The Bank of Japan's hawkish stance vs. the Fed's rate cut, is the yen trend about to change?

2025-08-05 16:47:33

The two-way impact of Bank of Japan policy and economic data

The Bank of Japan further clarified in the minutes of its June meeting released on Tuesday (August 5) that it would raise interest rates further if economic and price trends meet expectations. The minutes of the Bank of Japan's June meeting reiterated that if growth and inflation meet expectations, it will further consolidate market expectations of interest rate hikes and limit the downside of the yen.

The S&P Global Japan Services Purchasing Managers' Index rose to 53.6 in July 2025, slightly higher than the preliminary value of 53.5 and higher than 51.7 in the previous month, marking the fourth consecutive month of expansion and the fastest growth since February; the composite purchasing managers' index rose slightly to 51.6 last month, marking the strongest overall business activity growth since February, which became another boost to the yen.

On the other hand , the minutes showed that most Bank of Japan members supported keeping interest rates unchanged for now due to increased uncertainty about US trade tariffs.

Domestic political uncertainty could complicate the Bank of Japan's path to monetary policy normalization: The ruling Liberal Democratic Party's defeat in the July 20 election has raised concerns about Japan's fiscal health, with opposition parties calling for increased spending and tax cuts, suggesting the prospect of a further delay in the Bank of Japan's interest rate hikes. Bank of Japan Governor Kazuo Ueda last week downplayed inflation risks and signaled continued policy patience.

Supplementary background on Bank of Japan policy

The Bank of Japan is the central bank of Japan and is responsible for formulating monetary policy. Its mission is to issue banknotes and conduct monetary and monetary controls to ensure price stability (with an inflation target of approximately 2%).

The Bank of Japan has implemented an ultra-loose monetary policy (based on quantitative and qualitative easing, providing liquidity through asset purchases) since 2013. In 2016, it further introduced negative interest rates and controlled the 10-year government bond yield; in March 2024, it began to raise interest rates and exited its ultra-loose stance.

The ultra-loose policy has caused the yen to depreciate against major currencies. In 2022-2023, the depreciation will be even greater due to intensified policy differences with other central banks (raising interest rates to fight inflation) (the widening interest rate gap will drag down the yen); after the ultra-loose policy is exited in 2024, the trend will be partially reversed.

A weak yen and rising global energy prices have pushed up Japan's inflation (over the 2% target), which, combined with the prospect of rising wages, has prompted the policy change.

Fed policy expectations weigh on dollar, boost yen

Rising expectations of a September Fed rate cut could act as headwind for the US dollar and limit gains in the USD/JPY pair. With the Fed widely expected to resume rate cuts in September, any significant appreciation of the dollar seems unlikely; this expectation was reinforced by Friday's weaker-than-expected US non-farm payroll report.

The CME Group's FedWatch tool shows a more than 80% chance of a September rate cut, with about 65 basis points of cuts expected by the end of the year. This is keeping U.S. Treasury yields subdued and putting pressure on the dollar, which in turn could help the yen appreciate.

Political interference in federal agencies

Concerns about the Federal Reserve's independence are prompting caution among dollar bulls: U.S. President Donald Trump ordered the firing of the Bureau of Labor Statistics director hours after the release of disappointing jobs data, and Fed Governor Adrienne Kugler resigned from the central bank's board.

This comes against the backdrop of continued political pressure on Federal Reserve Chairman Jerome Powell to lower borrowing costs, which should limit the dollar's gains.

Traders are looking to the release of the US ISM Services Purchasing Managers' Index and comments from influential Federal Open Market Committee members for short-term momentum during the North American trading session, which will play a key role in driving demand for the US dollar.

Market sentiment and the role of external factors

Asian stocks rose in Tuesday's Asian trading session, boosted by a sharp rebound on Wall Street on Monday, which in turn weakened demand for traditional safe-haven assets and could limit the yen's gains.

As a result, the US dollar has gained some positive momentum, providing support for the USD/JPY currency pair; but overall, broader market risk sentiment, together with the above-mentioned policy factors, can create short-term trading opportunities for the USD/JPY currency pair.

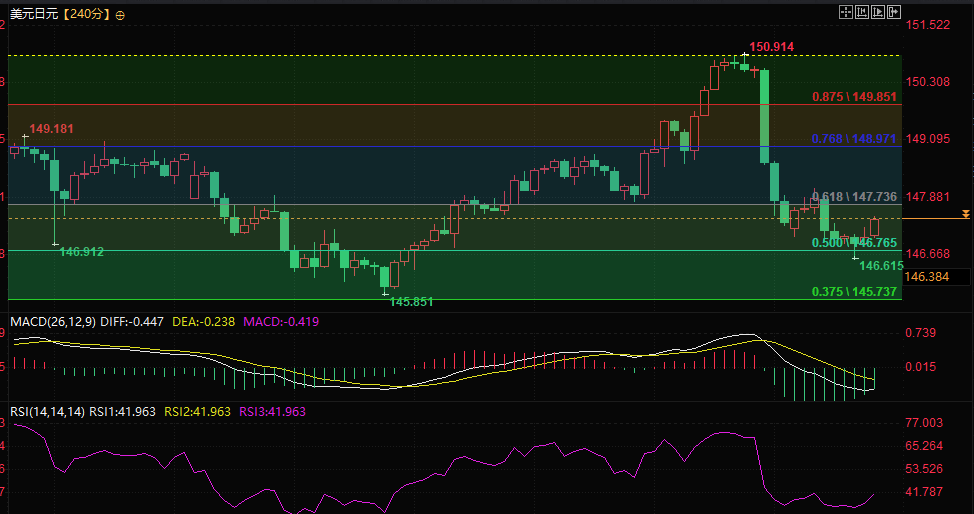

Technical analysis: support and resistance ranges are clear

The price of the US dollar is trading above the 50% percentile of the rebound from the July low. It retested the 50% percentile line during the session, showing resilience, and then returned to above 147.00, indicating that the US dollar bulls are stationed here and bears should be careful about short selling.

The neutral oscillator on the daily chart suggests that any further recovery may face immediate resistance around the 147.35 area, followed by the 147.75 area (38.2% Fibonacci retracement level) and the 148.00 round number mark; a sustained break above 148 would indicate that the USDJPY price has completed the bottom pattern after the decline and will turn to rise.

In terms of downside support, the 50% retracement level (around 146.85) provides immediate support; if there is continued selling below the lowest price of the Asian session on Tuesday (August 5) (around 146.60), the currency pair may accelerate its decline towards the 146.00 mark, and the downward trend may further extend to the 145.85 area (61.8% Fibonacci retracement level), and the yen will continue to appreciate.

USD/JPY 4-hour chart, source: E-HuiTong.

At 16:45 Beijing time, the USD/JPY exchange rate was 147.59.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.