Vale: Strong performance again delivered in the second quarter of 2025

2025-08-01 10:06:25

Performance Highlights

Operational and cost performance improved across all businesses, and all guidance targets were on track. Copper and nickel sales increased by 12,900 tons and 7,000 tons, respectively, year-over-year, representing increases of 17% and 21%, respectively. Iron ore shipments decreased by 2.4 million tons, or 3%, year-over-year, reflecting the ongoing product mix optimization strategy.

The average realized price of iron ore fines was US$85.1 per tonne, down 6% month-on-month and 13% year-on-year, in line with the overall downward trend of iron ore reference prices.

The C1 cash cost of iron ore fines (excluding third-party purchases) was US$22.2 per tonne, down 11% year-on-year, marking the fourth consecutive quarter of year-on-year cost reductions.

Total costs for iron ore, copper and nickel decreased by 10%, 60% and 30% year-on-year to US$55.3/ton, US$1,450/ton and US$12,396/ton, respectively, thanks to the implementation of efficiency measures and increased production.

Driven by solid operational performance and higher-than-expected gold prices, the 2025 all-in copper cost guidance was lowered from US$2,800/t to US$3,300/t to US$1,500/t to US$2,000/t.

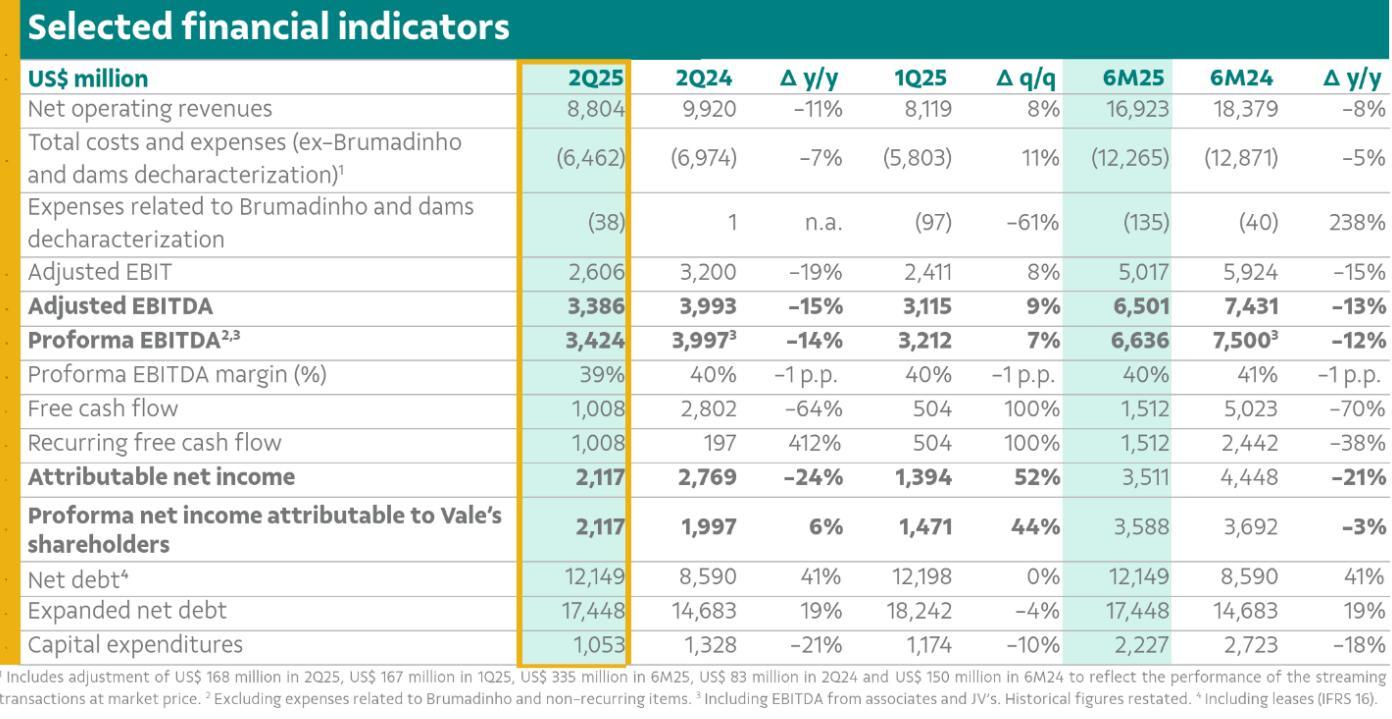

Pro forma EBITDA (earnings before interest, taxes, depreciation and amortization) was $3.4 billion, up 7% sequentially and down 14% year-over-year. Strong performance in copper and nickel, along with lower iron ore C1 cash costs, partially offset weaker commodity prices.

Capital expenditures were $1.1 billion, down $0.2 billion year-over-year and in line with the 2025 full-year guidance of $5.9 billion, reflecting ongoing efficiency initiatives.

• Recurring free cash flow was $1.0 billion, an increase of $0.8 billion year-over-year driven by more favorable working capital movements and lower capital expenditures.

Total net debt as of June 30 was $17.4 billion, a decrease of $0.8 billion sequentially, primarily due to free cash flow generation.

? Approved to pay interest on capital of US$1.448 billion in September 2025, representing an annualized yield of 7%1.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.