Aussie Dollar: 24 Hours of Life and Death! 4.3% Unemployment Becomes Last Line of Defense, Countdown to Rate Cut Begins!

2025-08-13 11:41:42

Labor market data is imminent

While Australian dollar crosses may not be the most exciting instruments to trade, they often present excellent trading opportunities for investors seeking to hedge against US dollar volatility. With the dust settling on this week's key risk event, the US CPI data, the Australian dollar is demonstrating unique investment appeal. Key wage and unemployment data due over the next two days will be particularly noteworthy, especially considering the Reserve Bank of Australia's latest forecast has pinned the unemployment rate at a critical 4.3% peak.

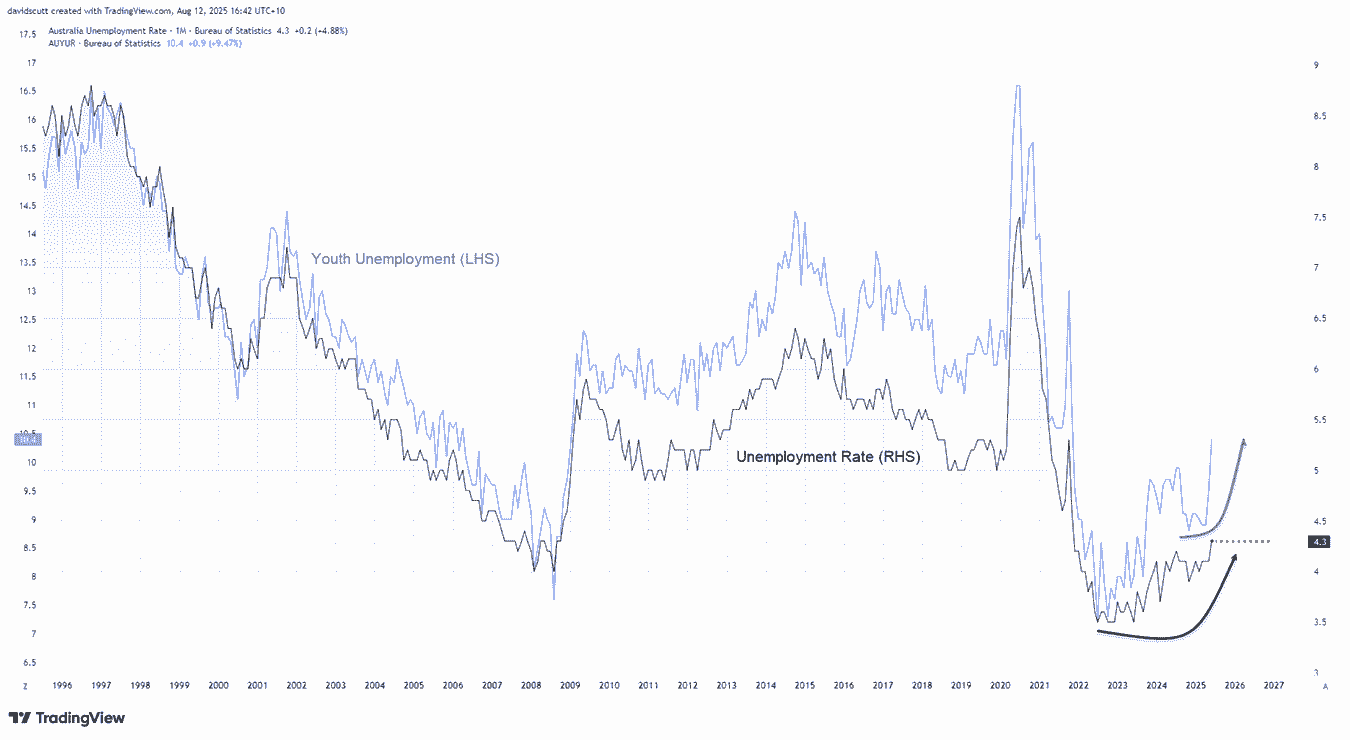

With expectations for three more cash rate cuts in this cycle (ultimately below 3%), any unexpected signs of labor market weakness could accelerate rate cuts and weigh on the Australian dollar. This risk is becoming increasingly apparent given the rise in both overall and youth unemployment rates (which are typically more sensitive to economic cycles), making the bar for further rate cuts extremely low.

(Australia's unemployment rate at a glance)

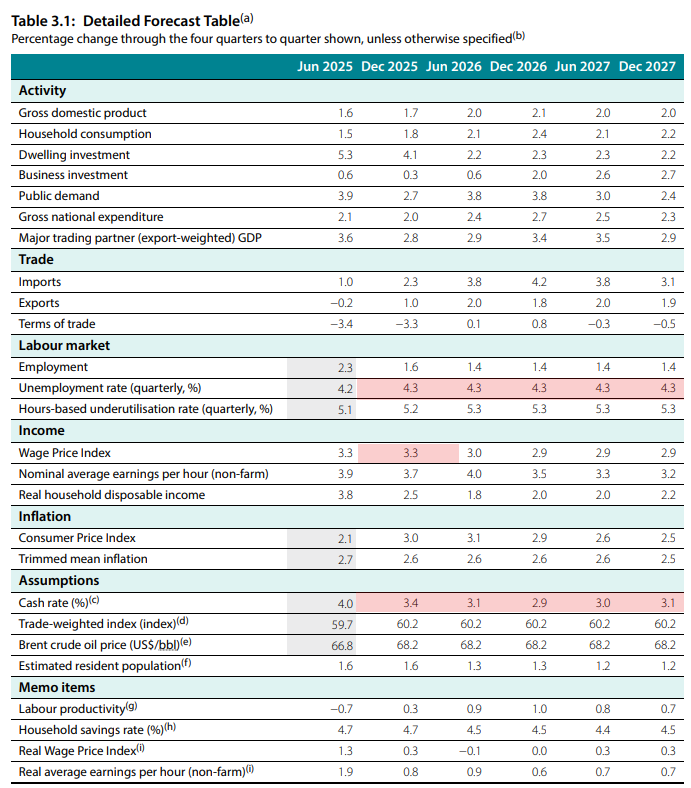

The table below shows market expectations for both the wages and employment reports. The RBA's forecast for the wage price index is for annual growth of 3.3%, which would be achieved if the quarterly growth rate were to reach 0.8% without revising previous figures.

(RBA's latest economic forecast)

Since payroll data typically doesn't offer major surprises, traders' focus naturally falls on Thursday's employment data, due out on August 14th. While the sharp rise in the unemployment rate in June was partly due to survey methodology (which may explain why economists expect it to fall to 4.2% in July), the recent slowdown in job growth is undeniable. If this trend continues and the labor force participation rate remains relatively stable, the unemployment rate could rise further.

The unemployment rate is far more important than the employment change in terms of the RBA's monetary policy decision and the interest rate outlook, so keep this in mind if trading around the data.

EUR/AUD: Bullish flag breakout watch

(Euro/Australian dollar daily chart, source: Yihuitong)

The EUR/AUD exchange rate is worth keeping a close eye on, as it is currently showing a clear bullish flag pattern, suggesting a possible resumption of the previous uptrend. The pair has attempted to break out to the upside several times, including after the Reserve Bank of Australia's interest rate decision on Tuesday, but has failed.

Bulls are currently lurking near the 50-day moving average, offering a potential entry point for traders considering a long position. The 1.7800 level has also recently shown support. If the exchange rate breaks below the 50-day moving average in the coming days, it is important to closely monitor price trends. A successful break below this moving average could increase the risk of a retest of the flag support level.

If an upward breakthrough is eventually achieved, bulls may target the July 7 high of 1.8100. After breaking through this level, the exchange rate may further rise to the important resistance level of 1.8400 when the tariff policy was announced in April.

The Relative Strength Index (14) and the MACD indicators are both sending mild bullish signals. In the short term, it is more appropriate to go long on dips rather than short the currency pair.

GBP/AUD tests top of range

(GBP/AUD daily chart, source: Yihuitong)

The GBP/AUD exchange rate has remained within a well-defined range of 2.0450-2.0742 over the past month, recently approaching the upper limit of this range following the Bank of England's hawkish rate cut last week. Bearish sellers have successfully defended this resistance level, potentially creating a trading opportunity in both the long and short directions depending on the short-term price trajectory.

A successful breakout and close above 2.0742 could attract further long positions, targeting the key resistance level of 2.1034. A stop-loss below 2.0742 is recommended to prevent a reversal. Conversely, if the price fails to break higher, consider initiating a short position below 2.0742 with a stop-loss above, aiming for downside targets of 2.0600 or 2.0450, depending on the trader's desired risk-reward ratio.

While the momentum indicator is slightly bullish, the overall signal remains neutral. Therefore, in actual trading, it is better to focus on price trends rather than sticking to a unilateral direction.

It is important to note that in the cross-trading of the UK and Eurozone major currencies against the Australian dollar, the preliminary GDP figures for the second quarter of the two places will be announced on Thursday. The market expects the quarterly growth rate of both the UK and the Eurozone to be 0.1%.

At 11:39 Beijing time, the Australian dollar was trading at 0.6529/31 against the US dollar.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.