Alert! Is the worst non-farm payroll report of 2025 coming soon? The risk of a short-term dollar correction is increasing.

2025-08-01 10:03:26

Non-farm payroll forecast overview

Last month, the market expected a gradual but persistent deterioration in the labor market, which would have posed a downside risk to the June nonfarm payroll report. The report, however, came in slightly above expectations, buoyed by government hiring and seasonal adjustments. The key question for traders this month is whether the nonfarm payroll report will show a delayed deterioration as temporary measures fade, or whether the labor market has rebounded enough to smooth out the mid-year hiring slowdown.

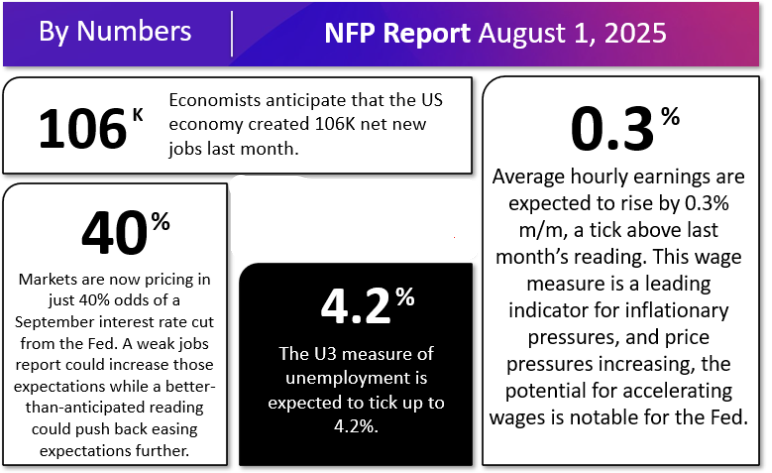

For the July employment report, the forecast is for 106,000 new jobs and an increase in the unemployment rate to 4.2%. A key indicator is average hourly earnings, which are expected to increase by 0.3% month-on-month, a slight increase from the previous month.

Crucially, after Fed Chairman Powell cast doubt on the likelihood of a September rate cut during his press conference, traders now expect the Fed to deliver only about 1.5 25 basis point rate cuts this year as concerns about tariff-driven inflation persist. Given concerns about both the employment and inflation sides of the Fed's dual mandate, a weak jobs report could push the central bank toward rate cuts.

Non-farm forecast reference

The market typically looks to four historically reliable leading indicators to predict the monthly non-farm payroll report… but due to the peculiarities of this month’s calendar, only two are available in advance:

ADP employment report: 104,000 new jobs were created, higher than the upwardly revised -23,000 jobs in the previous month.

The four-week moving average of initial jobless claims fell to 221,000 from over 240,000 last month.

Regardless, monthly fluctuations in the report are difficult to predict, so any forecast should not be relied upon too heavily.) As always, other aspects of the report, particularly the closely watched average hourly earnings figure (+0.2% month-over-month in the most recent NFP report), will be crucial:

Average hourly earnings are expected to rise 0.3% month-over-month, slightly higher than last month's data. This wage indicator is a leading indicator of inflationary pressures, and if wage growth accelerates, it will significantly affect the Federal Reserve's assessment of inflation.

The market currently sees only a 40% chance of a Fed rate cut in September. A weak jobs report could boost expectations of a rate cut, while a better-than-expected reading could further delay easing.

Non-farm payroll market reaction forecast

The US dollar index is in a completely different situation than last month, having reversed from a more than three-year low to a two-month high. This would increase the likelihood of a pullback in the dollar unless the jobs report is significantly stronger than expected.

US Dollar Technical Analysis

As the chart shows, the US Dollar Index (DXY) broke above its bearish trendline and after retracing from above, it broke through the previous resistance level of 99.25, ending its downtrend this year.

In the short term, the US dollar index has risen for six consecutive days, with the 14-day relative strength index (RSI) reaching its most overbought level since January. Unless the jobs report is particularly strong, there is a risk of profit-taking. On the downside, the previous resistance-turned-support level of 99.25 will be a key level to watch, and the medium-term outlook remains generally positive above this area.

The US dollar index faces little resistance above 101.00 if a strong jobs report calls into question whether the Federal Reserve will cut interest rates this year.

(Daily chart of the US dollar index, source: Yihuitong)

At 10:00 Beijing time, the US dollar index is currently at 100.13.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.