There are mixed signals before the release of non-farm payroll data. Will the price of gold return to above $3,300 per ounce or fall further?

2025-08-01 18:30:02

Gold price outlook

Gold prices have been volatile over the past few weeks, confusing market participants. However, the recent decline and trendline breakout has sparked concerns about further downside.

Gold buyers are holding on, but the lower peak at $3,435 is below the April high of $3,500, suggesting the rally may be losing steam after a 75% gain in 15 months.

Bulls have remained optimistic so far because gold attracted a surge of buyers during the two previous attempts by bears to take control, which resulted in higher lows rather than lower lows as expected in line with the trend.

In May, after falling from a high of around $3,500 per ounce, gold found support around $3,200 per ounce, buyers returned, and it subsequently rebounded to $3,433 per ounce. This was followed by a new low of $3,122 per ounce, which many believe could be the beginning of a long-term downtrend.

However, rising geopolitical risks led to higher highs in gold prices rather than lower highs, which was followed by two months of volatile trading.

This begs the question: Is the current drop the beginning of a larger downturn, or is it just history repeating itself?

US dollar recovery gathers pace

However, there is one significant difference in the current rebound.

First, geopolitical risks have receded into the background over the past three weeks, but that doesn’t mean they won’t return. The Iranian issue remains unresolved, with numerous media reports suggesting ongoing meetings and a potential regime change.

If the situation escalates again, safe-haven demand may return. But for now, this factor has led to a reduction in safe-haven inflows.

The US dollar has recently been supported by buying interest as the announcement of the trade deal appears to be positive for the greenback. With tariffs taking effect, the US Dollar Index (DXY) is at a critical juncture in its rebound. Ahead of today's non-farm payroll data release, the US Dollar Index is testing the key pivot level near 100.00.

Positive employment data is likely to bolster optimism about the US economy. As some analysts have pointed out, whether this optimism is misguided is less important than the behavior of market participants. Market trends clearly indicate growing confidence in global and US economic growth in the second half of 2025.

If this situation persists into August, gold bulls could face challenges. However, it is important to remember that the situation in 2025 is constantly evolving and unpredictable, so it is by no means set in stone.

Technical Analysis

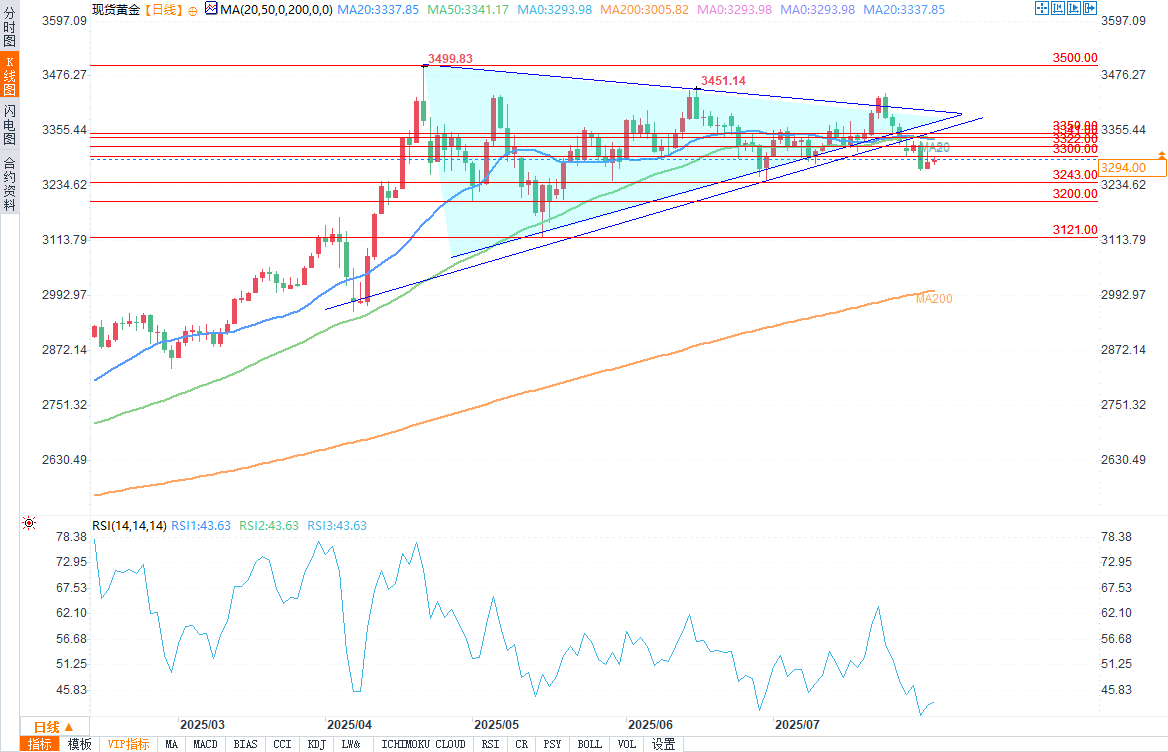

(Source of spot gold daily chart: Yihuitong)

From a technical perspective, the July gold monthly K-line closed with a huge shooting star, suggesting that there may be further declines in the future.

This is also the first bearish monthly close since December 2024, which may mark a shift in bullish and bearish momentum.

On the daily chart, the price has broken down from a triangle pattern, which had a false breakout to the upside last week.

Following the downward breakout, gold prices fell sharply, falling about 1.55% on Wednesday to their lowest closing price in more than a month.

However, an inside bullish candlestick appeared yesterday, and gold found some support near the 100-day moving average (about $3,270/oz).

If bulls want to push gold prices higher, it is crucial to hold above $3,300 an ounce, and a daily close above this level is needed to restore bullish momentum.

The immediate resistance levels are $3,322, $3,341 and $3,350 respectively.

If gold prices continue to fall, the first thing they need to do is to see a clear daily close below the 100-day moving average. This could open up further downside, targeting support levels at $3,243, $3,200, and possibly even $3,121.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.