AUD/USD Weekly Outlook: Fed policy bets boost AUD, weak US economic data

2025-08-04 18:19:46

AUD/USD is poised for a rebound as weak US economic data rekindles market bets on a Federal Reserve rate cut. However, this week's Reserve Bank of Australia (RBA) policy forecasts and key US services data will determine the pair's direction. Despite a 1.37% drop last week, AUD/USD remains the leading gainer, up 4.57% year-to-date.

Following the weak Non-Farm Payrolls (NFP) and Purchasing Managers' Index (PMI) data released last Friday, money markets are now pricing in a 25 basis point interest rate cut from the Federal Reserve in September. Although the Federal Open Market Committee (FOMC) minutes released earlier this week cast a cold light on a September rate cut, these weak data points are too weak to ignore.

The US added only 73,000 jobs in July, far below the expected 106,000. Perhaps even more worrying, however, was the significant downward revision to June's data, from 147,000 to just 14,000. While the unemployment rate remained relatively low at a flat 4.2%, June's data was already approaching a contraction signal. The latest PMI data showed that US manufacturing contracted for the fifth consecutive month in June, with the employment index falling to 43.4, the lowest level in a year, and new orders also shrinking for the sixth consecutive month.

A chart from CME Group's FedWatch tool shows that traders' expectations of three consecutive Fed rate cuts by December 2025, with a target range of 375-400 basis points, fell to 52.8% in December from 89.1% in September.

This week's ISM services report will be closely watched as any further signs of weakness will only reinforce market expectations of a Fed move. While markets are rekindling expectations of a rate cut from the RBA next week, this could still be a bullish signal for AUD/USD traders.

Quarterly inflation data could pave the way for the Reserve Bank of Australia to cut interest rates by 25 basis points, but the RBA is unlikely to be overly dovish and will continue to emphasize a cautious outlook. Meanwhile, as currency markets try to price in three consecutive rate cuts by December, the US dollar may have further room to fall against the Australian dollar, putting AUD/USD back in the range of a bullish breakout.

Technical Analysis

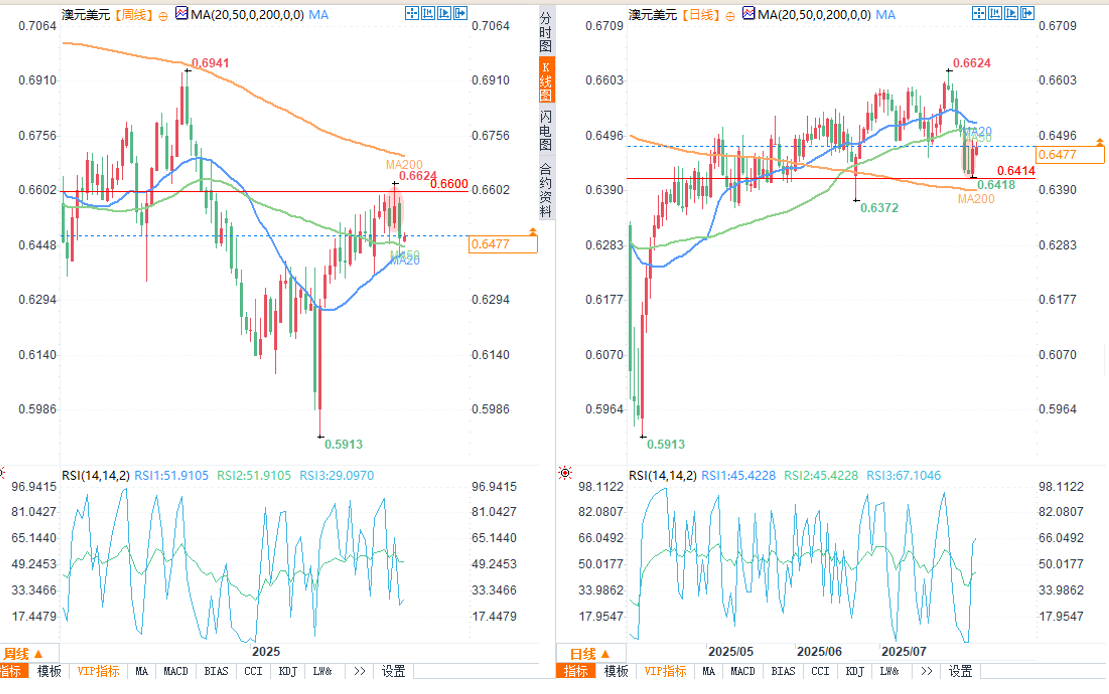

The AUD/USD pair is showing conflicting signals on both the weekly and daily charts. The weekly chart suggests the Australian dollar may have finally peaked, while the daily chart is flashing a bullish signal in the short term.

The Relative Strength Index (RSI(2)) on the daily chart was extremely oversold last Wednesday and Thursday before rebounding on Friday to form a bullish engulfing candlestick pattern, part of a bullish reversal pattern (Morning Star), which appeared just above the High Volume Node (HVN) at 0.6414. Currently, AUD/USD seems to be heading towards the 0.6500 level, with the possibility of breaking through its 50-day exponential moving average (0.6509) and 20-day exponential moving average (0.6523).

Whether it can reach 0.6600 may depend on whether the US ISM services report shows further weakness in the US economy - especially if prices fall fast enough to reduce inflation expectations. However, if the report is strong, upside for AUD/USD may be limited and the US dollar may regain some bullish momentum.

The weekly and daily charts of AUD/USD show a bearish engulfing candlestick pattern below 0.6600 on the weekly chart and a morning star reversal pattern near the 0.6414 support level on the daily chart. Last Thursday, the RSI(2) was extremely oversold, suggesting a potential rebound in the short term, the direction of which may depend on the upcoming US ISM Services PMI report.

AUD/USD correlation

Most market volatility can be traced back to expectations for the Federal Reserve's monetary policy, meaning the US dollar tends to move with the rise and fall of US Treasury yields, and AUD/USD has a strong negative correlation with both. The 20-day rolling correlation between the US Dollar Index and AUD/USD has risen to a high of 0.96, indicating a nearly perfect inverse relationship between the two.

While AUD/USD has stronger correlations with NZD/USD and CNY at 0.98 and 0.97 respectively, much of these correlations can also be traced back to the US dollar, yields and expectations of Fed policy.

At 18:18 Beijing time, AUD/USD was at 0.6477/78, up 0.06%.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.