Retail sales data hit a two-year high! The Australian economy is quietly bottoming out, and the Australian dollar staged a "Jedi counterattack" after five consecutive declines.

2025-07-31 15:16:13

From the consumer perspective , retail sales surged 1.2% month-over-month in June, far exceeding expectations of a 0.4% increase and marking the largest monthly increase since March 2022. Discounts and new product launches drove consumers back to stores, demonstrating the strong resilience of the domestic consumer market. Although overall retail sales performance remained sluggish in the second quarter, the explosive growth in the monthly data reflects the rapid release of domestic demand. As a core engine of economic growth, the recovery in consumption directly consolidates economic fundamentals and provides inherent support for the Australian dollar.

Regarding inflation , consumer price growth in the second quarter slowed to its slowest pace in more than four years, with core inflation hitting a three-year low. While this data reinforces market expectations for an August interest rate cut (with a 95% probability), more importantly, the significant easing of inflationary pressures creates a more stable environment for economic operations. Reserve Bank of Australia Deputy Governor Hauser praised the data, acknowledging the trend of inflation moving toward target while also suggesting that excessive tightening policy is not necessary to suppress the economy. This combination of "controllable inflation and a robust economy" actually reduces the risk of excessive easing weighing on the Australian dollar.

Regarding the job market , although the unemployment rate rose to 4.3% in June, Hauser explicitly stated that "the unemployment rate remains very low and the labor market remains close to full employment," and emphasized that a sharp rise in the unemployment rate is not the baseline scenario. This indicates that the labor market has not experienced a substantial deterioration, and the foundation of residents' income and consumption capacity remains, further consolidating the robustness of economic fundamentals.

Overall , strong retail sales data demonstrates the resilience of domestic demand, declining inflation opens up room for policy flexibility, and the labor market remains robust. These fundamental factors collectively support the strengthening of the Australian dollar against the US dollar. While a stronger US dollar may suppress the Australian dollar's performance in the short term, positive signals inherent in the Australian economy are expected to drive a gradual strengthening of the Australian dollar against the US dollar once market sentiment calms.

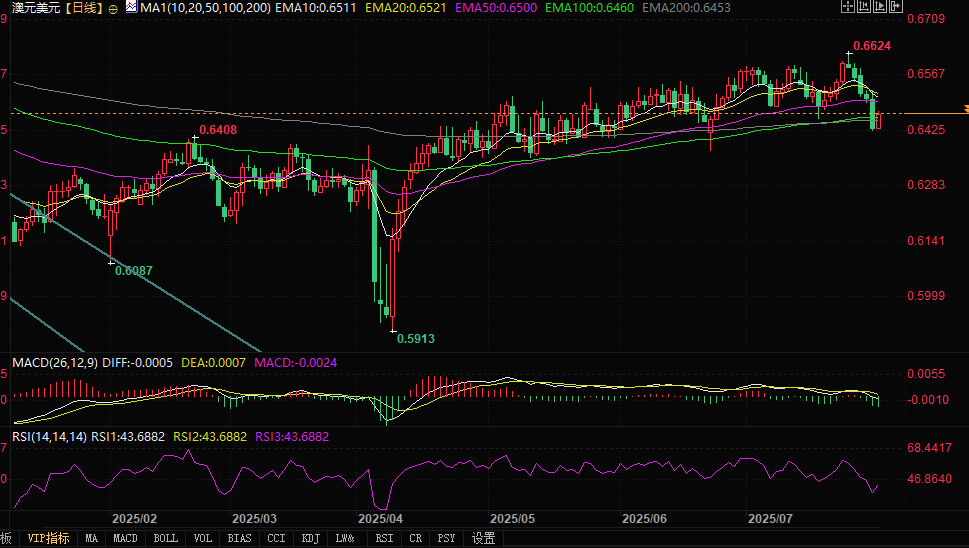

(AUD/USD daily chart, source: Yihuitong)

At 15:14 Beijing time, the Australian dollar was trading at 0.6468/69 against the US dollar.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.