COT report analysis: US dollar short positions have decreased, while crude oil short positions have continued to rise

2025-08-11 19:40:54

The Commitment of Traders report showed a reduction in short positions in the US dollar, a significant increase in short positions in GBP/USD and AUD/USD, short bets on the Volatility Index near a four-year high, and rising short positions in crude oil.

Last week's Commitments of Traders (COT) report revealed some interesting developments across major asset classes. Bond traders, anticipating lower yields, piled into the short end of the yield curve via the 2-year Treasury note. Regarding volatility, net short exposure in the VIX climbed to its highest level in nearly four years, suggesting growing complacency ahead of the seasonally volatile September.

In the foreign exchange market, GBP/USD shorts were frustrated by the Bank of England (BOE)'s interest rate cut reaction, while AUD/USD shorts were positioning for an expected rate cut by the Reserve Bank of Australia (RBA). In the commodity sector, WTI crude oil remained under significant selling pressure, but current positioning suggests that a potential cycle low may be forming.

Weekly Market Position Overview

Large speculators' net positions in major currencies, gold, silver, crude oil, volatility indices, stock indices, and U.S. Treasuries as a percentage of open interest. There are large net shorts in the Australian dollar, Canadian dollar, Swiss franc, and WTI crude oil, while there are large net longs in the Japanese yen, gold, and Treasuries.

US Dollar (USD): Asset managers reduced their net short exposure to the US Dollar Index for the third consecutive week. Euro (EUR): Large speculators reduced their net long exposure by 7,400 contracts. British Pound (GBP): Large speculators reduced their gross long position by 22,100 contracts (the fastest weekly decline in a year).

Japanese Yen (JPY): Net long exposure fell to a 22-month low, while shorts increased by 7.4% (5,500 contracts).

Australian Dollar (AUD): Large speculators pushed net short exposure to a 16-month high Canadian Dollar (CAD): Although net short exposure increased by 3,000 contracts, gross longs increased by 24% (4,200 contracts)

Swiss Franc (CHF): Large speculators reduced their total long positions by 24% (2,200 contracts)

New Zealand Dollar (NZD): Large speculators were net short for the third consecutive week, but only by 4,800 contracts. Gold (GC): Large speculators and managed funds increased their net long exposure to gold by about 33,000 contracts. Crude Oil (WTI): Managed funds and large speculators continued to increase their short bets on crude oil.

Large speculators' positions in major currencies, gold, silver, crude oil, volatility indexes, stock indices and US Treasuries show extremely bullish positioning in 2-year and 10-year bonds, and highly bearish positioning in the Australian dollar, British pound and WTI crude oil.

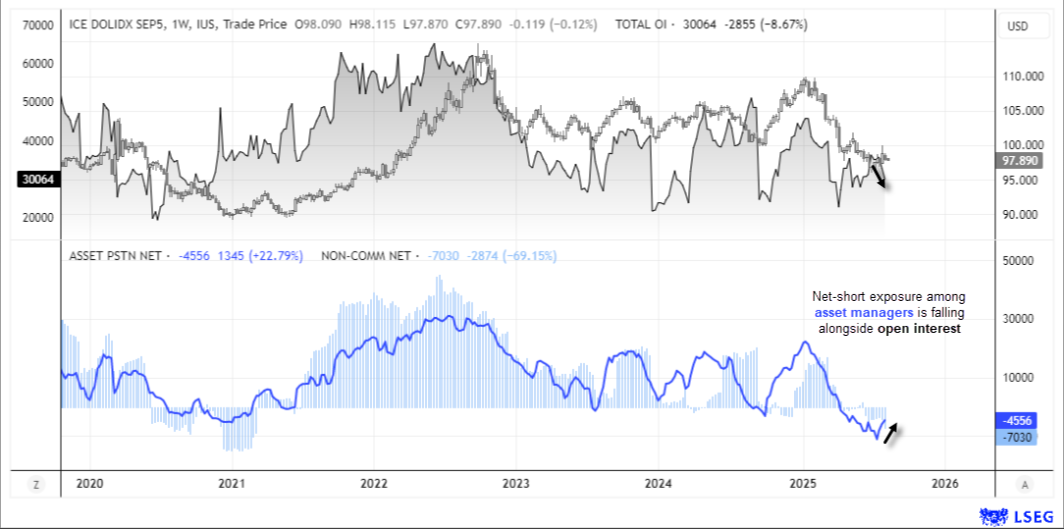

US Dollar Index (USD) Positions

(Total holdings have recently decreased significantly, indicating reduced market participation; asset managers' net short positions have decreased, and non-commercial holders' net short positions have decreased significantly, which may indicate a shift in market sentiment)

It is unclear whether the dollar will resume its dominant bearish trend or stage a counter-trend rally. The small bearish inside week seen last week does not give a clear signal.

Asset managers – often early movers of the dollar – reduced their aggregate short positions in the dollar index by 36% last week, following an 18% reduction the previous week. While this reduction in bearish exposure is noteworthy, aggregate longs remain low, suggesting a hesitation to buy the underperforming greenback.

In thin seasonal trading, open interest fell 9%, and tomorrow's US Consumer Price Index may be the catalyst that determines the dollar's next move.

The US Dollar Index futures chart and Commitment of Traders data show that asset managers reduced their aggregate short positions for the second consecutive week, while aggregate long positions remained low. The price action reflects market uncertainty about whether the dollar will resume its bearish trend or rebound, with open interest also declining.

GBP/USD positions

Ahead of last week’s Bank of England meeting, asset managers pushed their net short exposure to the British pound to its most bearish level in 15 months. Large speculators were net short for the second consecutive week, the most bearish level since November 2022.

However, the BoE’s rate cut was not as dovish as expected, sending GBP/USD sharply higher and suggesting a potential turning lower on the weekly chart. This positioning bias could fuel further gains if the pair breaks above short-term resistance.

Sterling futures charts and trader positioning data show that asset managers' net short positions are at their most bearish level in 15 months ahead of the Bank of England meeting. Prices rebounded sharply after the BoE rate cut, suggesting that the GBP/USD weekly chart may be turning lower.

AUD/USD positions

Futures traders increased their net short exposure to the Australian dollar to a 16-month high ahead of this week's Reserve Bank of Australia (RBA) meeting, where the bank is widely expected to cut interest rates by 25 basis points. The risk to short sellers is if the RBA avoids delivering dovish forward guidance.

Adding to potential volatility, tomorrow's US Consumer Price Index data could weigh on the Aussie if it shows inflation picking up - especially given the rise in "prices paid" in the latest Institute for Supply Management services report.

A chart of the Commitment of Traders report for AUD/USD futures shows that ahead of the RBA meeting, large speculators’ net short positions were at a 16-month high, while those of asset managers were at a 14-month high.

U.S. 2-year Treasury bond holdings

Renewed expectations for a September rate cut by the Federal Reserve drove the biggest bullish increase in 2-year Treasury positioning in 16 weeks, with asset managers adding 145,000 net long contracts.

Net long exposure is now at its highest level since the November record, and open interest is close to that peak - a sign of strong market confidence and potential downward pressure on yields.

According to data on U.S. 2-year Treasury bond futures prices and trader positions, open interest is near a record high, asset management companies' net long positions have surged to the highest level since November, net positions have risen sharply, and short positions remain depressed.

Volatility Index (VIX) futures positions

Large speculators’ net short position on volatility reached its highest level since September 2022, holding 86,400 contracts. Open interest also reached its highest level since August 2024, indicating strong confidence in the low volatility environment.

Historically, this crowded short volatility positioning can foreshadow a significant spike in volatility, and the risk is increasing as we approach September, a seasonally high month for volatility.

The VIX futures chart and trader positions data show that large speculators' net short positions are at their highest level since September 2022, and open interest is at its highest level since August 2024, which shows both the market's confidence in low volatility and a warning of possible volatility surges in the future.

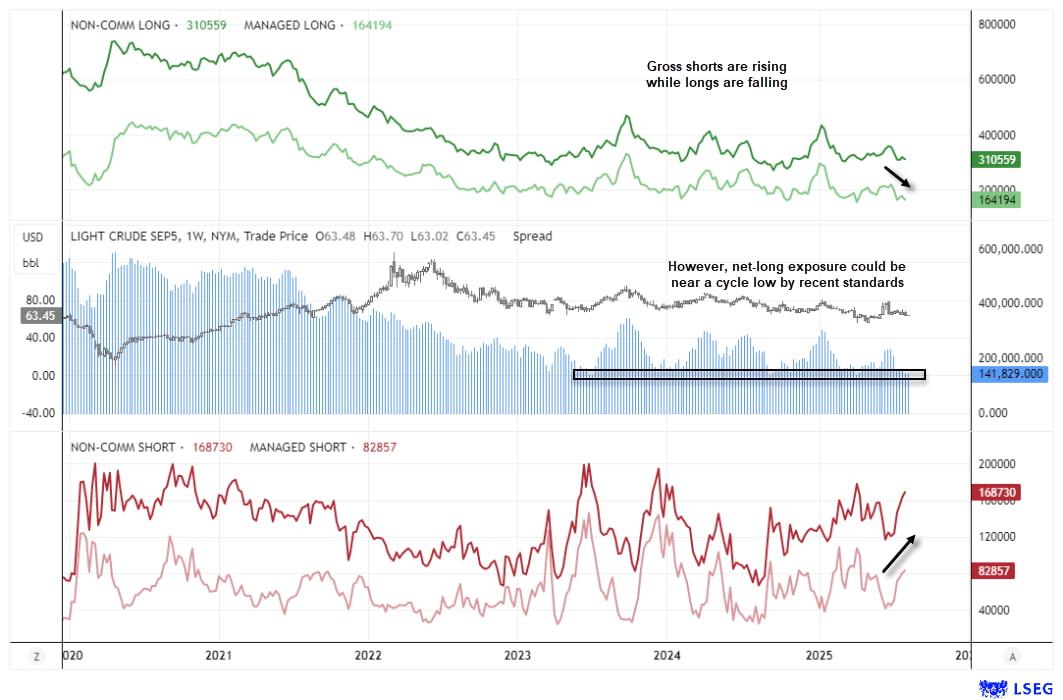

WTI Crude Oil Positions – Bearish Sentiment Nears Cycle Lows

(Changing trends in long and short positions in the crude oil market, as well as trading price fluctuations, with short positions increasing and long positions decreasing)

Bearish positioning in WTI crude oil deepened further last week, with large speculators and managed funds increasing their gross shorts and reducing their gross longs. Net long exposure is now at its lowest level since March-April.

While price action remains weak, history shows that levels like these are often the prelude to rallies, making this area worth watching for bears and bulls for a potential turn lower.

The Commitment of Traders (COT) report for WTI crude oil shows that gross short positions have increased, gross long positions have decreased, and net long exposure is nearing a cycle low. Price action remains weak, but positioning suggests a potential rebound.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.