Even a weaker dollar can't save the British pound? Expectations of a rate cut are weighing on the British pound, and bears are targeting it.

2025-08-07 16:22:09

GBP/USD and GBP/JPY are under pressure due to expectations of a dovish rate cut by the Bank of England, while a weaker dollar provides short-term support.

The British pound rebounded before the Bank of England (BOE) meeting, mainly driven by the weakening US dollar; but the market generally expects the Bank of England to cut interest rates by 25 basis points to 4.0%. Regardless of the voting distribution or forward guidance, if the meeting releases dovish signals, the downside risks of GBP/USD and GBP/JPY may further increase.

Meanwhile, the dollar's decline stemmed from weaker-than-expected non-farm payrolls and ISM services data, coupled with comments from Minneapolis Fed President Neel Kashkari on CNBC that fueled speculation of a Fed rate cut. While services inflation remains stubbornly high, traders are closely watching for further signals. Both GBP/USD pairs are trading near key technical levels, suggesting a potential reversal.

The dollar continues to weaken, and the Bank of England's interest rate cut becomes the key pressure on the pound

The US dollar fell broadly on Wednesday (August 6th), as pressure within the Federal Reserve for an interest rate cut continued to intensify. Kashkari's hint of a rate cut was reinforced by previously weak employment and services data. Despite rising service prices in the ISM data, Fed members expressed skepticism about whether tariff-induced inflation would be temporary. With weakening economic data, the case for a rate cut and a weaker dollar is strengthening.

From a technical perspective

The US dollar index, EUR/USD, AUD/USD, and USD/JPY all indicate bearish momentum for the US dollar: the US dollar index weakened above the 98 mark, with the 2-day RSI below 10, entering oversold territory; the euro is approaching the key level of 1.17 against the US dollar. A breakout would require the US dollar index to fall below its 50-day moving average, around 97.89, which currently serves as potential support.

The Australian dollar rebounded above 0.65 against the US dollar, but the 0.6513 where the 50-day and 20-day moving averages overlapped and traded in a dense area constituted resistance;

USD/JPY is temporarily stable above the low of 146.62, formed by the bullish engulfing candlestick combination on Tuesday. There may be a short-term rebound, but the probability of it eventually falling below 146 is higher. Overall, the US dollar still has room to weaken further before the Bank of England meeting and against the backdrop of rising expectations of a Fed rate cut.

The Bank of England is expected to cut interest rates, and the market is betting on further easing

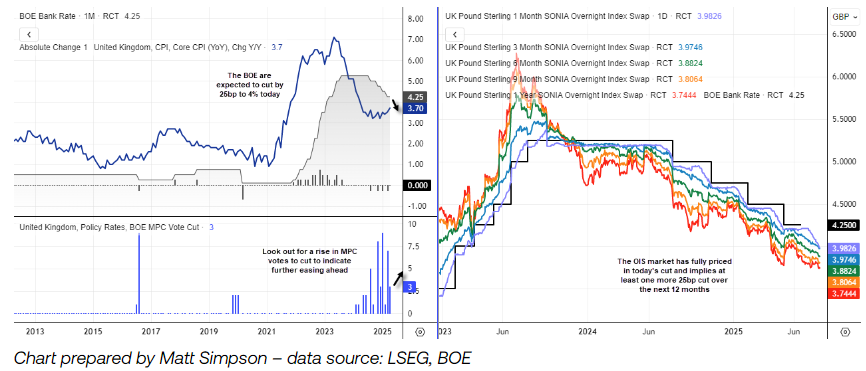

The Bank of England is expected to cut interest rates by 25 basis points to 4% today. The Overnight Index Swap (OIS) market has fully priced in this rate cut, with a dovish bias implied. The one-year OIS suggests at least another 25 basis point rate cut over the next 12 months. Traders should closely monitor the voting distribution at the UK MPC meeting on Thursday evening (August 7). If the number of votes in favor of a rate cut increases, it could signal that more easing measures are imminent, potentially further depressing the British pound, especially when coupled with dovish commentary.

In addition, before the New Zealand Reserve Bank meeting, New Zealand's inflation expectations are worth paying attention to: labor costs rose by 0.6% in the second quarter (higher than the expected 0.5% and the previous value of 0.4%), and CPI also rose; although the unemployment rate rose to 5.2%, which may support an interest rate cut, continued inflation may force the New Zealand Reserve Bank to remain cautious.

Judging from the Bank of England's policy expectations and OIS pricing, the left panel shows the Bank of England's interest rate, core CPI (annual rate of 3.7%) and the MPC voting count, pointing to a 25 basis point rate cut to 4.0% and further easing signals; the right panel shows the UK SONIA OIS curve showing that the 1-month to 1-year interest rate is lower than the current central bank interest rate, confirming the market's expectations of multiple rate cuts - both of which support the judgment that GBP/USD is under pressure due to the Bank of England's dovish stance.

GBP/USD technical analysis: short-term rebound high may be formed, with clear downward space

GBP/USD Weekly Perspective: GBP/USD has fallen 4.7% from its July high, with half of that decline occurring during last week's bearish engulfing candlestick pattern. Considering that most declines unfold in three waves, the current decline (4.7%) is relatively shallow (8.4% since the 2023 high and 9.9% since the 2024 high), suggesting further declines in the coming weeks and months. Key support levels include 1.2938, an area of high trading volume, as well as the April low and the 61.8% Fibonacci retracement level (just above 1.2700).

GBP/USD Daily View: Price is testing resistance at 1.3370, near the June low and the 50% Fibonacci retracement level. The 20-day EMA (1.3392), the 61.8% Fibonacci retracement level (1.3420), and the downtrend line form key resistance areas, suggesting bearish positioning. The RSI is nearing overbought levels, and while short-term momentum is biased upward, momentum could lead to a daily high.

The downside targets are clear: in the near term, we are looking at 1.32 and the 38.2% Fibonacci level of 1.3140, which represents the total increase from the May low. After breaking below this level, the focus will shift to the 1.30 mark and 1.2938. If 1.2900 is lost, it may fall to the 61.8% retracement level and 1.2700, which is above the April low.

GBP/JPY technical analysis: Momentum weakens, pointing down towards the key level of 194

After rising from 184 in April to nearly 200 in July (where resistance was encountered at the October 2024 high), GBP/JPY has since broken below its rising trendline and formed a lower shoulder, accelerating bearish momentum. Currently, price is in a retracement phase, similar to GBP/USD, and may form a daily high on low volume due to momentum inertia.

Technically, the 50-day moving average (MA) acted as resistance on Wednesday. Short sellers may enter the market to position for the next leg lower as prices approach the 20-day MA and the high weekly volume zone at 197.90. A key downside target is 194, where the 38.2% Fibonacci ratio, the 200-day MA, and the high weekly volume zone overlap, highlighting downside risk.

At 15:42 Beijing time, the pound sterling against the US dollar is currently trading at 1.3375/76

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.