Is $3,350 just the starting point? Two charts explain the logic behind the surge in gold prices: The Fed has no way out.

2025-08-14 10:22:34

The latest inflation report for July was mixed: the headline CPI remained unchanged, but the core index rose. Despite this, traders still widely expect Federal Reserve Chairman Jerome Powell and his team to restart the easing cycle in September.

Inside the Trump administration echoed the president's call for the Federal Reserve to cut interest rates, with Treasury Secretary Scott Besant publicly advocating that the Fed should cut interest rates by 50 basis points at its next meeting and suggesting that interest rates ultimately need to be lowered by 150 to 175 basis points.

Meanwhile, European and Ukrainian leaders plan to hold talks with Trump, followed by Russian President Vladimir Putin in Alaska to discuss a ceasefire in the Russia-Ukraine conflict. In trade negotiations, Washington and Beijing agreed to extend the trade truce for 90 days.

A lack of economic data left traders adrift, with Fed officials, led by Chicago Fed President Austan Goolsbee and Atlanta President Raphael Bostic, staying on the sidelines.

Traders will pay close attention to the intensive release of economic data from the United States: including the PPI for the week ending August 9, initial jobless claims, retail sales data and the University of Michigan's consumer confidence index.

Daily Market Update: Gold prices rise despite hawkish Fed stance

The US Consumer Price Index (CPI) rose 2.7% year-on-year in July, 0.1 percentage point below expectations and unchanged from June. The core CPI rose 3.1% year-on-year, exceeding expectations of 3% and the 2.9% reading in June. A breakdown of the data showed a 1.1% drop in energy prices and stable food prices.

Kansas City Fed President Jeffrey Schmid noted on Tuesday that while the impact of tariffs appears limited, current interest rates may be offsetting some of the price pressure. He believes the modest impact of tariffs on inflation demonstrates that current policy adjustments are appropriate.

Chicago Fed President Austan Goolsbee emphasized that economists agree that the Fed must maintain political independence, which is key to preventing a resurgence of inflation. He warned that tariffs would trigger a stagflationary shock and expressed concern that "a one-time tariff shock could cause a short burst of inflation."

Regarding future interest rate meetings, Goolsbee said decision-making will remain open and most Fed officials will not commit to interest rate stances in advance.

Following the CPI data, traders will also be watching the PPI and retail sales data for signs of labor market and consumer spending. July retail sales growth is expected to slow to 0.5% month-over-month from 0.6%. The final data for the week is the University of Michigan's preliminary consumer confidence index, which is expected to rise to 62 in August from 61.7.

The dollar index, which tracks the performance of the greenback against a basket of currencies, fell 0.25% to 97.81 on Wednesday. The weakening dollar pushed gold prices above the $3,350 mark.

The yield on the 10-year U.S. Treasury bond fell 5 basis points to 4.238% on Wednesday.

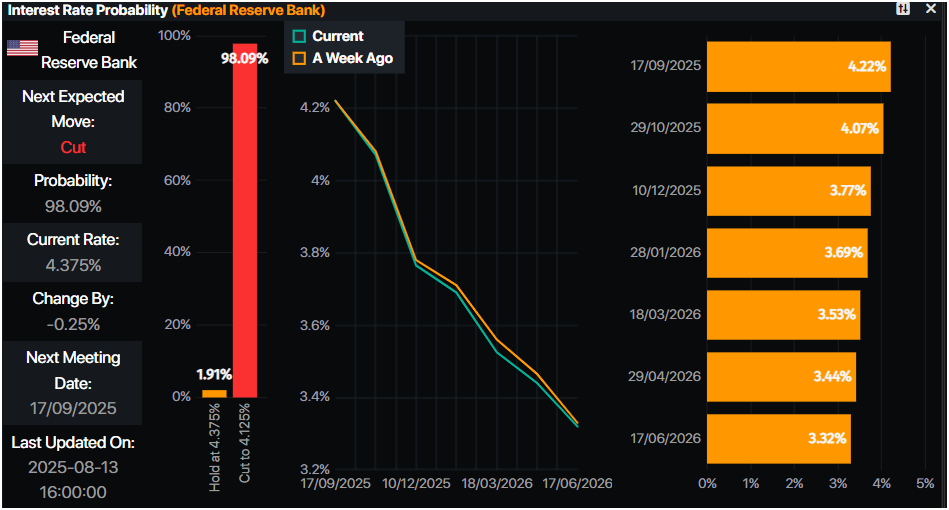

Federal funds rate futures showed traders had priced in a 98% probability of a 25 basis point rate cut at the September meeting, according to Prime Market Terminal data.

Technical Outlook: Gold prices climb but face resistance at the confluence of the 20-day and 50-day moving averages

Gold prices remained stable at the confluence of the 20-day and 50-day moving averages, failing to break through either upper or lower bounds. The relative strength index (RSI) indicated momentum was biased to the upside, but neither bulls nor bears were interested in initiating new positions ahead of the release of the PPI data.

The next resistance level is $3,380, followed by $3,400. A break above this level would place the June 16 high of $3,452 and the all-time peak of $3,500 as key targets. Conversely, a daily close below $3,350 could push gold prices towards the 100-day moving average support level of $3,302.

(Spot gold daily chart, source: Yihuitong)

At 10:21 Beijing time, spot gold was trading at $3,366.84 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.