Strategist: The decline in US stocks may be a catalyst for gold prices, and we can see $4,000 before the end of the year

2025-08-12 10:52:46

December gold futures fell more than 2% on Monday, while spot prices fell 1.4% as investors awaited clarity on possible tariffs on imported 100-ounce and 1-kilogram bars.

Mike McGlone, senior commodity strategist at Bloomberg Intelligence, said that despite recent fluctuations in gold prices, overall, gold prices will continue to hold the key support level above $3,300, and its technical price trend may indicate that gold prices will soon break through.

He added that the key to a breakout in gold prices could lie in the stock market, with the S&P 500 looking a bit heavy as it approaches its recent all-time high above 6,400.

In his latest report, he said: "The key catalyst for the next move towards $4,000 may come from some support from the US stock market, which may also highlight the risks of gold. Since April, gold has been firmly based around $3,300 per ounce, and it may take an unexpected force to push it below this threshold. ETFs have decisively turned to inflows after four years of outflows. A slight pullback in the US stock market may become a catalyst to push gold prices closer to $4,000. "

McGlone noted that the S&P 500 continues to outperform the MSCI All-Country World Index by a record amount, but he also warned that price action is testing support at its trendline.

He said: "In the long run, human ingenuity and gains are the main reasons why the stock market outperforms gold, but it is common for the long-term bond market to outperform the stock market. Since 2017, gold has been moving in sync with the total returns of AI-driven stock indices, which is not a good economic signal and may mean that risk assets are overvalued. If the S&P 500 index breaks through the global trend line before the end of the year, it may trigger a deflationary domino effect."

While McGlone will be keeping a close eye on the stock market to gauge gold’s next move, he also reiterated that U.S.-driven geopolitical uncertainty remains an important trigger for gold prices.

“President Trump’s resistance to U.S. statistics and Federal Reserve independence could be bullish for the gold market,” he said.

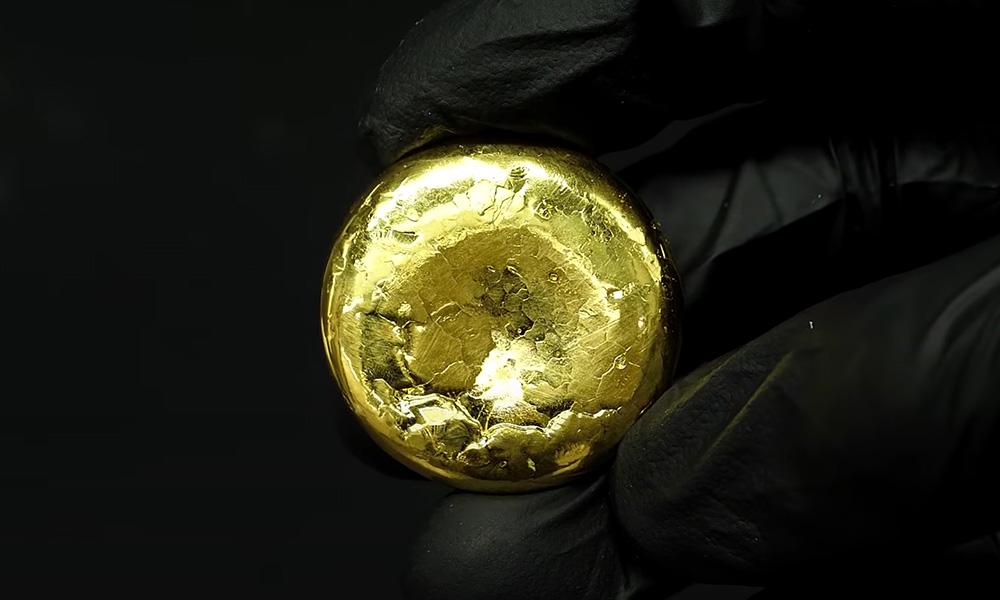

Spot gold daily chart Source: Yihuitong

At 10:42 Beijing time, spot gold was trading at $3,352.43 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.