The European economy is in a state of "ice and fire": Q2 growth rate drops sharply, and 60 companies spend 4.8 trillion to bet on a reversal!

2025-08-12 14:22:14

Eurozone economic growth slowed in the second quarter

According to Eurostat, the eurozone economy grew at a modest annualized rate of 0.4% in the second quarter. This slowdown, compared to the 2.4% growth in the first quarter, suggests that the acceleration in exports that drove GDP growth in the first quarter (designed to circumvent the tariffs announced by US President Donald Trump earlier this year) may have ended. The eurozone economy may weaken further in the short term, as data from Germany's Federal Statistical Office (Destatis) showed that factory orders in Germany fell for the second consecutive month in June, prompting automakers such as Volkswagen and Mercedes-Benz to lower their outlooks.

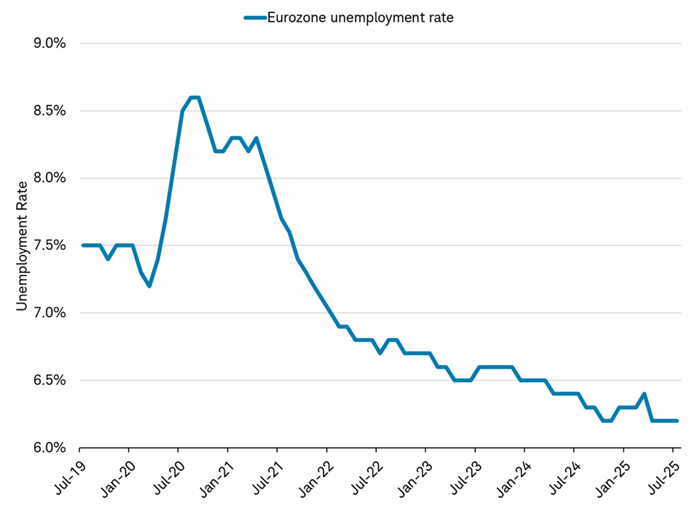

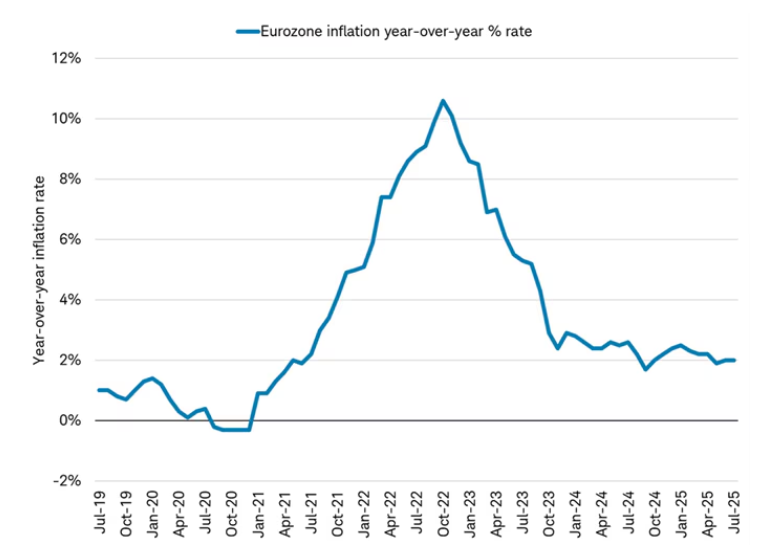

Despite the recent slowdown in growth, the outlook remains relatively positive. Eurostat notes that European consumers are benefiting from the lowest unemployment rate in 25 years and stabilizing inflation. The euro's appreciation this year has also boosted purchasing power, putting downward pressure on import prices. The European Central Bank's (ECB) wage tracking indicator projects wage growth of around 3%, consistent with its long-term inflation target of 2% plus 1% productivity growth, suggesting no expected inflation increase. If goods originally destined for export from China to the US are diverted to the eurozone, the increased supply could even put downward pressure on prices.

Eurozone unemployment at record low

(Overview of historical unemployment rate changes in the Eurozone)

Eurozone inflation stabilizes

(Overview of historical CPI data changes in the Eurozone)

While JPMorgan's global manufacturing Purchasing Managers' Index (PMI) declined in four of the first seven months of the year, the Eurozone's manufacturing PMI has remained resilient, rising monthly this year. Factors driving the PMI's rebound include new export orders returning to expansionary territory in June for the first time in over three years, while the pace of layoffs remained stable. Among the major countries in the region, Germany, Italy, Spain, the Netherlands, and Austria all saw improvements in their manufacturing PMIs in July. Data from the Organization for Economic Cooperation and Development (OECD) shows that leading indicators for Europe's four largest economies—Germany, France, the United Kingdom, and Italy—had risen for a record 32 consecutive months as of June.

Germany is driving market optimism about the future economy

Businesses in Germany, Europe's largest economy, are leading the economic optimism. German business confidence, as measured by the Ifo Business Climate Index, rose to 88.6 points in July, continuing its upward trend for several consecutive months this year. The sub-index for future expectations reached its highest level in two years. The report shows that despite weak growth in new orders, both current conditions and future expectations in the manufacturing and construction sectors have improved.

Germany's 2025 budget, adopted at the end of June, indicates a likely increase in government spending in the second half of 2025, particularly in the defense sector. New infrastructure projects are expected to accelerate starting in 2026. This spending stems from a multi-year investment bill passed earlier this year, which plans to invest €1 trillion in defense and infrastructure over the next decade. This is expected to boost annual economic growth by 1.5%, potentially injecting new momentum into European economic growth.

Corporate investment is expected to grow

Optimistic expectations for the future are driving a wave of investment from the private sector. Data shows that over 60 German companies are coordinating with Chancellor Friedrich Merz to promote the "Made in Germany" initiative, announcing €631 billion (approximately $738 billion) in new project investments over the next three years. Funds will be used for new and existing factories, as well as for research and development.

The German government recently announced plans to leverage private investment through a €100 billion (approximately $117 billion) "Germany Fund" (Deutschlandfonds). According to a statement released by the Ministry of Economics to Bloomberg on August 6, the fund will initially receive at least €10 billion in public funding, aiming to mobilize ten times the amount of private capital, focusing on strategic sectors such as defense, energy infrastructure, and critical raw materials. According to sources familiar with the matter, the fund is expected to officially launch in September or October, after the parliamentary summer recess.

Germany's economic growth will also be supported by policies such as simplified administrative procedures and the ruling coalition's commitment to reforming the labor and employment system. In his public speeches, Merz clearly listed the reform of the social security system as a top priority, which is expected to further reduce labor costs and improve business confidence.

Market impact analysis

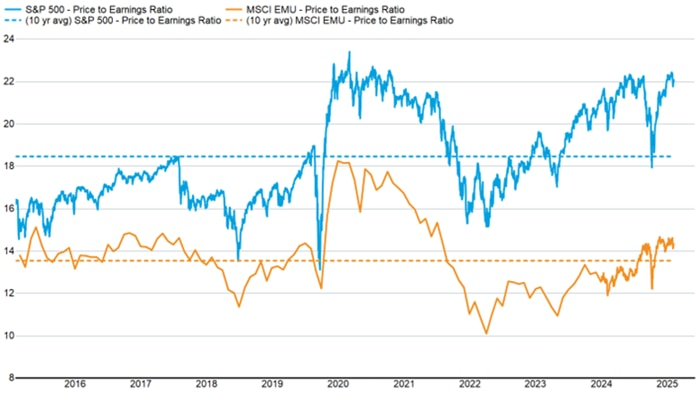

We believe European companies should be included in diversified portfolios due to their accelerating long-term growth potential and attractive valuations. As of August 5, the MSCI European Economic and Monetary Union (EMU) Index traded at a 12-month price-to-earnings ratio of 14.4, significantly lower than the S&P 500's valuation of 22.2. Furthermore, renewed US dollar weakness (possibly driven by market expectations of Federal Reserve rate cuts and the potential end of the European Central Bank's rate-cutting cycle) could further boost international stock returns. A stronger euro against the US dollar means that euro-denominated earnings can be converted into more US dollars, thereby enhancing returns for US investors.

(Comparing the S&P 500 and EMU indices, European stocks are currently trading at a significant discount to US stocks)

Economically sensitive cyclical sectors in Europe outperformed, led by financials and industrials—a trend typically seen when investors anticipate improving economic growth. These two sectors comprise the largest proportions of the MSCI EMU Index, at 24% and 21%, respectively. According to data from the London Stock Exchange Group Institutional Brokers Estimates System (LSEG I/B/E/S), the financial sector saw the highest concentration of upward earnings estimate revisions within the STOXX Europe 600 Index during this quarter's earnings season.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.