Dollar Weakens, Yen Rebounds: How Does Bank of Japan Policy Uncertainty Impact Forex Markets?

2025-08-13 16:09:33

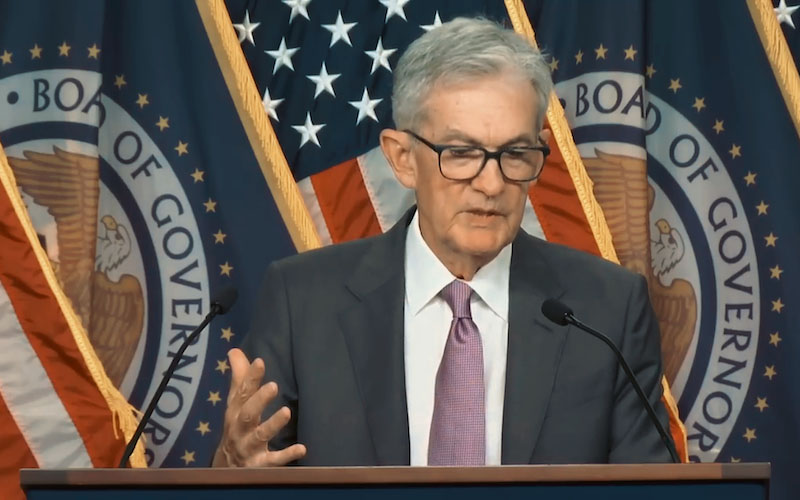

On the other hand, rising global risk appetite, fueled by the US-Russia summit aimed at ending the conflict between Russia and Ukraine, has also weakened the yen's safe-haven appeal. Despite this, the market generally believes the Bank of Japan will raise interest rates before the end of the year, while the Federal Reserve (Fed) is expected to cut rates in September. This expectation has further weighed on the dollar, further supporting the yen.

Fundamentals

The Japanese economy faces numerous uncertainties in the near term, particularly domestic political volatility and the potential for additional US tariffs. The outlook remains challenging. Japan's Corporate Goods Price Index (CGPI) rose 2.6% year-on-year in July, down from 2.9% the previous month, indicating a easing of domestic inflationary pressures. However, rising food and agricultural commodity prices still suggest the potential for further inflationary pressures. This phenomenon may continue to fuel market expectations of a Bank of Japan interest rate hike this year, despite the constraints imposed by Japan's economic struggles.

July's US Consumer Price Index (CPI) data showed that the CPI remained at 2.7% year-on-year, while the core CPI rose to 3.1%. This data supports the market's view that recent tariff pressures are primarily temporary and is consistent with signs of a deteriorating US labor market and economic slowdown. This has reinforced market expectations of a September interest rate cut by the Federal Reserve, putting pressure on the US dollar.

The Bank of Japan revised its inflation forecasts at its July meeting and reiterated its intention to raise interest rates further if economic growth and inflation meet expectations. However, due to pressures facing the Japanese economy, including political instability, potential US tariffs, and continued declines in real wages, the market is cautious about the Bank of Japan's expectations for rate hikes. Under these circumstances, market sentiment is uncertain, and the yen is likely to remain volatile in the short term.

Technical aspects:

USD/JPY is currently approaching the lower Bollinger Band (146.914), suggesting potential downside support. A break below this level could lead to further declines. The narrowing of the Bollinger Bands suggests a weakening of market volatility and a potential consolidation phase. Therefore, it remains to be seen whether prices can remain within the current range.

The MACD indicator shows a positive DIFF value, but the DEA value is close to 0, and the MACD histogram is gradually shortening, indicating that the market's bullish momentum is weakening. There are currently no strong buy signals, and prices are expected to remain volatile in the short term, or even face downward pressure.

The RSI is currently at 43.341, approaching oversold territory, suggesting a potential short-term market rebound. However, the RSI has not yet entered the fully oversold zone (i.e., below 30), so downside risks remain.

Market Sentiment Observation

Amid a resurgence in global risk appetite, the yen's safe-haven properties have weakened. The Federal Reserve is expected to cut interest rates in September, while the Bank of Japan has yet to confirm a rate hike date, reducing demand for the yen. Nevertheless, the weakening dollar continues to provide some support for the yen. In the short term, global economic and political uncertainty may lead to fluctuations in market sentiment and affect the yen's exchange rate.

Market Outlook

Bullish Outlook:

If USD/JPY can hold above the 147.400 support level and the RSI approaches oversold territory, the market could see a technical rebound. At this point, the exchange rate could rally back to around 148.300. However, it's important to note that the current market lacks strong bullish momentum, so the rebound is likely to be short-lived.

Bearish Outlook:

If the price breaks below the lower Bollinger Band and the MACD indicator shows a persistent bearish signal, the market could decline further to the support level of 146.615. A break of this support level could lead to further downside. Given global economic uncertainty and the ambiguity surrounding the Bank of Japan's policy, bearish sentiment is likely to prevail in the short term.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.