August 1st Financial Breakfast: Trump's tariff deadline approaches, safe-haven demand boosts gold prices, focus on non-farm payroll data

2025-08-01 07:17:21

Focus on the day

stock market

U.S. stocks closed lower on Thursday after an early rally failed to sustain itself as investors digested the latest round of corporate earnings and economic data and awaited earnings from Amazon and Apple after the market closed.

Microsoft shares rose 3.5% after the company released a strong earnings report and briefly surpassed the $4 trillion market capitalization threshold, becoming the second public company after Nvidia to reach that milestone.

Meta Platforms surged 11.3% to $773.44, a record high, as its core advertising business saw growth driven by artificial intelligence and it issued bullish revenue forecasts.

However, other AI-related companies performed weaker during the session. Chipmakers Broadcom fell 2.9% and Nvidia dropped 0.8%, dragging down the PHLX Semiconductor Index. The chip index fell 3.1%, its biggest one-day drop since April 16.

"Looking at today's market action, there were both gains and losses, and several technology companies, such as a lot of semiconductor-related stocks and semiconductor capital equipment-related stocks, performed quite poorly," said Ellen Hazen, chief market strategist at FL Putnam Investment Management. "Of course, Microsoft also performed quite well, as did Amazon and Meta, which performed very well."

As of Thursday morning, 80.8% of the 297 companies in the S&P 500 that have reported earnings have beaten analysts' expectations, compared with 76% of the past four quarters, according to data from the London Stock Exchange Group (LSEG). Amazon's stock fell 2.6% in after-hours trading following its quarterly earnings report.

The Dow Jones Industrial Average fell 0.74% to 44,130.98 points; the S&P 500 fell 0.37% to 6,339.39 points; and the Nasdaq fell 0.03% to 21,122.45 points.

The S&P 500 rose as much as 1% earlier in the session, while the Nasdaq rose 1.5%. However, the Nasdaq hasn't seen a 1% move since July 3, while the S&P 500 last saw a 1% daily move on June 24.

Economic data released earlier by the U.S. Commerce Department showed inflation picking up in June as new tariffs pushed up prices, fueling expectations that price pressures could intensify in coming months, while initial jobless claims last week pointed to a steady labor market.

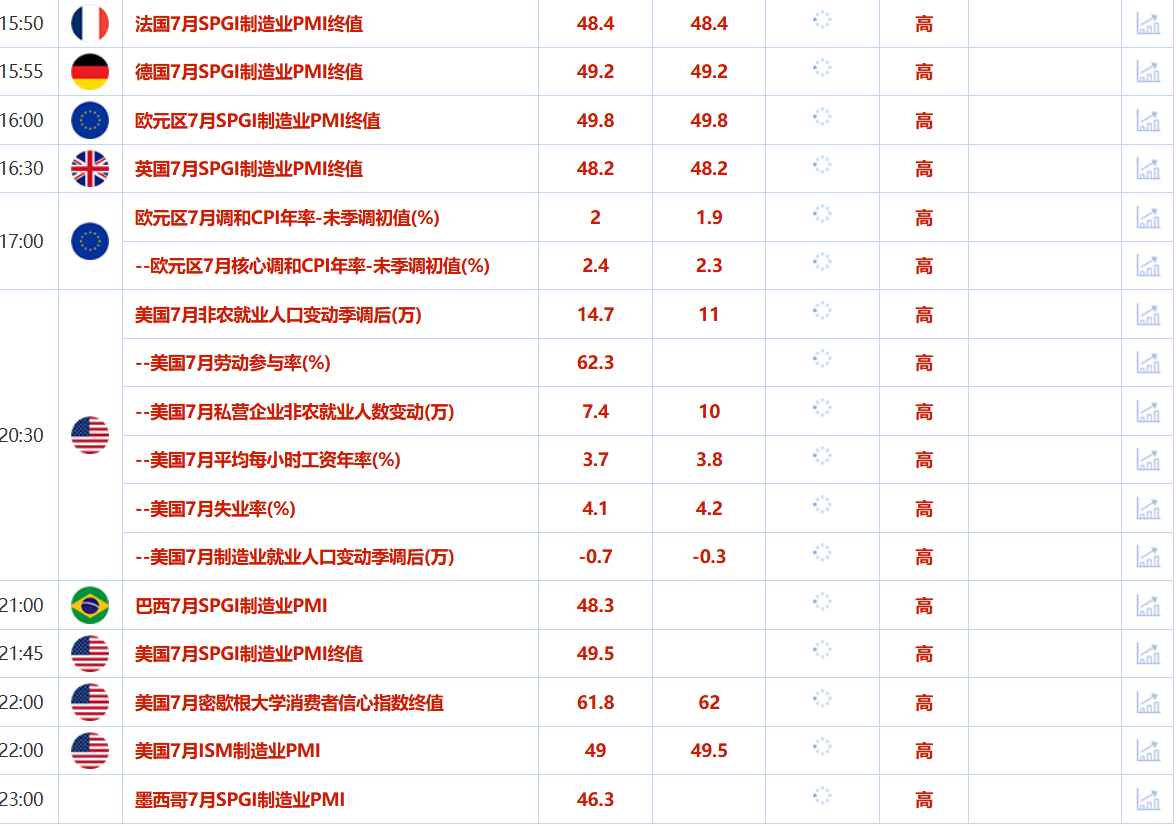

Investors will now focus on Friday's non-farm payroll report and a looming tariff deadline, as U.S. President Donald Trump is expected to issue higher final levies on countries with which he has yet to reach a deal, although Mexico was granted a 90-day reprieve from tariffs.

U.S. stocks began to fall sharply in early April after Trump announced a series of major tariff measures, and then rebounded as agreements were reached with many trading partners on tariff levels.

In July, the S&P 500 rose 2.17%, the Nasdaq rose 3.7%, and the Dow Jones Industrial Average rose 0.08%. All three major indices achieved their third consecutive monthly gain.

Pharmaceutical stocks also weakened after the White House said Trump sent a letter to the CEOs of 17 major pharmaceutical companies urging immediate action to lower prescription drug costs for Americans. The NYSE Arca Pharmaceutical Index fell 2.9%, its biggest drop since May 14 and its fourth consecutive day of losses.

Gold Market

Gold prices rose on Thursday as traders turned to safe-haven assets amid lingering uncertainty over tariffs ahead of an Aug. 1 deadline set by U.S. President Donald Trump to conclude negotiations.

Spot gold rose 0.6% to $3,294.56 an ounce, having earlier risen more than 1%. U.S. gold futures settled down 0.1% at $3,348.60. "We're seeing some heightened trade uncertainty as the August 1 tariff deadline approaches, and we're only seeing a little bit of safe-haven buying re-emerge today," said Peter Grant, vice president and senior metals strategist at Zaner Metals.

Trump said he had agreed to extend the existing trade deal with Mexico for 90 days and continue negotiations during that time with the goal of signing a new agreement.

Trump announced a series of tariffs on Wednesday, including tariffs on imports from Brazil and South Korea. U.S. inflation rose in June as import tariffs began to push up the cost of some goods. The personal consumption expenditures (PCE) price index rose 0.3% in June from the previous month, after an upwardly revised 0.2% increase in May.

Meanwhile, the Federal Reserve kept its target interest rate range unchanged at 4.25%-4.50% on Wednesday, with Chairman Jerome Powell's remarks following the decision dampening hopes for a September rate cut.

Investors are currently awaiting U.S. non-farm payrolls data on Friday for more clues on the Federal Reserve's interest rate path.

Spot silver fell 1.4% to $36.61 an ounce, its lowest level since July 7. Platinum fell 2.1% to $1,285.20, hitting its lowest level since June 24. Palladium fell about 2% to $1,181.49, hitting a more than two-week low.

"It wouldn't be surprising if the strong selling pressure in the silver futures market was due in part to some of the collateral damage from the sharp sell-off in copper," said Jim Wyckoff, senior analyst at Kitco Metals.

Oil Market

Oil prices fell on Thursday as U.S. President Trump's August 1 tariff deadline loomed and investors focused on uncertainty surrounding countries with which the United States has yet to reach trade deals.

Brent crude futures for September delivery, which expired Thursday, settled at $72.53 a barrel, down 0.97%. U.S. crude futures for September delivery settled at $69.26, down 1.06%. U.S. crude futures earlier fell by more than $1.

The White House said on Thursday that countries that have not yet reached trade deals or received tariff letters from the Trump administration will receive notification of trade terms from the United States by the end of the day. The United States has agreements with two-thirds of its top 18 trading partners.

Trump said he and Mexican President Agustin Sheinbaum agreed to extend the existing trade deal between the two countries for 90 days and continue negotiations during that time to sign a new agreement.

Trump posted on social media: "Mexico will continue to pay its 25% Fentanyl Tariff, its 25% Auto Tariff, and its 50% Steel, Aluminum, and Copper Tariffs. In addition, Mexico has agreed to immediately end its many non-tariff trade barriers."

John Kilduff, partner at Again Capital, said the news of the agreement extension put pressure on crude oil futures. “Tariffs are generally negative for future oil demand, and this situation in Mexico is just delaying the problem.”

Data from the U.S. Energy Information Administration (EIA) showed that U.S. crude oil production reached a record high of 13.49 million barrels per day in May. The EIA announced on Wednesday that U.S. crude oil inventories rose by 7.7 million barrels to 426.7 million barrels in the week ending July 25, driven by declining exports. Analysts had expected a 1.3 million barrel draw. Gasoline inventories fell by 2.7 million barrels to 228.4 million barrels, compared with a forecast of a 600,000 barrel decrease.

"U.S. inventory data showed a surprise increase in crude oil stocks but a bigger-than-expected drop in gasoline inventories, supporting views of strong demand during the driving season. The report had a neutral impact on the oil market," said Toshitaka Tazawa, an analyst at Fujitomi Securities.

foreign exchange market

The dollar was set to post its first monthly gain against major currencies since 2025 on Thursday, supported by easing trade tensions and a recovering U.S. economy.

The dollar rose against the yen, hitting its highest level since May 28. It rose about 5% in July, the biggest monthly gain since December 2024. It was last at 150.765, up 0.83%.

The Bank of Japan (BOJ) on Thursday unanimously kept its short-term interest rate at 0.5%, a move widely expected by markets, and also raised its inflation forecasts for the coming years.

The move came after the Federal Reserve held U.S. interest rates steady on Wednesday, defying President Trump's persistent calls for lower borrowing costs. Fed Chair Jerome Powell also indicated he was in no rush to cut rates.

The dollar was supported by a hawkish Federal Reserve and the resilience of the U.S. economy, with uncertainty over Trump's chaotic tariffs easing after a series of trade deals.

The dollar index rose 0.16% to 99.949 after surging nearly 1% in the previous session. The index recorded its first monthly gain since 2025.

“There’s a conflict and a friction between what the Fed is seeing and what it’s deciding, and what many in the White House and the stock market want the Fed to do,” said Juan Perez, head of trading at Monex USA. “If we completely moved away from the hawkish tone, the hawkish stance, the hawkish press conferences, then it would make sense for the dollar to rise, and it did. But today, the dollar is hitting the brakes again because of the friction between the Fed and the White House.”

Data showed the number of Americans filing new applications for unemployment benefits rose slightly last week, suggesting the U.S. labor market remained stable.

The euro has been one of the biggest victims of a stronger dollar this month as investors unwound bets made at the beginning of the year that European markets might offer better opportunities.

The euro was last up 0.19% at $1.1426, having hit a seven-week low on Wednesday. The euro is set to fall nearly 3% this month.

"I think there was an excess of optimism built into the euro price," said Jane Foley, a strategist at Rabobank. "And I think that sentiment has come off a bit this week. There's been a lot of talk about the EU giving in to the U.S. on this trade deal, and that's been a dose of reality for Europeans."

The dollar fell 0.31% against the Swiss franc to 0.812 Swiss franc, but was on track for a gain of 2.36% this month.

The deal reached on Sunday between the European Union and the United States to impose a 15% tariff on EU exports to the United States removed much of the uncertainty.

Bank of Japan Governor Kazuo Ueda also said the U.S.-Japan trade deal reduced uncertainty about the outlook and increased the likelihood that Japan would sustainably hit the Bank of Japan's 2% inflation target, a prerequisite for further interest rate hikes.

The new US trade deal includes an agreement with South Korea, and Trump said on Wednesday that South Korean exports to the US would be subject to a 15% tariff. This is lower than the 25% he had threatened, and the South Korean won strengthened on the news, trading at 1395.21 per dollar in late trading.

Trump also imposed 50% tariffs on most Brazilian goods on Wednesday and said the United States was still negotiating with India. But he gave Mexico a 90-day reprieve from its tariffs ahead of a Friday deadline for a deal.

"However, we continue to expect that even though some bilateral announcements (particularly regarding the EU) may have catalyzed the impressive USD rally so far this week, the tariff rates now announced and codified will ultimately prove more negative for the USD," Goldman Sachs analysts led by Stuart Jenkins wrote in an investor note.

International News

Most of Trump's tariffs face tough legal tests amid sharp U.S. appeals court challenges

The legality of US President Trump's sweeping global tariffs is facing a test. A US federal appeals court held a hearing on Thursday, the day before higher tariffs on several countries were set to take effect. A panel of 11 judges took turns questioning a senior US Department of Justice official, focusing on the Trump administration's claim that the United States's persistent trade deficit constitutes a national emergency, allowing the president to bypass Congress and impose tariffs on countries around the world. Brett Shumate, head of the US Department of Justice's civil division, stated at the hearing that Trump's tariff policy is intended to address the "consequences of our growing trade deficit" and allows the president to "put pressure on other countries." He added that Trump has determined that the trade deficit has soared to a "tipping point."

Trump's team led a rare earth conference last week to provide minimum price guarantees and financial support

Sources said senior White House officials informed a group of rare earth companies last week that the administration is planning to use a pandemic-era strategy to boost U.S. production of critical minerals by guaranteeing minimum prices for their products. The meeting, which has not been publicly reported, took place on July 24 and was led by White House trade adviser Peter Navarro and National Security Council official Steve Copley, who oversees supply chain strategy. The sources said participants included 10 rare earth companies, as well as tech giants like Apple (AAPL.O), Microsoft, and Corning. The two officials stated at the meeting that the minimum price guarantee for rare earths provided to MP Materials earlier this month as part of a multi-billion dollar Pentagon investment was “not a one-off initiative” and that similar agreements are underway, the sources said. In addition to the minimum price guarantee, officials also recommended that participating companies take advantage of existing government financial support, including billions of dollars in incentives from Trump’s tax and spending bill passed on July 4, the sources said.

Trump and his donors will pay for $200 million White House renovations

According to Politico, the White House will undertake a massive $200 million renovation of its East Wing, which is Trump's latest construction project for the executive residence. White House Press Secretary Levitt announced on Thursday that construction of a White House state dining room with an area of approximately 90,000 square feet and a capacity of 650 people will begin in September. According to the White House website, Trump and other "patriotic donors" will pay for the $200 million renovation project. Levitt said that the East Wing will also undergo "modernization" and that all office areas, including the First Lady's office, will be temporarily relocated during construction. This is the latest and most expensive of a series of recent White House renovation projects during Trump's tenure. Levitt said that the project is expected to be completed before the end of Trump's term.

Trump writes to 17 global pharmaceutical giants urging them to slash U.S. drug prices

US President Trump sent letters to 17 of the world's largest pharmaceutical companies, including Eli Lilly, Novo Nordisk and Pfizer, urging them to cut the prices of new drugs in the United States to the lowest levels paid in certain other countries. Trump asked the companies to immediately reduce the prices of existing drugs charged to Medicaid and to ensure that the prices of future drugs are comparable to overseas prices. He said the US government will work with them to ensure that overseas price increases are consistent with domestic prices. Any profits that companies make from price increases in Europe and other regions must be returned to the United States to reduce domestic costs. Trump also asked pharmaceutical companies to establish direct-to-consumer purchasing mechanisms for high-selling drugs, allowing consumers to buy drugs directly at discounted prices obtained by third-party insurance companies.

Brazilian President: Whether the United States wants to fight a political war or negotiate trade, we will accompany it

The US government previously threatened to impose high tariffs on trading partners that failed to reach trade agreements with the US, starting August 1st. With the deadline approaching, Brazil and India have stated that they will not succumb to US pressure and will take all necessary measures to safeguard their national interests. Previously, the US announced a 50% tariff on goods imported from Brazil, effective August 1st. On July 30th, The New York Times published an interview with Brazilian President Lula, in which Lula stated that he had attempted to contact US President Trump, but the latter showed no willingness to discuss the tariff issue. Lula stated that the US tariff threat made Brazil "concerned," not "fearful," and that he would not succumb to the US decision. Whether the US wants to engage in a political battle or negotiate trade, Brazil will participate, but the US should not conflate political and trade issues. (CCTV News)

Nvidia responds to chip "backdoor" issue late at night

Late on the night of July 31st, in response to allegations of serious security issues with Nvidia's computing chips, Nvidia responded: "Cybersecurity is of paramount importance to us. NVIDIA's chips do not have 'backdoors' and do not allow anyone to remotely access or control these chips."

Domestic News

Foreign trade data in many places are on an upward curve

In the first half of this year, several major foreign trade provinces delivered impressive results, playing a significant role in stabilizing the fundamentals of foreign trade. Foreign trade growth in many central and western provinces exceeded the national average, further unleashing their development potential. In the first half of the year, foreign trade data for most provinces showed a clear upward trend. Experts believe that maintaining stable foreign trade volume and improving its quality remain a key focus for all provinces. Policies to stabilize foreign trade are expected to be further strengthened in the second half of the year, with the introduction of financing support policies for hard-hit foreign trade enterprises. Data from the General Administration of Customs shows that in the first half of the year, imports and exports in 18 central and western provinces totaled 3.95 trillion yuan, an 11.2% year-on-year increase, 8.3 percentage points higher than the national average. Their share of the total trade increased by 1.3 percentage points to 18.1%.

my country plans to introduce regulations to protect the basic rights and interests of over-age workers

On July 31, the Ministry of Human Resources and Social Security issued the "Interim Provisions on the Protection of the Basic Rights and Interests of Over-Age Workers (Draft for Public Comment)" and is soliciting public opinion from now until August 31. The draft clearly defines the protection of the basic rights and interests of over-age workers, proposes strengthening protections for their basic rights such as labor remuneration, rest and leave, labor safety and health, and work-related injury insurance, and facilitates dispute resolution channels. Over-age workers can safeguard their legitimate rights and interests through labor dispute mediation and arbitration, filing lawsuits in the People's Court, and filing complaints with human resources and social security departments.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.