname, Sao Tome and Principe, Cape Verde, Morocco, Ethiopia, Myanmar, Denmark, South Sudan, Iceland, Bangladesh, Nigeria, Honduras, Nicaragua, Mongolia, Republic of the Congo, Cameroon, Equatorial Guinea, Madagascar, Chad, Cuba, Fiji, Iran, Iraq, Oman, Congo, Gabon, Haiti, Libya, Nepal, Yemen, Maldives, Macedonia, Central African Republic, Trinidad and Tobago, Tunisia, Algeria, Papua New Guinea, Swaziland, Pakistan, Sri Lanka, Bahamas, Lithuania, Georgia, Lebanon, Mauritania, Liberia, Guatemala, Burundi, Angola, Belize, Bhutan, Brunei, Vietnam, Guinea, Guyana.

This article is original content from Huitong Finance, all rights reserved. It is for reference only and should not be used as a basis for trading.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.