Historic data revisions spark rate cut fears! Is the Euro a safe haven, while the British pound is being abandoned?

2025-08-04 11:45:05

Weak non-farm payroll data reinforces expectations of a Fed rate cut, putting significant pressure on the US dollar

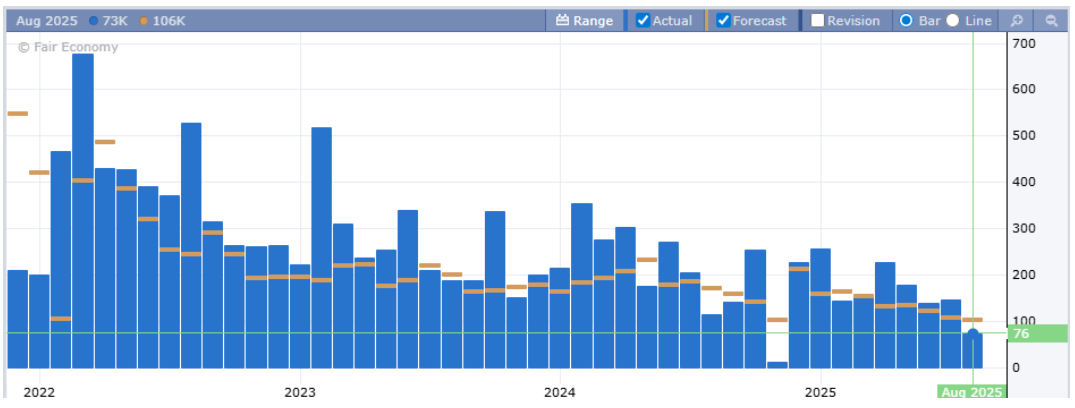

The latest US non-farm payroll report shows just 73,000 new jobs added in July, far below the expected 106,000. The previous reading was revised down significantly by 258,000 to 33,000. May's figure was revised down by 125,000, from +144,000 to +19,000. June's figure was revised down by 133,000, from +147,000 to +14,000. This massive "statistical swing" exceeds the scope of conventional seasonal adjustments and represents the largest downward revision since the COVID-19 pandemic.

This data not only exposes the accelerating deterioration of the US labor market but also fuels strong market expectations of a policy shift by the Federal Reserve. CME Group data indicates that the market's probability of a 25 basis point rate cut at the Fed's September 17 meeting has risen to 80.9%. Furthermore, a rare disagreement within the Fed, with two board members opposing maintaining interest rates, further underscores policy uncertainty.

The non-farm payroll data showed an overall contractionary trend, and the US dollar index fell from over 100 to 98.78, reflecting the market's wavering confidence in US dollar assets. A premature rate cut by the Federal Reserve could reduce the attractiveness of dollar-denominated assets, while a delayed cut could exacerbate the risk of a hard landing. This policy dilemma makes it difficult for the US dollar to escape its weak tone in the short term, providing room for appreciation for the euro.

The ECB maintains a firm interest rate stance, supported by inflation targets and economic resilience

Eurozone consumer prices rose 2.0% year-on-year in July, unchanged from June and slightly above the expected 1.9%. Core inflation (excluding energy and food) remained stable at 2.8%. This data not only confirms the ECB's confidence in its medium-term inflation target but also provides justification for delaying interest rate cuts. The European Commission took a rare pause in its rate-cutting cycle at its July meeting, stating that "inflation is close to target, though victory has not yet been declared." Officials such as Patasalides emphasized the "remarkable resilience of the eurozone economy" and believed that "inflation will stabilize around 2%."

Although Eurozone GDP grew by only 0.1% in the second quarter, core economies such as Germany and France maintained resilient growth thanks to a rebound in consumption and inventory adjustments. More importantly, the European Central Bank's response to trade risks has become more flexible: on the one hand, it is preparing to implement a retaliatory tariff list against the US (covering €72 billion in goods), while on the other hand, it is maintaining room for policy adjustment through a "wait-and-see" approach. This self-centered policy framework has made the euro a stronger safe-haven asset during a weakening dollar cycle.

The escalation of trade tensions and technical factors are both bullish

While the 15% tariffs imposed by the United States on EU exports have been partially mitigated by the trade agreement, the EU retains its retaliatory measures. This "fight but not break" pattern has actually strengthened market preference for euro assets. The deadline for trade negotiations with the White House has arrived. While some countries have reached agreements to avoid high tariffs, others are now facing significant tariffs. For example, Brazil will face a 50% tariff, and Canada will face a 35% tariff, although some strategic partners have already received a 15% tariff reduction. Most worryingly, these new tariffs mark a new phase in global trade, with the United States imposing broad measures on goods from around the world. Beyond the percentage, the market is also concerned about rising import costs and the possibility that many countries will retaliate with reciprocal tariffs, further increasing uncertainty in the global economy.

Against this backdrop, the euro is beginning to emerge as a more stable alternative, especially compared to the US dollar, which is weighed down by its own internal pressures. The belief that the European economy may be better able to weather this new trading environment is helping to maintain confidence in the euro in the short term.

From a technical perspective , the EUR/USD pair has broken through its highest high of 1.1488 (July 30), remaining within an upward trend. The MACD's green bars have narrowed since its first dip below zero, while the RSI has rebounded to around 50 after falling below 50, suggesting a period of consolidation before a short-term upward move. However, vigilance remains regarding risks within the Eurozone: Italy lowered its 2025 GDP growth forecast from 0.6% to 0.5%, directly attributing this to the impact of the euro's appreciation on exports. A continued strengthening euro could exacerbate trade imbalances in southern European countries, creating a negative feedback loop of appreciation, declining exports, and economic slowdown.

Institutional Views and Risk Warnings

Citigroup notes that the dollar sell-off triggered by non-farm payroll data could drive the euro higher in the short term, but the 1.20 level remains a significant psychological barrier. Deutsche Bank believes that if US-EU trade friction escalates, the euro could strengthen further due to safe-haven demand, but caution is warranted regarding the possibility of the ECB being forced to cut interest rates. The market currently needs to focus on two key risks: progress on the August 7 deadline for US-EU trade negotiations and the ECB's reassessment of the inflation path at its September meeting.

Overall , the euro is expected to continue its short-term upward trend against the dollar, driven by expectations of a Fed rate cut and the ECB's policy resilience. A break above the previous resistance level of 1.180 could push it towards 1.20. However, economic divergence within the eurozone (such as sluggish growth in Italy) and the risk of escalating trade frictions could weigh on the euro in the medium to long term. Investors are encouraged to enter long positions on dips.

(Euro/USD daily chart, source: Yihuitong)

At 11:44 Beijing time, the euro is trading at 1.1576/77 against the US dollar.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.