A chart: The Baltic Index fell due to falling Capesize and Panamax freight rates

2025-08-11 21:38:16

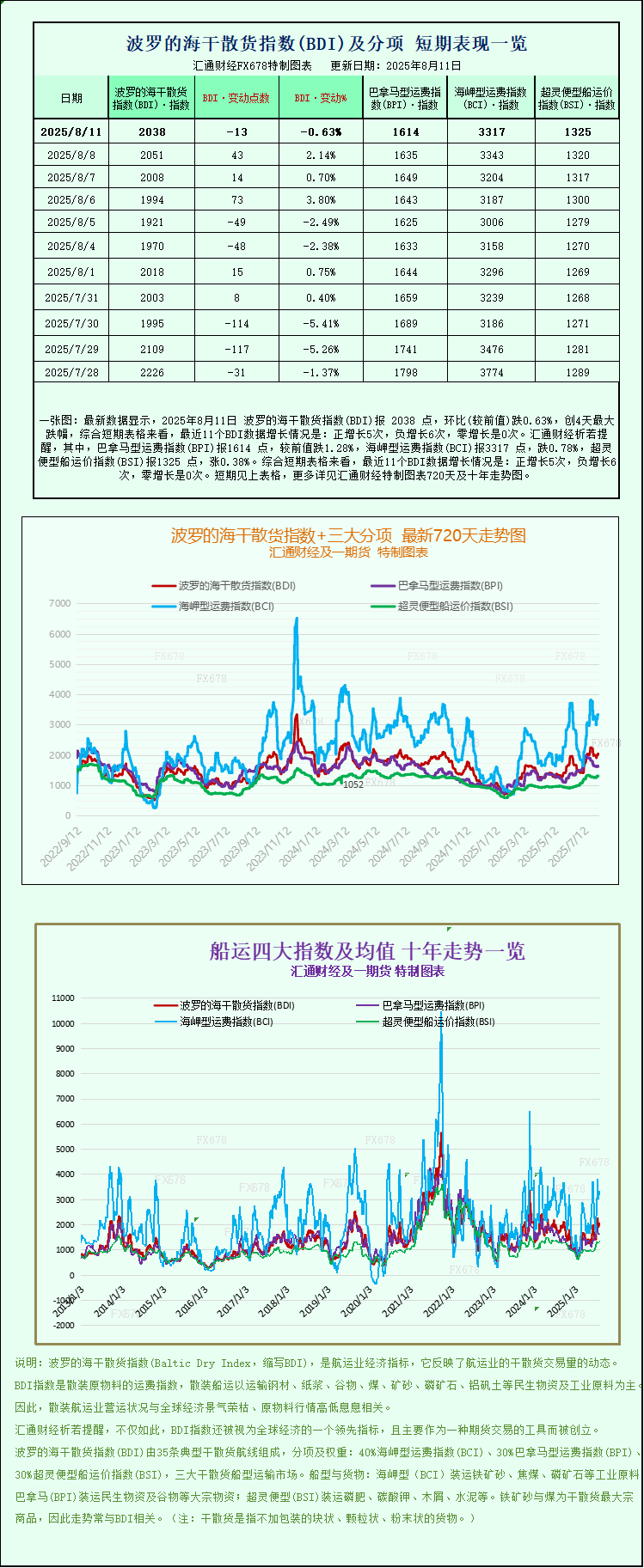

The Baltic Exchange's main ocean freight index, a measure of how much ships carry dry bulk cargoes, fell on Monday, led by declines in Capesize and Panamax rates.

The main index tracking rates for Capesize, Panamax and Supramax vessels fell 13 points, or 0.6%, to 2,038, snapping a three-day winning streak.

The capesize index fell 25 points, or 0.8%, to 3,317 points, snapping a three-day winning streak.

Average daily earnings for capesize vessels, which typically carry 150,000 tonnes of cargoes such as iron ore and coal, fell $210 to $27,506.

Iron ore futures rose, supported by strong restocking demand from Chinese steel mills amid healthy margins and low inventories, but expectations of output cuts in northern China limited gains.

Among smaller vessels, the supramax index rose 5 points, or 0.4%, to 1,325, its seventh consecutive day of gains.

The panamax index fell to a one-month low, down 21 points, or 1.3%, to 1,614. The index fell to its lowest level since July 8.

Average daily earnings for Panamax vessels, which typically carry 60,000-70,000 tonnes of coal or grain, fell $183 to $14,529.

Separately, a liquefied natural gas (LNG) tanker under U.S. sanctions has been moored at Russia’s Arctic LNG-2 facility, ship tracking data from Kpler and LSEG showed, the fourth such vessel to do so this year.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.